The future of digital finance requires a paradigm shift toward a holistic, customer-centric approach that incorporates the best possible strategies for creating an exceptional user experience (UX). Today's consumers demand more than reliable transactions and secure storage of their funds; they seek seamless, intuitive and emotionally resonant interactions with their financial institutions. We offer ten examples of financial app design transformation that exceeds expectations and creates an emotional connection through a stunning UX design by UXDA.

Stagnation is the enemy of progress. To stay relevant and move ahead of the competition, financial organizations must adopt a completely different approach to financial product design—one that revolves around customer needs, emotions and continuous innovation. By leveraging aesthetics, tone of communication and personalized interactions, institutions can create a sense of connection and empathy. This, in turn, fosters stronger relationships, enhances customer retention and transforms financial transactions into meaningful experiences.

UXDA's “Before-After” Financial App Design Transformations

In the past nine years, the UXDA team has completed over 150 digital financial app design transformations for Fintechs and banks in 36 countries. These transformations looks amazing, but please don't be fooled; what you're seeing is not a surface interface design revamp similar to what's offered by full-range digital agencies or freelancers. What you are seeing is a complete overhaul of the user experience, requiring a 100% competence focus on research, rethinking and innovation in financial services design.

A superficial UI revamp, while potentially improving the visual appeal of a financial app, is often not enough for several compelling reasons:

1. A good-looking app might initially attract users, but if the app is difficult to navigate or slow to respond, users will quickly become frustrated. UX encompasses much more than just aesthetics; it includes usability, accessibility, and the overall flow of interactions.

2. Modernizing the appearance of an app without addressing its information architecture can lead to user journey bottlenecks, usability issues, and scalability obstacles.

3. A mere UI update does not match the level of innovation required to compete effectively.

4. Today’s consumers expect intuitive, fast, and reliable digital experiences. A superficial UI revamp does not sufficiently address these expectations, and it does little to attract new customers in a market where user experience can be a significant differentiator.

5. Financial ecosystems are increasingly interconnected, and a surface UI revamp may not take into account the need for consistency between different channels, products, services and brand.

6. Superficial changes can lead to a fragmented UI design system and increased design debt, making the app more difficult and costly to maintain, update and scale over time.

7. While a rapid surface UI revamp can make an app more visually appealing, it falls short of addressing the strategic needs of modern digital banking, including user experience, performance, usability, scalability, and innovation.

For financial institutions to truly thrive in the digital age, a deeper strategy-driven transformation that encompasses both the user interface and the user experience architecture is essential. Let’s explore ten spectacular stories of how banking and financial products are transformed when they are given soul and subsequently switch to a customer-centric approach:

my.t money Banking & Lifestyle Super App

Mauritius Telecom (MT), the top telecom company in Mauritius, aimed to shape a digital future for Mauritians. Their focus was on expanding the existing my.t money app into a digital bank, establishing a pioneering financial Super App. Their my.t money app, launched in 2019, had already revolutionized payments with digital P2P and QR code transactions. Through collaboration with UXDA, they created an integrated platform merging finance, telecom and lifestyle services.

With a customer-centric vision, MT aimed to enhance convenience and advancement for Mauritius' 1.3 million inhabitants. Read more in the my.t money UX case study.

BKT Retail Banking App

Banka Kombëtare Tregtare (BKT), Albania's largest and oldest commercial bank, recognized the need to modernize their digital offerings to meet current service expectations.

UXDA's challenge was to overhaul mobile banking's customer service by redesigning user journeys in alignment with BKT's user needs. The aim was to create an inviting and reliable digital banking companion, empowering users to enhance their financial decisions and money management, ultimately enhancing their quality of life.

These mobile banking enhancements not only transformed BKT's perception of the brand from a digital perspective but also solidified their market leadership. They defied conventional notions of digital banking by offering a light, enjoyable and user-friendly experience. BKT's comprehensive transformation focused on providing users with convenient, innovative mobile customer service, empowering them to seamlessly manage their financial tasks and marking a significant leap in the bank's legacy. Read more in the BKT UX case study.

Emirates NBD Retail Banking App

Emirates NBD, a leading middle eastern bank serving 17 million customers across 13 countries, embarked on a transformation journey to elevate its app into a cutting-edge digital service surpassing traditional retail banking. This ambitious vision involved consolidating various solutions, such as retail banking and deals, into a unified app. Additionally, the aim was to transform wealth management from an offline process to a fully online one by integrating it into the same app, all while catering to the unique needs and expectations of distinct customer segments.

The challenge at hand was the creation of an enhanced digital user experience that not only fulfills user needs but also imparts a sense of individualized importance. Emirates NBD's ultimate aspiration was to establish their mobile app as the preferred choice for financial and investment management for retail and private banking customers in the region.

CRDB Bank Retail Banking App

CRDB, a prominent bank in Tanzania, embarked on a transformative journey to revolutionize the banking experience in Tanzania through a modern app design. Striving for innovation, they partnered with us to overhaul their digital strategy, introduce novel features to meet evolving customer needs and stay ahead in the competitive financial landscape.

The reimagined digital strategy empowered CRDB to serve its customers more effectively, offering a user experience that was not only modern but also highly engaging. The revamped app marked a significant leap in CRDB's digital journey, catering to the evolving needs of Tanzanian users and reshaping their perception of banking.

United Arab Bank Retail Banking App

United Arab Bank (UAB), one of the leading financial solutions providers in the UAE, aimed to align their mobile banking experience with their commitment to exceptional customer service. Despite offering tailored financial services, UAB's existing mobile app didn't fully embody their values. They sought to enhance their digital offerings and reduce the need for physical branch visits.

UXDA's task was to transform UAB's mobile banking into an intuitive, engaging platform that motivated users to shift from branch visits to app usage. The goal was to foster relevance, simplicity and contextual information presentation, aligning with UAB's mission to provide superior digital banking in the UAE. Read more in this United Arab Bank UX case study.

Bank of Jordan Retail Banking App

Bank of Jordan, a well-known and respected middle eastern bank, had a goal to enhance and digitalize the user experience in the mobile app. The Bank of Jordan's app offered a wide array of features that unintentionally created more complexity for users to perform basic tasks. The challenge was to remove the complexity and create a convenient and powerful mobile app in which users can perform as many operations as possible on the go, eliminating the need to go to the branch.

They updated their mobile banking app with a remarkable transformation in just six months, soaring from a 2.8 to a 4.7-star rating on Google Play, leading to enhanced accessibility and convenience for millions of users in the middle east. Read more in this Bank of Jordan UX case study.

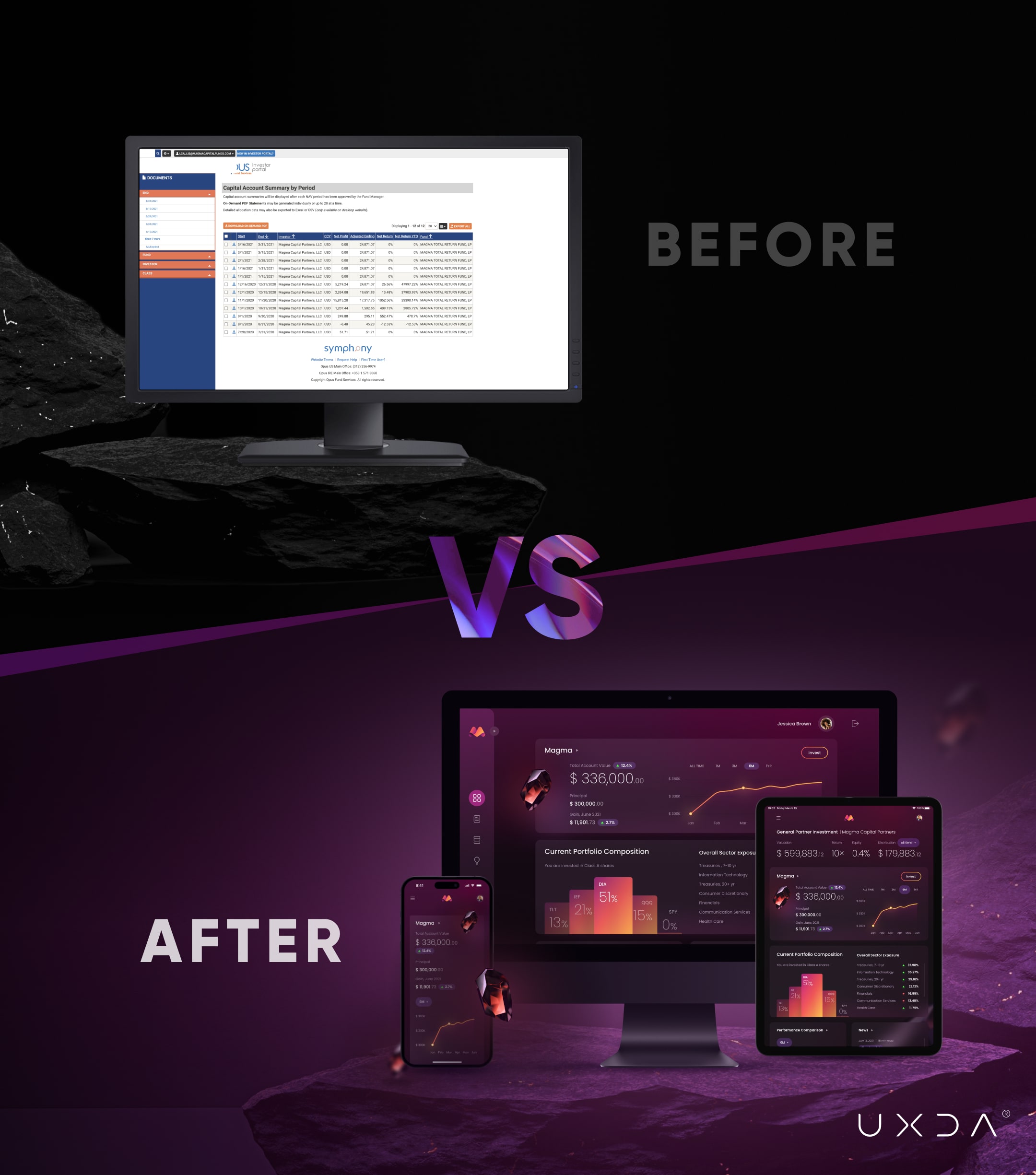

Magma Hedge Funds Platform Ecosystem

Magma Capital Funds aimed to revamp the investment experience for digital-savvy users. They sought a user-friendly, luxurious digital solution to attract and empower new-gen high-net-worth investors, offering control, sophistication and convenience.

Their goal was to overcome HNWI obstacles, replacing paper-based procedures with seamless digital onboarding, enabling remote investment management. By eliminating transparency issues and undisclosed strategies, they aimed to redefine hedge fund relationships. Read more in this Magma UX case study.

Private Wealth Systems Wealth Management Platform

Private Wealth Systems, a provider of advanced investment reporting and analytics for affluent families and financial advisors, initiated a profound revamp of the product and their platform's user experience. Their challenge revolved around aligning their platform with the expectations of their high-net-worth clientele.

The existing user interface and experience fell short in delivering the sophistication and service quality that their customers demanded. PWS sought to revamp their investment reporting and analytics platform, aiming to create a more intuitive, visually appealing and functionally efficient system that resonated with their users' high expectations.

Private Wealth Systems is a unique gem in the industry that smooths friction and makes managing complex wealth delightful. This is a one-of-a-kind wealth management system that is a must-have for any ultra high-net-worth individual. This transformation has redefined how affluent individuals and their financial advisors interact with investment data, elevating the platform to an essential tool for ultra high-net-worth individuals seeking sophisticated wealth management solutions.

ITTI Digital Cloud-Based Core Banking

ITTI Digital, a banking software vendor, underwent a profound transformation by collaborating with UXDA to migrate a 15-year-old core banking solution to the Cloud. This shift led to remarkable improvements in banking service speed, employee productivity and customer satisfaction.

Learning curves for banking employees are reduced from months to hours, lowering the risk of human error. The Cloud-based system also expanded ITTI Digital's global market reach. Consequently, the core banking system received the prestigious IF Design Award after just a few months following their visual product release.

Throughout the project, ITTI Digital's perspective changed significantly as they prioritized users and their needs. They embraced user feedback and empathized with their struggles, resulting in a more user-centric approach. Sixty-five percent of the previous platform's functionality was removed due to being unnecessary, and entirely new functionality was added based on the user needs that they uncovered. Read more in this ITTI UX case study.

CR2 White Label Banking Ecosystem

CR2 is a global leader in the Digital Banking Platform market, particularly renowned for its dominance in Africa. It offers various digital channel solutions, encompassing mobile, internet, SMS, USSD, payments, card management systems, ATM and kiosk. Recognizing the need to enhance cross-channel customer experiences, CR2 undertook a mission to establish a unified UX/UI design system and digital strategy for their white label ecosystem.

As a result, CR2 has crafted a harmonious white-label ecosystem, including desktop, tablet, mobile and ATM, empowering financial institution departments to collaborate seamlessly, ensuring uninterrupted customer experiences across different channels. This commitment solidifies CR2's position as a pioneer in shaping comprehensive financial solutions.

The Transformative Power of Design

These transformations are amazing, but please don't be fooled; what you're seeing is not a surface interface design revamp similar to what's offered by full-range agencies or freelancers. What you are seeing is a complete overhaul of the user experience, requiring a 100% focus on research, rethinking and innovation in financial services design.

A superficial UI revamp, while potentially improving the visual appeal of a financial app, is often not enough for several compelling reasons:

- A good-looking app might initially attract users, but if the app is difficult to navigate or slow to respond, users will quickly become frustrated. UX encompasses much more than just aesthetics; it includes usability, accessibility, and the overall flow of interactions.

- Modernizing the appearance of an app without addressing its information architecture can lead to user journey bottlenecks, usability issues, and scalability obstacles.

- A mere UI update does not match the level of innovation required to compete effectively.

- Today’s consumers expect intuitive, fast, and reliable digital experiences. A superficial UI revamp does not sufficiently address these expectations, and it does little to attract new customers in a market where user experience can be a significant differentiator.

- Financial ecosystems are increasingly interconnected, and a surface UI revamp may not take into account the need for consistency between different channels, products, services and brand.

- Superficial changes can lead to a fragmented UI design system and increased design debt, making the app more difficult and costly to maintain, update and scale over time.

- While a rapid surface UI revamp can make an app more visually appealing, it falls short of addressing the strategic needs of modern digital banking, including user experience, performance, usability, scalability, and innovation.

The success of such financial app design transformation is firmly rooted in creating memorable, emotionally resonant experiences that cater to customers' unique needs. Moving from basic functionality to a next-gen financial experience requires a shift in financial product design that prioritizes customer-centricity, emotions and innovation. By harnessing technology, embracing customer feedback and instilling trust through empathic design, banks and financial organizations can position themselves at the forefront of the industry's evolution, setting new standards for the financial experiences of tomorrow.

These ten examples of financial app design transformation show that design goes beyond aesthetics. Instead, it pervades every aspect of a product, influencing how users interact, perceive it and ultimately benefit from it. What's more, these examples underscore a key takeaway: design effectiveness increases as an organization becomes design-mature. As financial institutions evolve and implement design thinking methodologies, they are moving beyond transactional interactions to foster meaningful connections with users.

This transformative power of design has a tangible impact on financial companies. It elevates their offerings, creating a competitive edge that resonates with customers on a deeper level. By implementing a user-centric approach, financial institutions increase trust, loyalty and brand affinity. As design-thinking matures within these organizations, it fosters agility, allowing them to adapt to evolving market dynamics and changing consumer expectations. Ultimately, product design is the driving force that drives the financial industry forward, redefining relationships, enhancing experiences and shaping a brighter future for both financial companies and their customers.

Following is a list outlining the key points to successfully transform a financial app through a customer-centric design and user experience (UX):

UX Audit

Conduct thorough user and product research to detect usability issues, pain points and improvement opportunities. This informs the design process and ensures that the app caters to real user requirements.

More: Shift Perspective to Improve Financial Products with a UX Audit >>

Design-Driven Strategy

Align the app's strategy with design principles. Prioritize design decisions that enhance user satisfaction, engagement and ease of use.

More: Banking Innovation Only Thrives in Design-Mature Financial Organizations >>

Design Ops

Implement Design Operations (DesignOps) practices to streamline and optimize design processes, fostering collaboration among teams and ensuring consistency across your digital ecosystem.

More: Implementing DesignOps in Banks and FIs >>

Multi-Value Approach

Consider financial market development and your customers’ key values in your product design. Tailor the product's design to cater to a diverse range of user needs and goals.

More: Financial UX Design Methodology: the Value Pyramid >>

Human-Centricity

Keep the human at the center of your business strategy and all design decisions. Make your business purpose-driven to bring good to the community and align with customers’ expectations.

More: How Purpose-Driven Banking and Fintech Create Next-Gen Products >>

Customer Perspective

Continuously view the app through the lens of the customer. Regularly seek user feedback and insights to refine and enhance the app's design based on user context.

More: Don't Let Financial Experience Fail Ignoring the Problem-Solution Cycle >>

Customer-Centric Culture

Cultivate a company culture that combines value and design to encourage collaboration among design, development and business teams. Customer-centricity should be integral to the overall company culture.

More: The UX Matrix: Grow a Customer-Centric Banking Culture >>

Key Scenarios

Identify critical user scenarios, such as onboarding, transactions, customer support, etc. Streamline these interactions to minimize friction and provide a seamless experience.

More: Fintech UI Design: 20 Tips to Improve Mobile Banking Usability >>

Design Thinking

Apply design thinking methodologies to creatively solve user problems. Empathize with users, define their needs, ideate solutions and prototype and iterate based on feedback.

More: How To Implement Design Thinking In Banking >>

Experience Gap

Identify areas in which the user experience might be disjointed or inconsistent. Smooth out these gaps to ensure a cohesive and coherent journey for users by detecting and resolving blind points in your business.

More: Customer Experience Gap Model: Blindspots That Ruin Digital Banking >>

Launch Strategy

An excellent app design doesn't guarantee success without a strong launch strategy. Continuously monitor user behavior, gather feedback and make improvements based on data and insights.

More: A Poorly Executed Launch Could Sink Even a Perfect Financial Product >>

Remember, a successful financial app design transformation requires a holistic approach that combines design expertise, user insights and a commitment to delivering an exceptional customer experience.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin