What is a financial product design agency?

To more clearly define financial product design agency, we need to present a brief financial products industry overview. New technology in financial products led to the fact that now a lot depends on whether or not the user likes the digital solution. And, the only way to ensure this is the financial product user experience design.

So, the definition of financial product design agency can be: the design firm that architects and designs digital financial products. Finance digital agency performs research into finance institutions to find the main business requirements, customer research to identify the user context, financial experience engineering, financial solutions interface design and financial product user testing. Only in this way is it possible for such a Fintech digital agency to design innovative financial products that meet and exceed user expectations.

Enhancing the customer experience in financial products is not a simple challenge for a design agency of financial services; it requires a deep domain knowledge and expert skill in multiple industries, including:

- financial business design

- IT solutions

- user interface design

- human psychology and behavior

- business consulting and marketing, etc.

UXDA’s UX architects and UI designers have designed multiple banking and financial products, as well as Fintech mobile banking and have become award-winning TOP Fintech digital agency in creating the best UX design for financial products.

Check out the best articles by UXDA agency about financial services design.

UXDA Wins the Prestigious UX Design Award 2022

UXDA team's work has been awarded by the global design competition for excellent experiences - The UX Design Awards 2022.

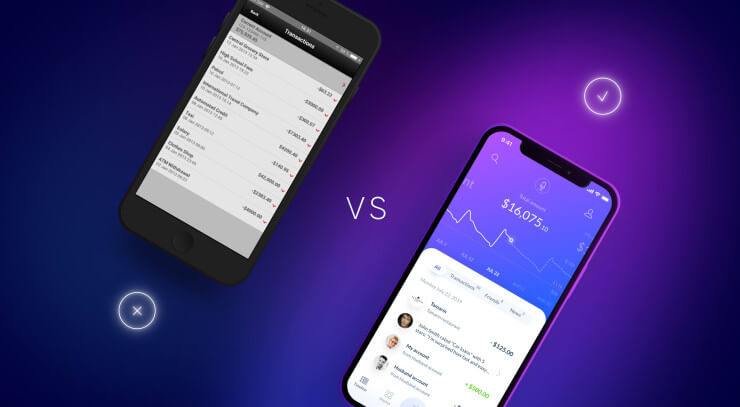

Fintech App Design Guide: 20 Simple Tips to Fixing Common Financial App Issues

Is it possible to improve the customer experience of a financial app in just a few days? Check out our guide with 20 examples that demonstrate how you can skyrocket the user experience of mobile banking solutions using the power of financial UX design.

Five Best Practices for UX Research in Financial Services

There are dozens of research methods available, but from our experience to create a user-centered financial product, five key research methods should be highlighted.

Financial Services Design: Building Reputation for the Experience Economy

What is the most valuable thing in any company that can be built and developed over 20 years, but can be destroyed in five minutes? It is brand reputation.

What Are The Digital Banking Customer Expectations From Financial Services

In recent years there has been growing discussion on the ability of traditional businesses to adapt their services to the expectations of digital customers. What should financial brands consider in order to offer the best digital service?

Fintech UX Design Trends: 10 Banking Innovation Ideas

The UXDA team has highlighted 10 design trends that demonstrate the evolution of digital financial products and the way financial interfaces are created and perceived by the users.

UX Case Study: How to Design Best Digital Bank For Kids

How could parents ensure their kids' financial future? UXDA explored this challenge with a research-based purpose-driven banking app concept. It provides insights into how an app could impact family relationships and ensure children's successful inclusion in the modern digital economy.

Why Customer Experience in Retail Banking is Sabotaged

What leads to a bad outcome when it comes to customer experience design in financial services?

TOP10 Misconceptions About The Financial UX Design

Thousands of digital financial services do not achieve their goals. This is partly due to the design or, specifically, to the financial UX design misconceptions.

Don't Let Financial Experience Fail Ignoring the Problem-Solution Cycle

Why some digital financial products are demanded and loved by the customers while others bankrupt? In the series of "Financial UX Explained" we look at the Financial UX Methodology.

How To Implement Design Thinking In Banking

Find out what is the definition of the Design Thinking in banking, what steps the process includes and how to implement Design Thinking to overcome challenges.