To ensure clients' dreams are realized through financial advisor strategies, Carson Group is creating a powerful financial advisory platform and has become the frontrunner of purpose-driven financial innovations. Carson's journey isn't just about numbers — it's a saga of empathy and unwavering will to build a better future for advisors and their clients. UXDA was honored to assist the Carson team in designing a work environment that would unify the current advisor tech stack into one revolutionary product that is now under development.

In this case study, we unfold the way we tackled the challenge of integrating Carson's mission and commitment to three value-based tenets, “Run, Grow, Love”, into their digital product and how we reshaped the experience of financial advisors. Find out how a customer-centered product design approach could help financial advisors enjoy their work, focus on growing potential, unleash creativity and even deliver personalized attention to clients.

Client: World's Best Financial Advisor and Visionary

Ron Carson is CEO of Carson Group, a leading financial advisory company serving financial advisors and investors through its three businesses: Carson Wealth, Carson Coaching and Carson Partners. Ron Carson is a New York Times bestselling author, one of only two advisors ever inducted into the inaugural Barron’s Hall of Fame, an award-winning entrepreneur, a dynamic keynote speaker and a passionate philanthropist. His purpose-driven company is a registered investment manager and a powerful platform for advisors. They manage $32 billion in assets with a US-based nationwide network of 145+ partners and 380+ advisors serving 50,000 families.

Ron Carson's journey as a financial advisor started in 1983 in a university dorm room and has evolved into a career focused on providing financial advisory services that go beyond mere money. He believes advising is about guiding individuals to discover purpose and meaning in their lives and to achieve their goals. Drawing from his empathetic vision and successful financial advisory experience, he founded the company to help other advisors grow on a larger scale.

Ron Carson has become an influential voice in activating and accelerating social and environmental change, pursuing his mission to “do the greatest amount of good for the greatest number of people.” That's why Carson's brand and philosophy prioritize purpose over product and transactions, with the core tenets of “Run, Grow, Love” defining their distinctive mission.

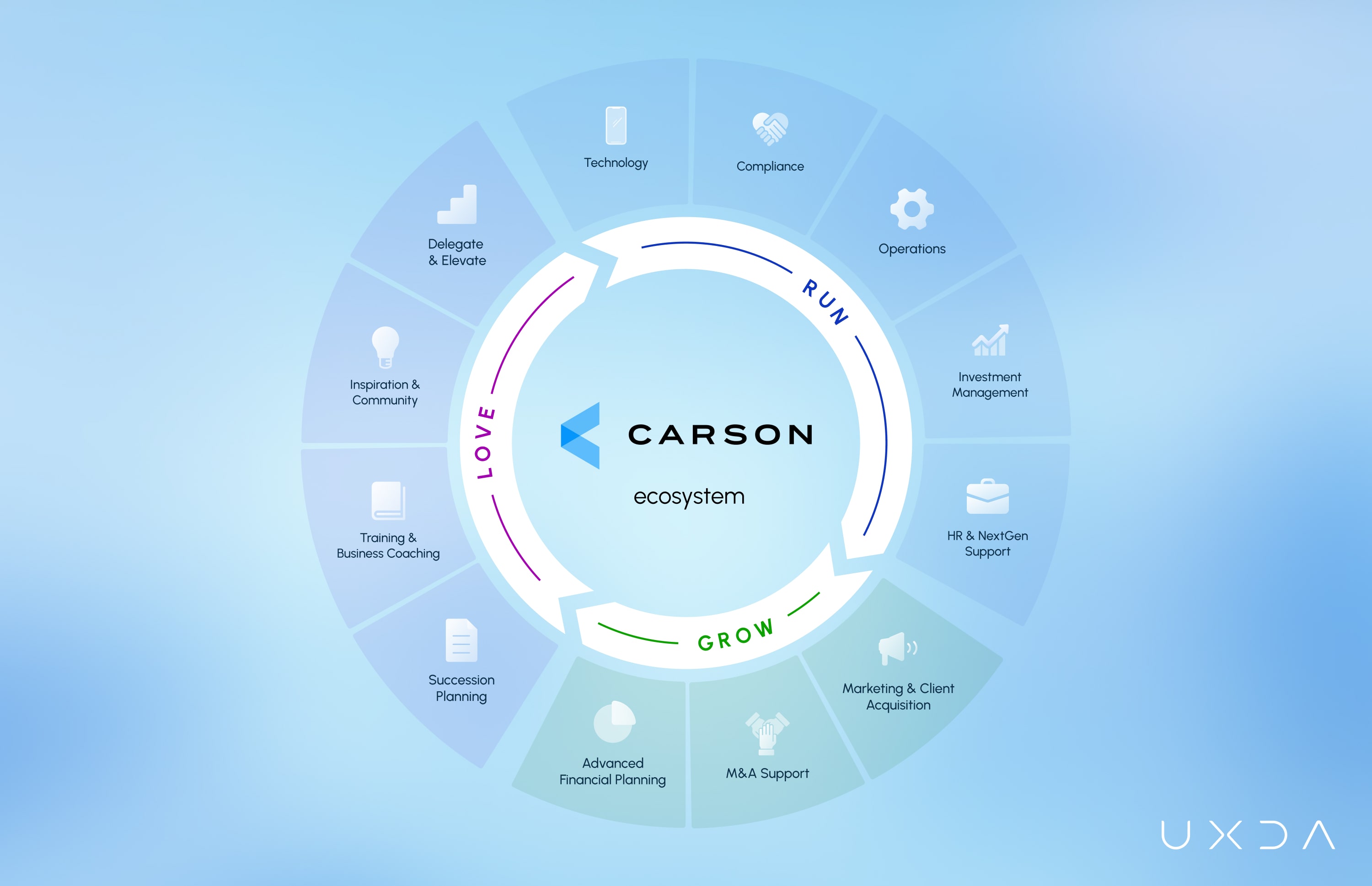

The diagram illustrates the Carson Ecosystem.

The diagram illustrates the Carson Ecosystem.

These values are inherent to the client's identity and organizational ethos.

Run. Carson's first tenet is based on ensuring technological infrastructure tailored to advisors’ needs, allowing them to focus on streamlining processes and running their business rather than being overwhelmed by it. Carson makes complex matters simple for the advisors and investors they serve.

Grow. Carson generously invests its wealth of expertise and actively engages with every partner entering the community, guiding them in how to grow and develop their businesses while staying true to their core values. Carson Coaching is a leading national coaching and resource program designed to help growth-minded financial advisors build their businesses.

Love. At Carson, the team understands that it is challenging to love your business when you are stuck, isolated and anxious. Therefore, they strive to provide an environment that helps advisors bring maximum value to their clients, CEOs to make informed business decisions, and everyone to love their job and improve their lives. The tenet of “Love” is also incarnated through “Lovable things,” one of the key elements of Carson's client-oriented approach. Throughout the collaboration, advisors note personal preferences, life milestones and unique financial goals in their clients' profiles to make the cooperation deeply personalized.

Carson has reimagined the traditional paradigm, presenting financial advisory services in an empathetic and purposeful manner, which yields higher levels of satisfaction and profound enhancement in the overall experience for both advisors and their clients. This results in an environment that fosters long-term relationships for all parties involved. Strong emphasis on putting clients first, focusing on maintaining trust through care and adaptability and promoting innovations truly elevates Carson in the market and positions them as a trusted partner for like-minded advisors.

Challenge: Defragmentation and Adapting to Diverse Advisor Preferences

Carson's tech stack includes several digital tools that help financial advisors manage and strategize their clients and assets under management. Because many of these tools were not interconnected, this resulted in a fragmented user experience. Consultants spent significant time manually consolidating information from various sources to stay on top of ongoing processes. To combat this, Carson's team decided to reimagine the user experience through defragmentation and the creation of a single platform. With this challenge, they came to UXDA.

UXDA believes that any financial services company should carry user-centric values through the ecosystem, community and support, and deliver products that provide maximum value to the user. UXDA's approach to creating human-centered products interested Carson's team because it aligned with their values and goals, which is why Carson chose UXDA to integrate empathetic vision into their advisors' digital experiences. We've put this into practice with a next-level, flexible and customizable solution that will deliver a defragmented and simplified experience for financial planning and advisory services.

The main goal was to unite the whole stack in an all-encompassing digital work environment, considering three sides of the advisory process ─ the advisor's experience, the client's journey and the operational workflow. The UXDA team mainly focused on enhancing the efficiency of advisors' work processes and freeing up their resources to create a better connection and truly help their clients achieve life goals. Our UX consultants holistically examined the advisors' experience to align Carson's digital ecosystem with the brand's purpose, philosophy and strategy, paving the way for a more effective and innovative solution.

Secondly, Carson's team required a customer-centered perspective on the valuable research data they collected. They needed fresh insights on how to improve their current product and strengthen the product's value. The difficulty is that methods of providing financial advisory services differ from firm to firm depending on their previous experience, personal preferences, technological savviness and the scale of the firm and its clients. As there is a huge diversity in how advisors use the Carson platform for FI advisors, our challenge was to navigate through all the advisors' feedback and crystallize it to find flexible solutions that would not simply patch the existing drawbacks but solve them at the roots.

Solution: Empowering Financial Advisors to Grow

The aforementioned challenges required a fresh perspective fully reflected in Carson's 3-tenet philosophy. We envisioned a platform that helps advisors structure their workflow to grow and provide excellent client care without worrying about administrative tasks. The platform had to mirror the collaborative nature of financial advisory services by aligning the vision with the needs of advisors, clients and operational staff. We found a way to ensure the symbiotic relationship among technology, human expertise and a personal purpose-driven approach that further fostered Carson's uniqueness in financial advisory services.

Carson had already performed significant background work gathering key market and user-related information and insights. The combination of Carson's input with our comprehensive UX analysis and engineering strengthened the foundation of a product that aligns perfectly with their ambitious goals and direction. Moreover, this collaboration and knowledge sharing have allowed the Carson team to strengthen their comprehension of user-centered UX methodologies and approaches that they can apply to continue carrying their mission through the current and future digital experiences.

During the project, Carson's team visited and interviewed financial advisors throughout the U.S. and conducted usability tests on product wireframes, supported by practical tips and guidance from the UXDA team's specialists. As a result of the intensive day-to-day collaboration and research, we gained valuable insights from the interviews and a deeper understanding of advisors' approaches, needs and pain points. Subsequently, we swiftly updated the product wireframes until the next interview, where the new ideas were validated. This iterative wireframing ensured the product best met the users’ needs and desires.

“Being part of the research and not only process hands-on as one team,

UXDA and Carson, was a really great collaborative experience.”

Carson's Product Design Director

The resulting dashboard solution has been designed to allow advisors to navigate the advisory process seamlessly, ensuring they could focus on meaningful client relationships. By consolidating information and tools in one dashboard, the time spent switching between fragmented systems will be eliminated. The new product design is set to enable advisors to devote more time to crafting and managing personalized financial strategies. Combined with a stronger emphasis on clients'' “Lovable things” in the revamped product, these advancements will help advisors guide clients' portfolios toward the established meaningful goals.

Approach: Streamlining Advisors' Daily Routines

The journey from conception to realization was greatly supported by the common efforts of the UXDA and Carson teams. Using our methodology, rich experience with financial products and ability to extract the maximum efficiency from the processes, we navigated step-by-step toward the vision for the financial advisors' experience. We focused on crafting a product structure and design that resonated deeply with Carson's tenets, core values and branding.

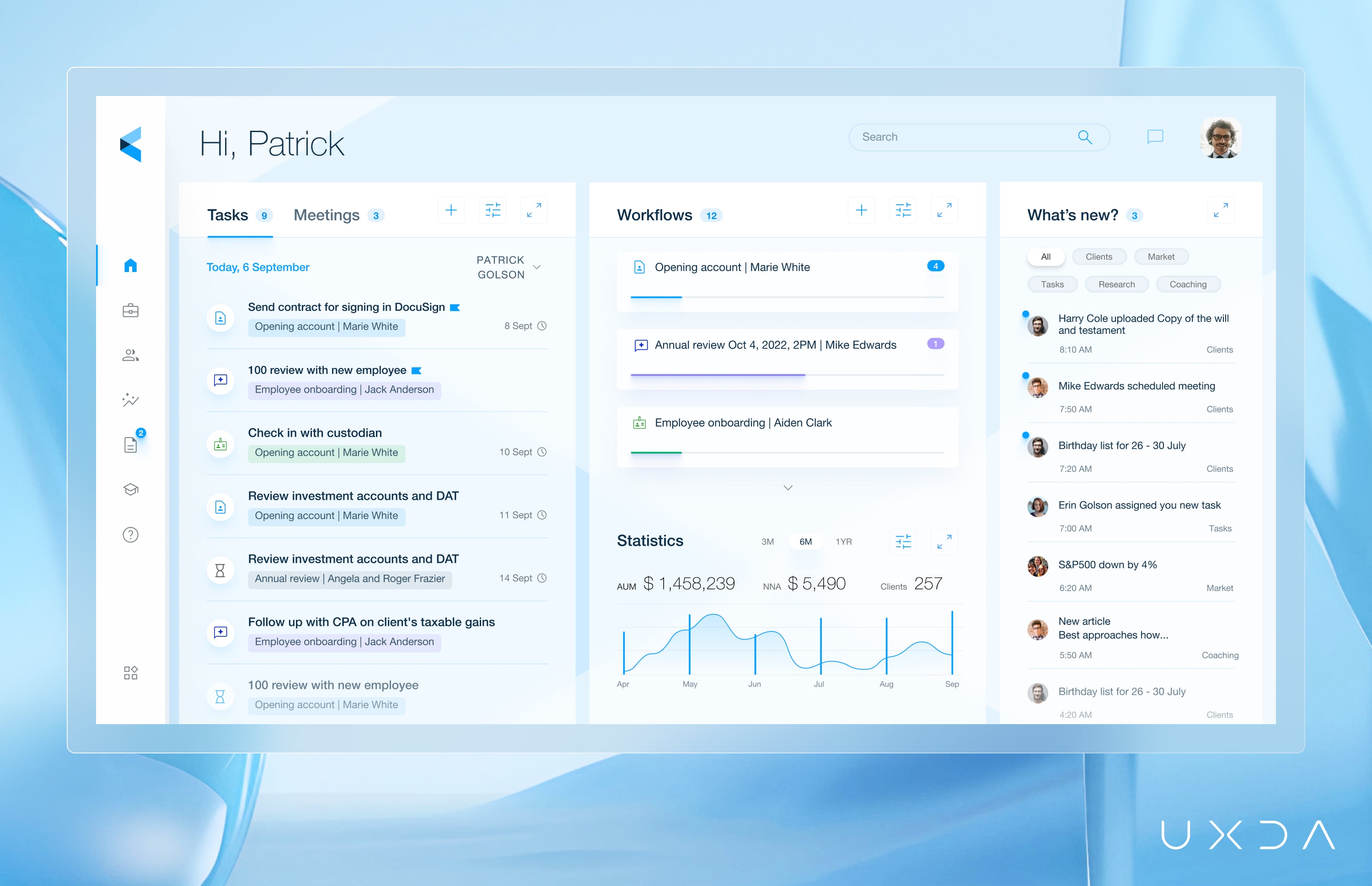

The new Carson advisors' platform experience starts with the Advisor's Dashboard, which is the brain center for advisors. It is designed to significantly enhance efficiency by enabling advisors to start their day knowing exactly what tasks were planned for the day, control client workflows that are in progress, overview the firm's KPIs and stay informed about important news.

Advisor's dashboard

Advisor's dashboard

Embodying purpose-driven design

The most important thing was to embody the main tenets of Carson’s philosophy (“Run, Grow, Love”) in the product. This was the main way to ensure a holistic interaction with the brand throughout the advisor user journey.

A detailed understanding of Carson’s business strategy and philosophy was necessary to closely align design decisions with their purpose. This ensured that the architecture and design of the new digital product, in addition to meeting functional requirements and user needs, also resonated deeply with Carson's mission and values to grow the business.

“Run” - embodied in the design by visually dividing the dashboard into thematic segments and targeting the user's attention to the most crucial information according to the advisors' priorities, simplifying the interaction with the daily activities.

“Grow” - designing an experience that drives loyalty and increases trust, thus helping advisors develop their business and build transparent and reliable collaboration with their clients.

“Love” - providing a visually appealing and comfortable environment for the advisors that makes them love and enjoy their work, which consequently is directly reflected in their clients' financial well-being and life achievements.

The intention of the customer-centered UX design approach is to transform Carson's platform for FI advisors, elevating the experience for advisors and clients. We integrated Carson's philosophy into the financial advisory experience design, optimized workflows for advisors and addressed their needs.

The desired level of UI and UX was achieved by working closely with the Carson team on bridging the detected experience gap. Our collaborative efforts ensured that the digital product exceeded expectations, providing a user experience that resonated with advisors.

While designing the financial advisory platform, the UXDA design team was guided by the research and insights acquired during the pre-design stages. The detailed brand book provided was another key factor conveying a sense of belonging to Carson's ecosystem.

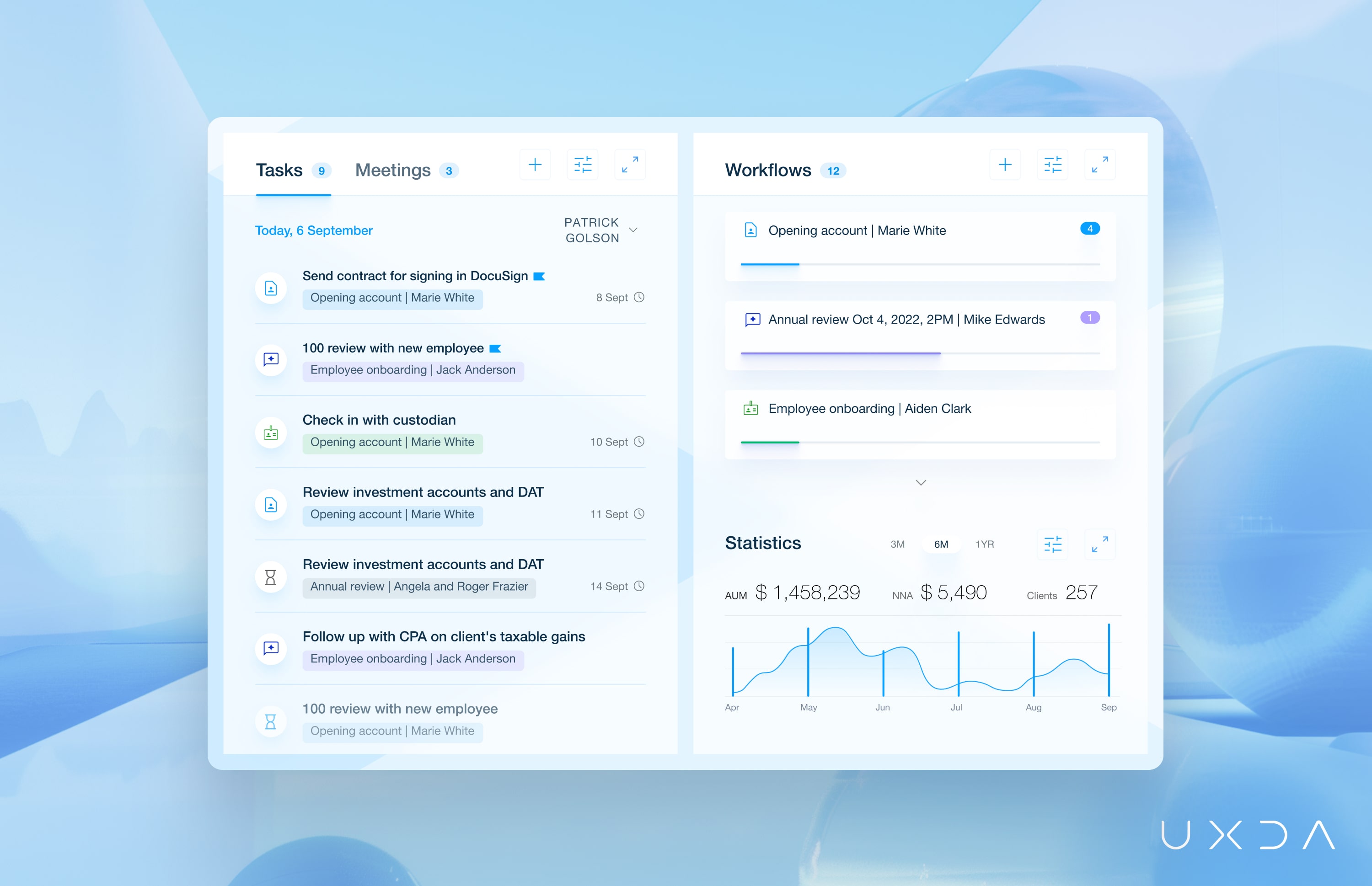

Tasks, meetings, workflows: managing work processes

Financial advisors require a comprehensive view of their day, encompassing previously planned tasks, meetings and ongoing workflows within the advisory firm. Recognizing this, UXDA designed enhanced advisors' planning and task management capabilities by providing them with an information-rich environment.

Advisor's task and planning management

Advisor's task and planning management

What's new: keeping advisors informed

We’ve introduced a dynamic "What's New" feed to keep advisors ahead of the curve. It delivers the latest updates advisors need to be aware of regarding the business processes, their clients, markets and materials provided by Carson. All these aspects are essential for financial advisors to effectively kickstart their mornings, be proactive in decision-making and timely react to updates, consequently lowering risks and improving customer service.

Advisor's latest updates feed

Advisor's latest updates feed

Statistics: following firm's performance

The CEOs of advisory firms can see crucial Key Performance Indicators directly on the dashboard. Assets under Management (AUM), Net New Assets (NNA) and the number of clients help to perform quick assessments of the firm's performance, fostering a sense of control and enabling informed decision-making.

Advisor's statistics module

Advisor's statistics module

UXDA Deliverables

- Stakeholders’ interviews

- Product strategy

- User interviews

- User personas through a JTBD framework

- Empathy map

- User journey map

- Scenario prioritization in red route map

- Information architecture

- Value storyboard

- User flow maps

- Wireframes

- Key design concept

- Product experience movie

- Product motion design

- Usability testing

Takeaway: Impact of Purpose-Driven Design

The main takeaway from this case study revolves around the integration of a purpose-driven philosophy into digital design and product development. It is a powerful example of how UX design approach can address complex challenges and bring significant benefits in the digital product landscape, particularly in the financial advisory sector.

A purpose-driven approach differentiates Carson's brand in the market, requiring a digital platform that resonates with the advisors and clients' needs for a purposeful financial advisory experience. And, together with Carson Group, the UXDA team designed a digital product experience that supported and adhered to the company's core tenets - "Run, Grow, Love".

Design challenge underscored the importance of growth and creativity within the financial advisory sector, and Carson is creating a new platform for advisors that provides it. By prioritizing the human element in financial advisory services, it will develop a more dynamic and innovative advisory community that nurtures loyalty and trust. Focus on purpose, values and user-centric design will facilitate the development of deeper and more meaningful relationships between advisors and their clients. Also, the emphasis on making advisory processes more efficient and less fragmented will lead to a better alignment of advisors' efforts with clients' financial goals, enhancing overall satisfaction.

Project succession was supported by close teamwork and active communication between both teams, which greatly benefited the achievement of project goals. A collaborative effort led to greater value delivery and enhanced results and also allowed Carson's team to find unity internally, aligning them around a shared vision and future direction. A UXDA partnership with Carson was not just about enhancing UI/UX ─ it was about empowering them to realize their full potential and make a meaningful impact in the lives of advisors and their clients.

The Carson case study highlights the transformative power of purpose-driven design in creating digital products that not only meet the functional needs of users but also resonate with their values and aspirations. This case study serves as a compelling example for other companies in the financial sector and beyond, demonstrating how integrating purpose into digital design can lead to significant business impact and outcomes.

“If anything, we really were impressed with what we had fit in during such a tight timeline. I really loved working with UXDA, and every time we asked for something, somehow, they were able to sneak it in. Especially at the end. The ability to pivot with us and stay patient and understanding so they could give us what was expected and some was great.”

Carson's Product Design Director

Explore our client's next-gen financial digital products and UX transformations:

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin