UX experts 100% focused on next-gen financial services, fintech, and banking design

Driving market leadership for financial brands through strategic UX design

Explore case studies

Cutting-edge UX Strategy | Research | UI Design innovations powering 150+ financial products:

- Retail banking

- Corporate banking

- SME banking

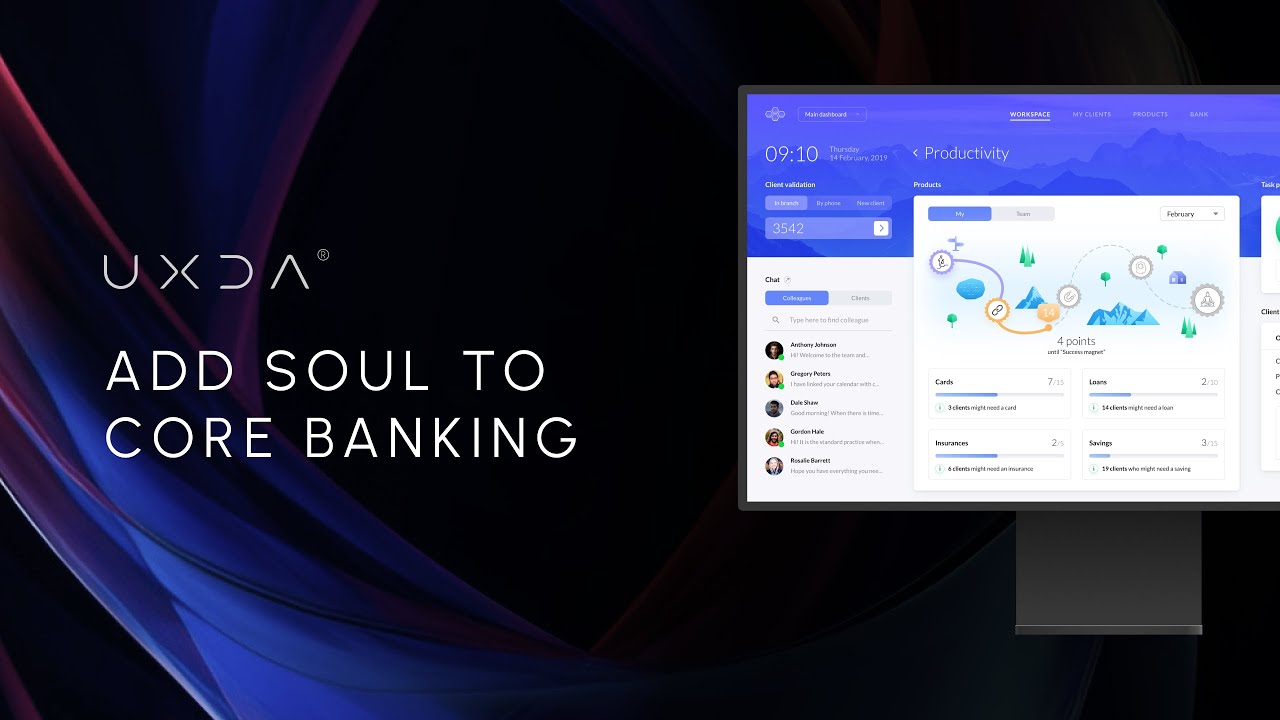

- Core banking

- Islamic banking

- Kids and family banking

- AI and Conversational

- Spatial banking

- VR/AR banking

- ATM's solutions

- Credit Unions

- Trade finance

- Financial advisory

- Remittance

- Super Apps

- Wealth management

- Payment processing

- Savings

- Investing

- Trading

- Insurance

- Lending

- Tax automation

- PFM

- Crypto

- Credit scoring

- Sustainable finance

- White-label solutions

Driving ROI with Strategic UX in Middle East Banking

Emirates NBD’s new digital experience is seamless, personalized, and designed to align with Dubai’s tech-savvy population, continually embracing the future.

Cost of this type of UX/UI: from 500 000 €

Rebuilding a Reliable Trading & Investing Platform

Garanti BBVA's Securities eTrader mobile app empowers new users to master financial markets while catering to the needs of experienced traders.

Cost of this type of UX/UI: from 500 000 €

Empowering Mexicans with Novel Digital Banking

The first digital bank by Banorte for Mexico offers a next-gen UX/UI, hyper-personalization, unwavering support, and user guidance toward informed financial decisions and goals.

Cost of this type of UX/UI: from 450 000 €

Turning Liv Bank into Spatial Banking Experience

Real life example how Liv Bank could work in a spatial environment. Prototype was showcased in the Dubai Fintech Summit with 3 use case scenarios and was received with much amazement and excitement.

Cost of this type of UX/UI: from 500 000 €

Building a New Investment Experience for 90M Users

An investment platform accessible to every Filipino, enhancing their knowledge and supporting throughout their GInvest journey.

Cost of this type of UX/UI: from 350 000 €

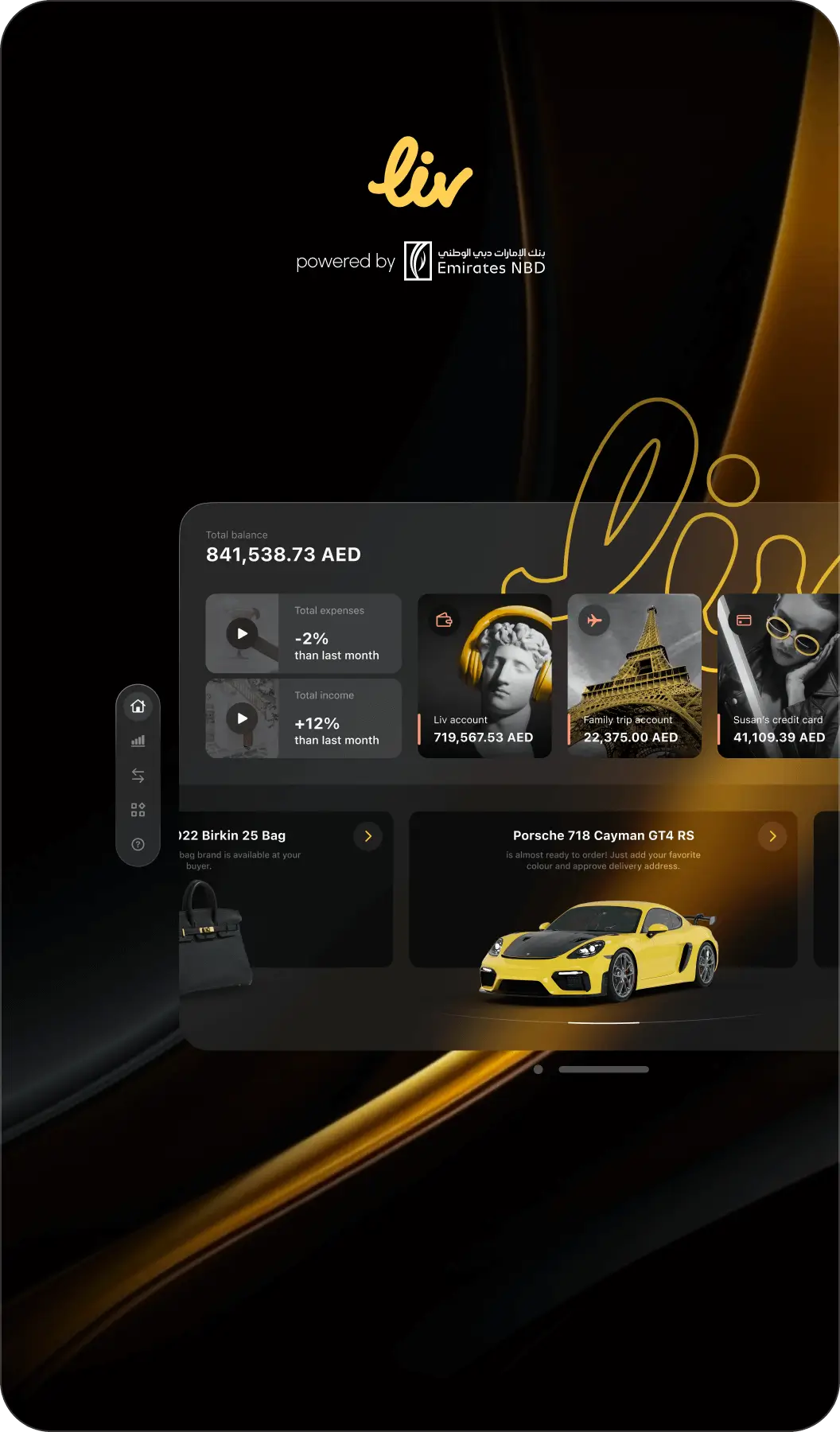

Injecting Style into Dubai's Digital Banking

A digital bank with its own personality, empowering users in their lifestyle. It's crafted as an art object with vibrant energy, which can be personalized to suit individual personalities.

Cost of this type of UX/UI: from 450 000 €

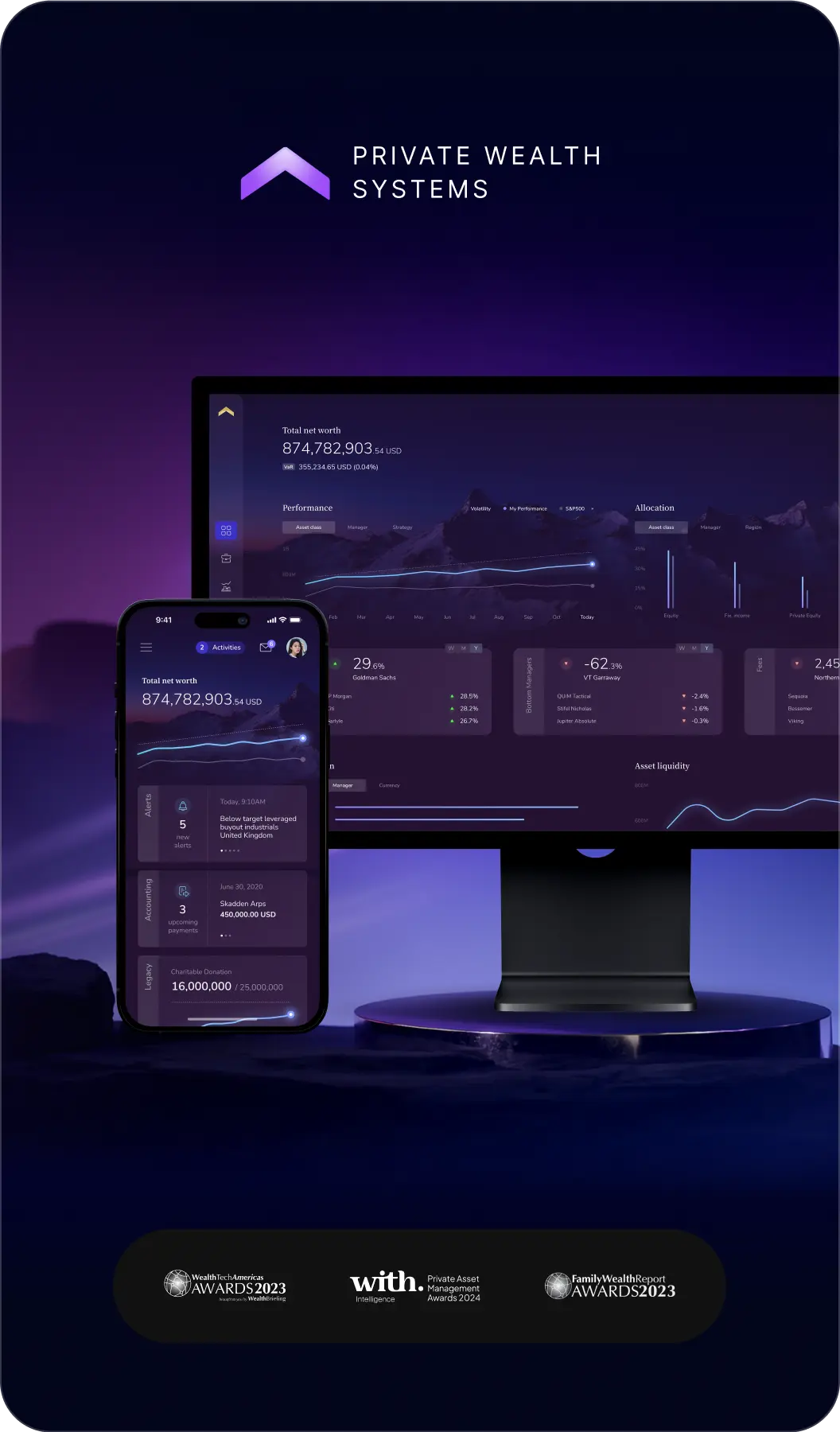

Redefining Wealth Management for UHNWI

A unique gem in the industry that smooths friction and makes managing complex wealth delightful. Premium experience that is a must-have for any ultra high net worth individual.

Cost of this type of UX/UI: from 450 000 €

Changing the Perception of Digital Banking in Albania

We have removed the friction from everyday banking, making it easy, with clear guidance. Users can now complete tasks digitally without any assistance, thus achieving a pleasant user experience.

Cost of this type of UX/UI: from 450 000 €

Thought leaders in financial UX

Financial brands have long competed on speed, safety, and features—but real loyalty comes from emotion, not functionality. As expectations shift from efficiency to feeling, the winners will be those who design relationships, not just interfaces. This article shares 10 principles to turn financial apps into emotionally engaging growth engines.

Customers Flip Banking Upside Down, Leaving Inside-Out Banks Under Siege

For decades, banks were built inside-out—core systems first, then products, and only later the customer. Digital-first challengers invert this logic, starting with brand purpose and experience and building the core to serve it. This article shows how traditional banks can turn their architecture upside down to compete in the outside-in era.

How Banks Can Avoid Being Blacklisted by Design Agencies

Partnerships with design agencies can unlock innovation for banks—but repeated “red flag” behaviors risk damaging trust. This article reveals what blacklisting really means in the design industry and why premium agencies quietly avoid difficult clients.

Unlocking Executive Buy-In for UX and Digital Branding in Banking

Banks don’t lose customers over rates—they lose them over experience. While fintechs set the standard for seamless UX, many banks still treat it as “just design.” This article reveals how you can get executive buy-in for UX to future-proof your digital strategy.

Our impact in numbers

150+

Banking & Fintech products designed

80+

Financial institutions turned into loved brands

39

country collaborations established

15

years spent to develop Unique Financial Design Methodology

30+

globally famous design and finance awards received

81

Net Promoter Score - 87% of clients recommend UXDA at the highest rate

4.8

average App Store and Google Play rate of financial apps designed by UXDA

1M+

people from 127 countries inspired by our blog posts

Stop Copying. Start Leading.

Building great financial brands in the digital space isn’t about luck, it’s about strategy. What if your product’s digital experience could not only meet expectations, but will redefine them?

Exclusive Agency with Premium Service

True excellence lies in exclusivity. We don't take on every project that comes our way like a generalist agency. Being highly selective, we onboard only seven clients each year—each one a chance to break new ground. For a decade, we've forged emotional bonds between customers and financial brands with authentic UX of 150+ banking and fintech products designed across 39 countries. An agency for those who dare to be exceptional.

Tailor-Made Digital Excellence

Tired of cookie-cutter apps? So are we. At UXDA, we don’t outsource, or replicate designs. Each project, like a unique maze, starts from scratch, built around the soul of the brand and the essence of its strategy. We dive deep into research, prototyping, and crafting every pixel in-house. Because every financial brand is unique and must offer an authentic, intuitive experience designed with purpose and precision.

Long-Term Focus on Financial Brand Growth

Quick fixes and a short-term facelift don’t solve long-term business issues. When working on digital products across 16 financial categories, as complex as a 6,000-screen corporate banking platform, we focus on the cohesive brand experience to ensure long-term impact, reflected in our flawless 5.0 ratings on Clutch and Google. Enhancing product interface is one thing; strategically transforming brands' digital experience is another.

Pioneering Innovation in Financial Products

Following trends is easy. Setting them? That’s our specialty. With 30 international awards and 200+ publications, UXDA experts constantly scale new heights of financial UX design. UXDA is at the forefront of innovation in financial services, pioneering the design of banking superapps, cloud-based core banking, AI banking, spatial banking, etc. We redefine the standards of financial services, by crafting rich UX that stands the test of time.

Philosophy-Driven Design Approach

In UXDA, design is not just about product looks or functionality; it is about crafting a digital brand experience that resonates. With a philosophy rooted in our core values, we partnering with brands that share our vision. Our unique approach to building digital ecosystems in finance unites 44 proven design methods into 8 frameworks, integrating digital design as a strategic driver for your financial brand’s future.