These principles enhance user experience, ensure products are efficient and engaging and align with business goals. By applying these design concepts, financial product owners can create user-friendly, intuitive, next-gen digital services that empathize with users, organize content logically and design accessible, visually appealing interactions.

On-Device vs Cloud AI and the Future of Personalized Banking UX

Integrating AI into banking services will obviously revolutionize the user experience in financial services, offering real-time advice and 24/7 transaction monitoring. The main question is which AI will serve banking first ─ on-device AI or cloud-based AI? Let’s compare!

Psychology Meets Finance: Ten Laws Shaping Fintech and Banking Apps Design

Let's explore the psychology of financial and banking product users by looking into their minds, behaviours and main aspects of why certain products are disliked while others are desired.

AI as a Humanizing Force in Financial Brand Marketing

There is another promising area of AI use for financial brands ─ marketing and brand communication. The UXDA team assessed the potential of humanizing financial brands using ChatGPT and Midjourney by creating digital mascots based on the mobile service interface.

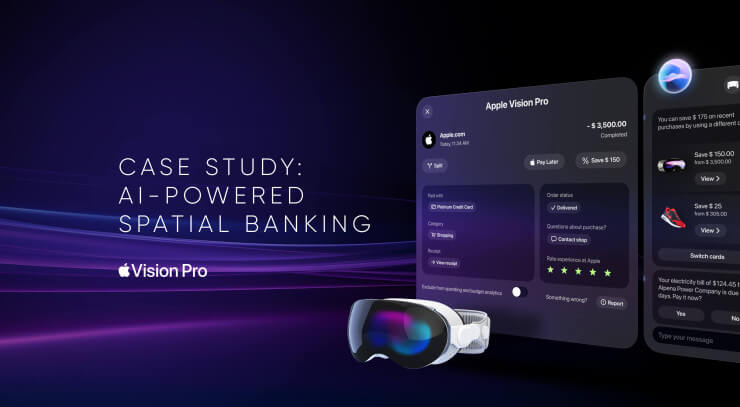

UX Case Study: Implementing AI to Shape the Future of Spatial Banking

Apple Vision Pro could start the next digital revolution. Wizards from Cupertino offer a mind-blowing spatial experience on the visionOS platform. But how could spatial banking feel and look?

Future Banking Trends: Enable Next-Gen Financial UX

Future Banking Trends include technologies such as Generative AI, the metaverse, the blockchain, embedded banking, DeFi with CBDCs, and open banking which are creating the next-gen financial UX.

Musk’s Global Bank Ambition for X: Tackling UX Challenges Head-On

Knowing Elon Musk's large-scale approach, his intention to turn X into a bank could have disruptive consequences for the banking industry. However, the conflict between the existing UX patterns of a social network and the implementation of financial functions can complicate the transformation.

From Outdated to Outstanding: 10 Experience Redesigns in Fintech and Banking

Today's consumers seek seamless, intuitive and emotionally resonant interactions with their financial institutions. We offer ten examples of how financial products can be transformed to exceed expectations and create an emotional connection through a stunning UX design by UXDA.

Next-Gen Digital Banking Design: Top 10 UX Strategies Unveiled

What is the main difference between next-gen financial products and legacy services, and what do financial institutions need to create next-gent digital offerings?

The Future of AI in Banking and Fintech

Will AI make customers' lives better than ever before or become dangerous if applied without human-centricity?