Banks invest millions into their digital service, launch it proudly and then stop nurturing it. But digital products are not assets—they are relationships. And relationships break when ignored. After a decade redesigning financial ecosystems—from retail banking to trading, wealth, SME, insurance, crypto and payments—we distilled 10 practical, experience-tested recommendations that any financial company can apply to turn an ordinary app into a growth engine.

The Silent Crisis in Financial Digital Products

Almost every financial executive today feels the same pressure, whether they admit it publicly or not: “We have invested millions into digital. Why doesn’t it feel like an advantage?”

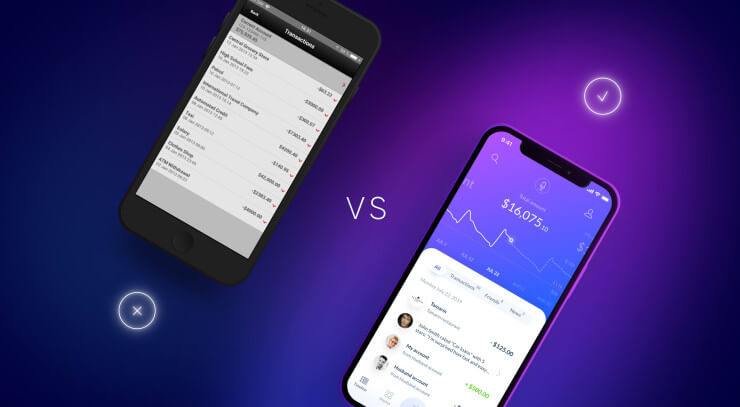

For years, competitive advantage in financial services was built through products, pricing, and technological capability. Today, most banks operate with comparable platforms, similar feature sets, and access to the same technologies. Functional differentiation has narrowed to the point where it no longer creates sustained advantage.

You modernized. You built the app. You digitized processes. You bought the systems. You launched the features. You ran the marketing.

And yet the outcome is painfully familiar. Users still abandon onboarding halfway. Customers still call the contact center for basic tasks. Competitors still seem “more intuitive.” Adoption plateaus. Satisfaction stalls. Internal teams blame legacy systems, and legacy systems blame “future phases.”

Meanwhile, your customers compare you not with banks—but with every brilliantly simple digital experience in their daily lives. Because digital finance isn’t competing on products anymore. It’s competing on how those products feel.

In a digital space built on trust, speed and clarity, financial companies can lose customers in seconds—during a confusing form, a slow-loading screen, a vague message or a moment of hesitation that breaks confidence.

The digital world has reshaped customer expectations so dramatically that even strong institutions risk becoming irrelevant—not because their services are bad, but because their experience doesn’t match the emotional reality of digital-native decision-making.

"Most financial products are built as transactional calculation systems—not as human experiences."

The winners of the next decade will be those who close this gap—not by adding more features but by turning every digital touchpoint into a relationship that feels intuitive, empowering and unmistakably human. It is experience—and more precisely, how digital experiences shape trust, confidence, and long-term brand perception.

For more than a decade, across 150+ complex financial projects in 39 countries, we’ve learned one truth:

"Digital transformation succeeds when the product becomes a trusted companion for customers—not a generic interface."

Below are 10 recommendations distilled from UXDA’s global experience—practical, human-centered principles designed to help financial institutions turn their digital products into indispensable value engines users never want to live without:

1. Coach your users. Don’t command them.

Most financial apps overload users with instruction modals, warnings, tours, tooltips and rigid flows. The result? Confusion, abandonment and support costs.

What works:

Create guided discovery, not guided suffering.

This is the UXDA principle of progressive disclosure—revealing information only when it becomes relevant.

Why it matters in finance:

Money, investments, loans and insurance already cause cognitive stress. A product that teaches gently instead of forcing steps builds trust and confidence.

UXDA case example:

When redesigning the Garanti BBVA mobile banking experience, UXDA focused on transforming complex financial functionality into a personal financial coaching journey. Instead of overwhelming users with data, options, and instructions, the app guides them step-by-step, adapting its interface to each user’s level of financial confidence.

More in BBVA Garanti Securities Case Study

More in BBVA Garanti Securities Case Study

Recommendations:

- Give beginners safety and clarity

- Give experts freedom and power

- Let the journey expand as skills grow

2. Make personalization your core value driver—not a widget.

Users stay loyal to apps that feel tailored to them, not to “average personas.” Personalization in finance isn’t about showing a name in the header.

It’s about:

- Predicting the next best action

- Adapting flows based on past behavior

- Surfacing relevant tools at the right moment

- Guiding financial literacy with contextual education

This transforms your app from a tool into a personal financial ally.

UXDA case example:

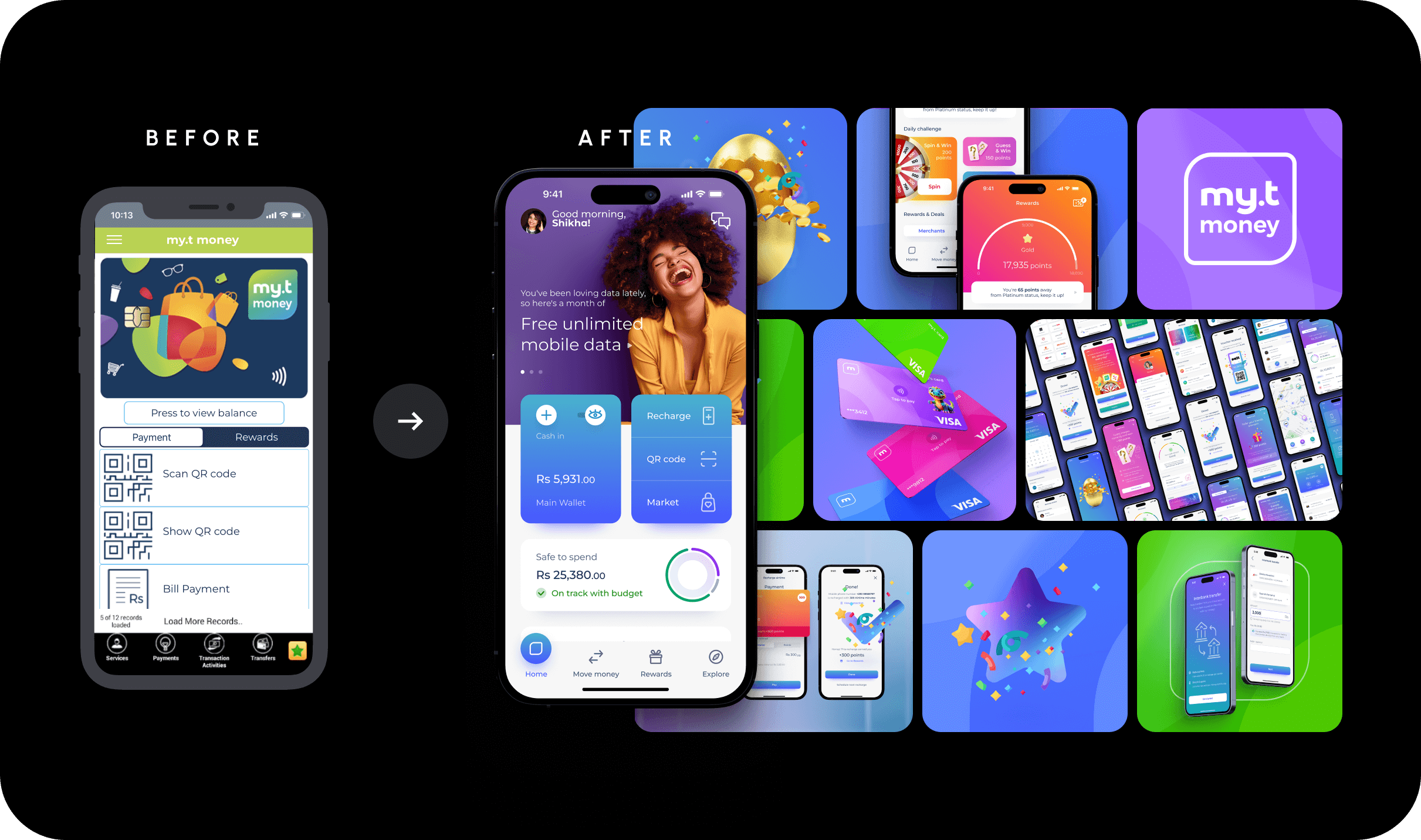

When UXDA partnered with Mauritius Telecom to redesign my.t money, the goal was to create more than just a payment app—it was to build a superapp that would redefine the way Mauritians live, pay, and bank. By implementing deep personalization across every journey, my.t money became an adaptive ecosystem that understands each user’s lifestyle, habits, and financial needs.

Recommendation:

Design your product like a mentor who remembers, understands and anticipates user needs—not like a static filing cabinet.

3. Build human trust—don’t hide behind corporate language.

Financial services often frame customer behavior as logical and data-driven. In reality, financial decisions are deeply influenced by emotional states:

- Uncertainty

- Risk perception

- Responsibility toward family and future

- Desire for reassurance and control

Digital experiences mediate these emotions every day. In finance, trust is UX. Research from PwC, Emplifi and Invoca all show that even one frustrating moment can send a customer running to a competitor. Cold language, robotic flows and generic templates signal: “Your needs and emotions don’t matter to us.”

When experiences are unclear, inconsistent, or purely transactional, they introduce friction at an emotional level—even if usability metrics appear strong. Over time, this erodes trust silently.

UXDA observation:

Products that talk human-to-human earn emotional safety, which translates to:

- Higher retention

- Lower support calls

- More cross-sell opportunitie

- Users actively recommending the app

UXDA case example:

When creating a Conversational Banking experience for one of our clients, we discovered how crucial the language and tone are in defining user trust. The more innovative and AI-driven the experience becomes, the more intuitive and emotionally human it must feel.

More in Conversational AI Case Study

Recommendation:

- Use simple, empathetic language

- Celebrate milestones: saved money, paid-off loan, completed investment

- Offer versatile support—from chat to branch scheduling

A financial product is not a calculator. It is a companion that is with them through their hardest and happiest moments.

4. Infuse your product with unmistakable brand charisma.

If removing your logo makes your app look like every other app, you have a problem. Brand is not decoration. Brand is recognition, emotion, loyalty and identity.

Most financial institutions articulate strong brand values:

- Trust

- Stability

- Responsibility

- Long-term partnership

However, digital experiences often fail to express these values consistently.

This creates a structural gap:

- The brand promises one thing

- The digital experience behaves differently

Customers may not articulate this gap explicitly, but they feel it — and adjust their behavior accordingly. This is where differentiation is lost. The real competitive gap lies between brand intent and digital behavior.

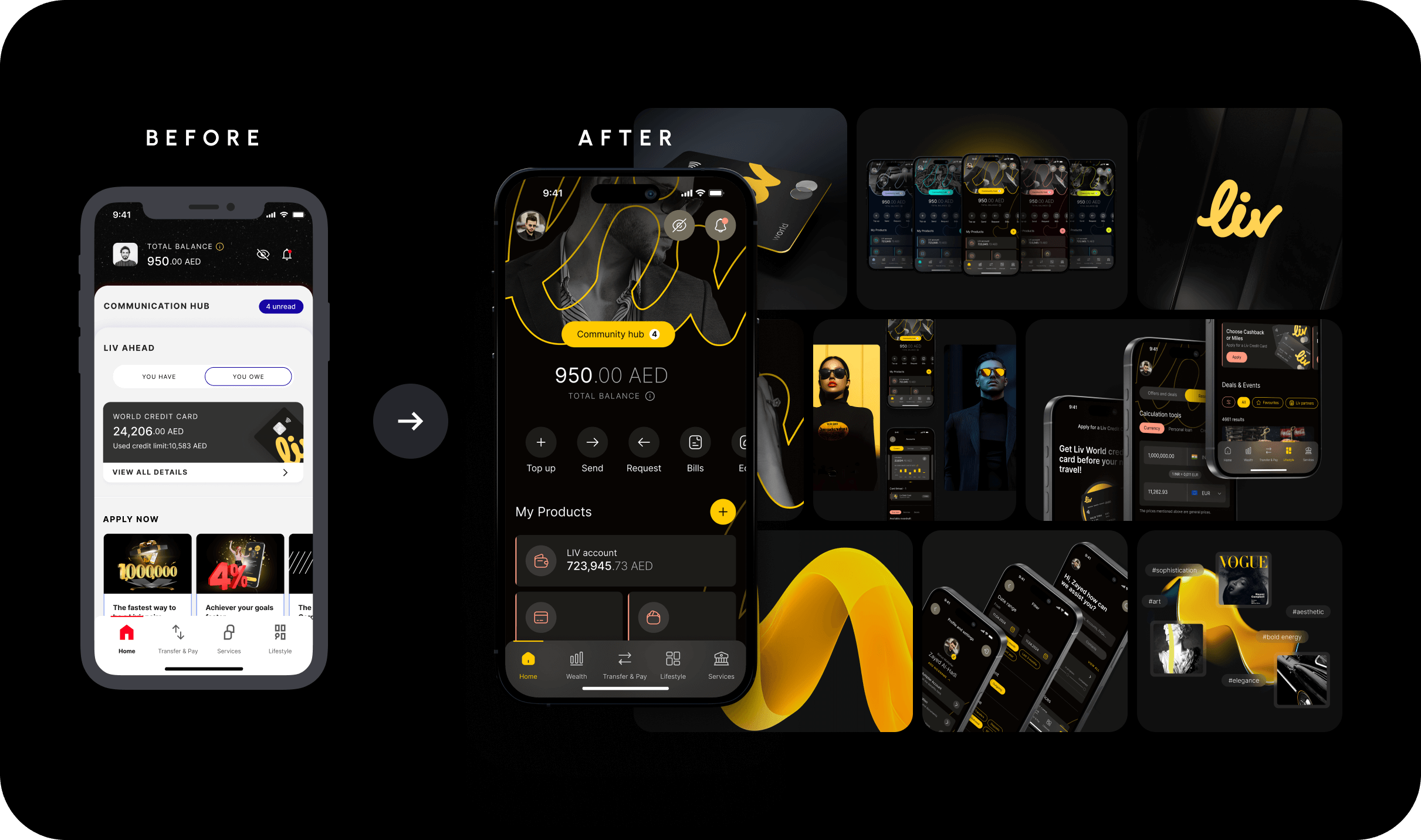

UXDA case example:

When UXDA partnered with Emirates NBD to create Liv X, the next-generation evolution of its award-winning digital bank, our mission was to design a lifestyle banking experience that resonates with the ambitions and energy of Dubai’s young, creative generation. Liv X was built as a brand ecosystem that feels alive—a digital space that blends finance with fashion, music, travel, and social culture.

Recommendation:

Craft a visual and verbal universe users can feel—not just see. Your brand should narrate the story of who your customers want to become through your product.

5. Design for user growth—not just initial acquisition.

Financial life evolves, and your product must evolve with it. If your app doesn’t help users advance—financially, behaviorally or emotionally—it becomes a short-term tool rather than a long-term relationship.

UXDA case example:

Fitness apps raise goals automatically; investment apps should, too. With over 94 million users, GCash is one of the world’s largest financial superapps—and a vital part of everyday life in the Philippines. When UXDA was invited to design the GCash Investments experience, our mission was to make investing accessible, motivating, and growth-oriented for millions who had never invested before.

More in GCash Investments Case study

Recommendation:

Design adaptive pathways that unlock deeper value as users mature:

- A basic savings user grows into an investor

- A novice trader evolves into a confident strategist

- A first-time borrower becomes a wealth planner

- An SME owner progresses from invoice tools to cashflow optimization

6. Make speed your competitive weapon.

In a world where three seconds can cost half your traffic, slow products kill trust. Speed is not just “nice to have.” Speed is retention insurance, revenue protection and brand credibility.

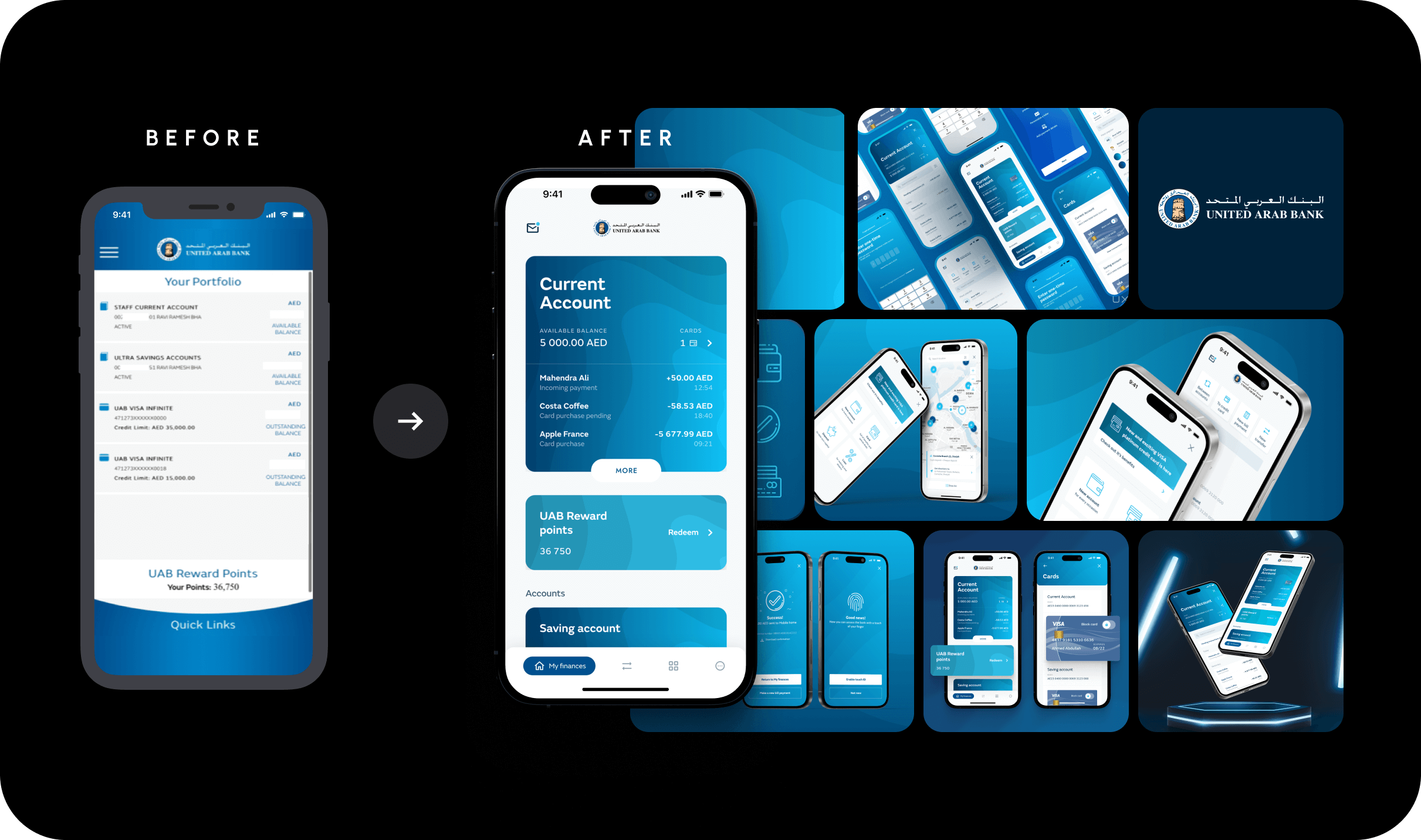

UXDA case example:

When UXDA partnered with United Arab Bank, the challenge was clear—despite strong offerings and trust in the brand, customers perceived the digital experience as slow, complex, and outdated. Our goal was to transform speed into a core brand promise, not just a technical metric. By introducing biometric login, optimizing flows and surfacing quick actions, we made tasks 27× faster—and churn dropped immediately.

More in United Arab Bank Case Study

Recommendation:

- Establish performance budgets

- Reduce steps in high-frequency flows

- Pre-load critical data

- Treat speed as part of your brand promise

Fast experiences feel premium—even when the UI is simple.

7. Transform listening into a strategic operating system.

Analytics show what people do. Feedback reveals why. Great financial products combine both.

UXDA case example:

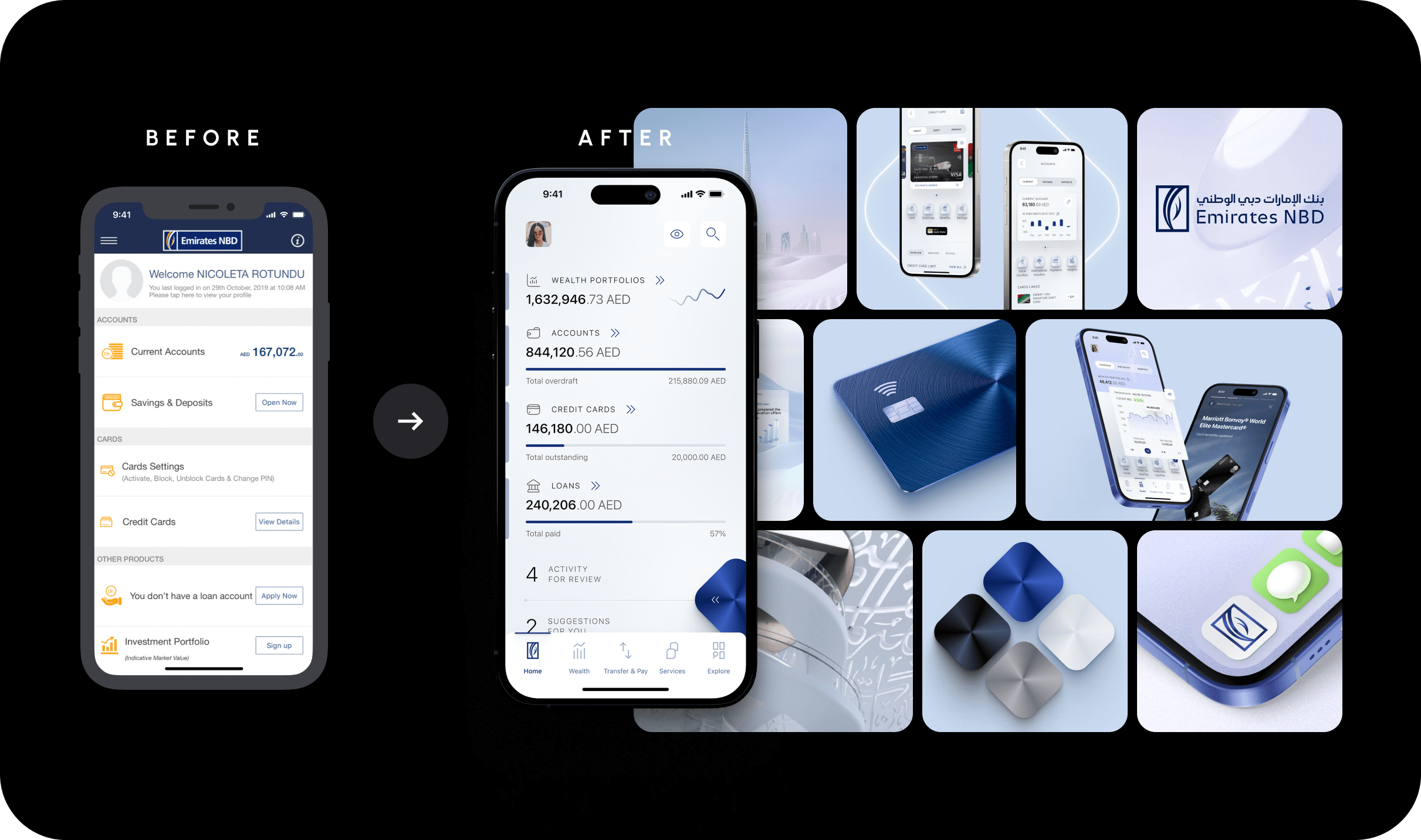

When designing the digital ecosystem for Emirates NBD, one of the leading banks in the Middle East, UXDA’s goal was to strategically deliver next-generation experiences to customers living in Dubai’s fast-paced, innovation-driven environment.

More in Emirates NBD Case Study

Recommendation: Creating a Continuous Listening Loop:

- In-app feedback modules

- Trigger-based surveys

- Journey-based telemetry

- User interviews on every sprint

- Rapid experimentation cycles

Users must feel the product is co-created with them and not just built behind closed doors.

8. Use micro-interactions to build dopamine-positive habits.

Feature parity is now the baseline, not the advantage. Functional improvement alone no longer explains why customers choose, stay, or disengage. Today, in all banking apps, customers can:

- Transfer funds instantly

- Open accounts digitally

- Access sophisticated financial products

- Manage finances through intuitive interfaces

These capabilities are no longer differentiators. They are expectations. When banks continue to compete primarily through features, they enter a cycle of diminishing returns:

- Innovation becomes reactive

- Products converge

- Costs increase

- Loyalty weakens

Financial behavior is emotional. Tiny signals of progress can dramatically improve engagement. A joyful animation, a subtle haptic click or a meaningful congratulatory message at the right time creates:

- Habit loops

- Emotional connection

- Positive reinforcement

- Long-term stickiness

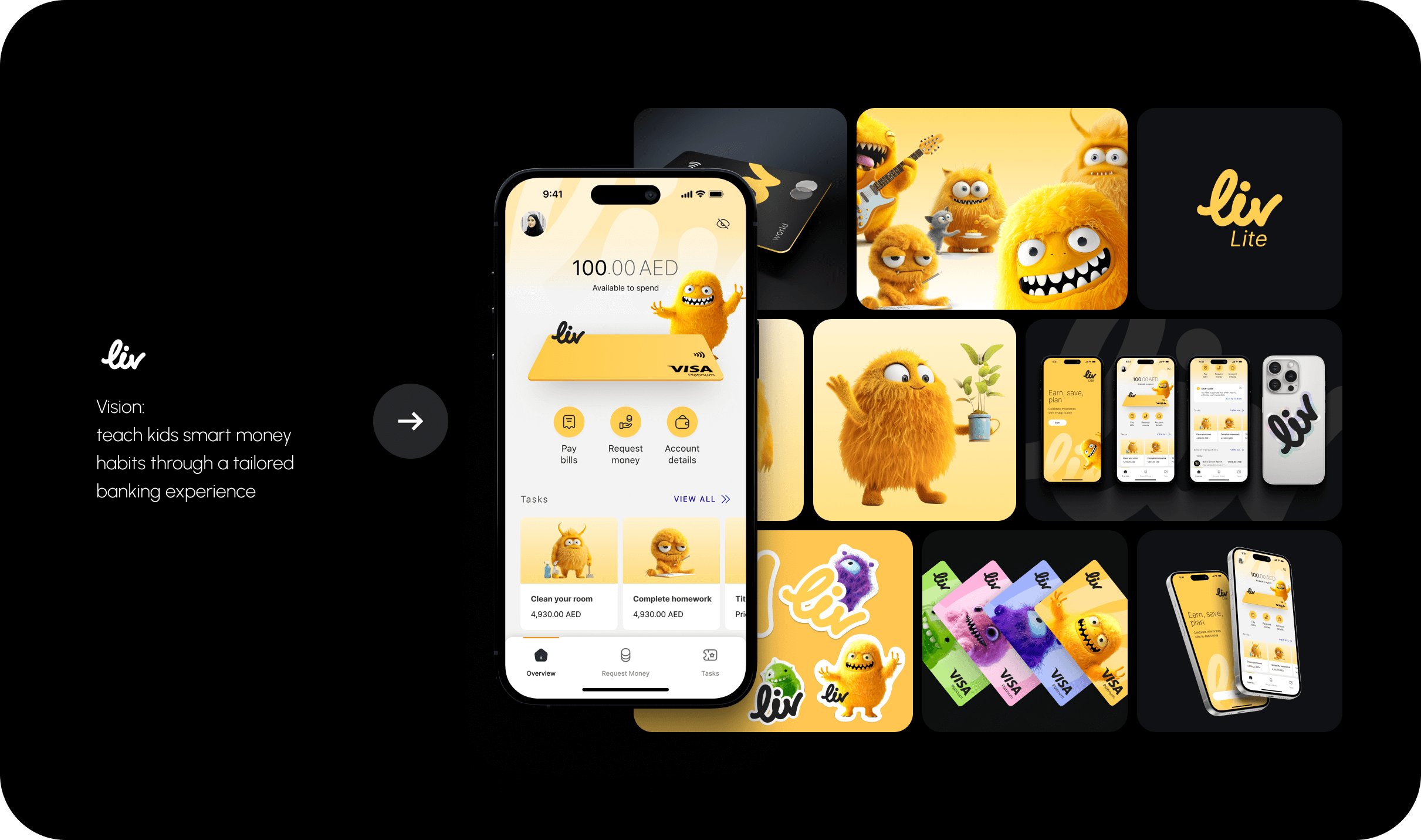

UXDA case example:

When designing Liv Lite, the new children’s banking product by Emirates NBD, UXDA focused on using positive emotions to shape healthy financial habits for the next generation. Every micro-interaction — from joyful animations to empathetic feedback messages — was carefully crafted to make managing money feel encouraging, not intimidating.

Recommendation:

Use delight as seasoning—not decoration. And only where it reinforces progress.

9. Turn your vision into a clickable strategic engine.

Many financial companies have bold transformation statements but no translation into user journeys. A vision without a UX strategy is a brochure. A vision translated into flows becomes a growth roadmap.

UXDA case example:

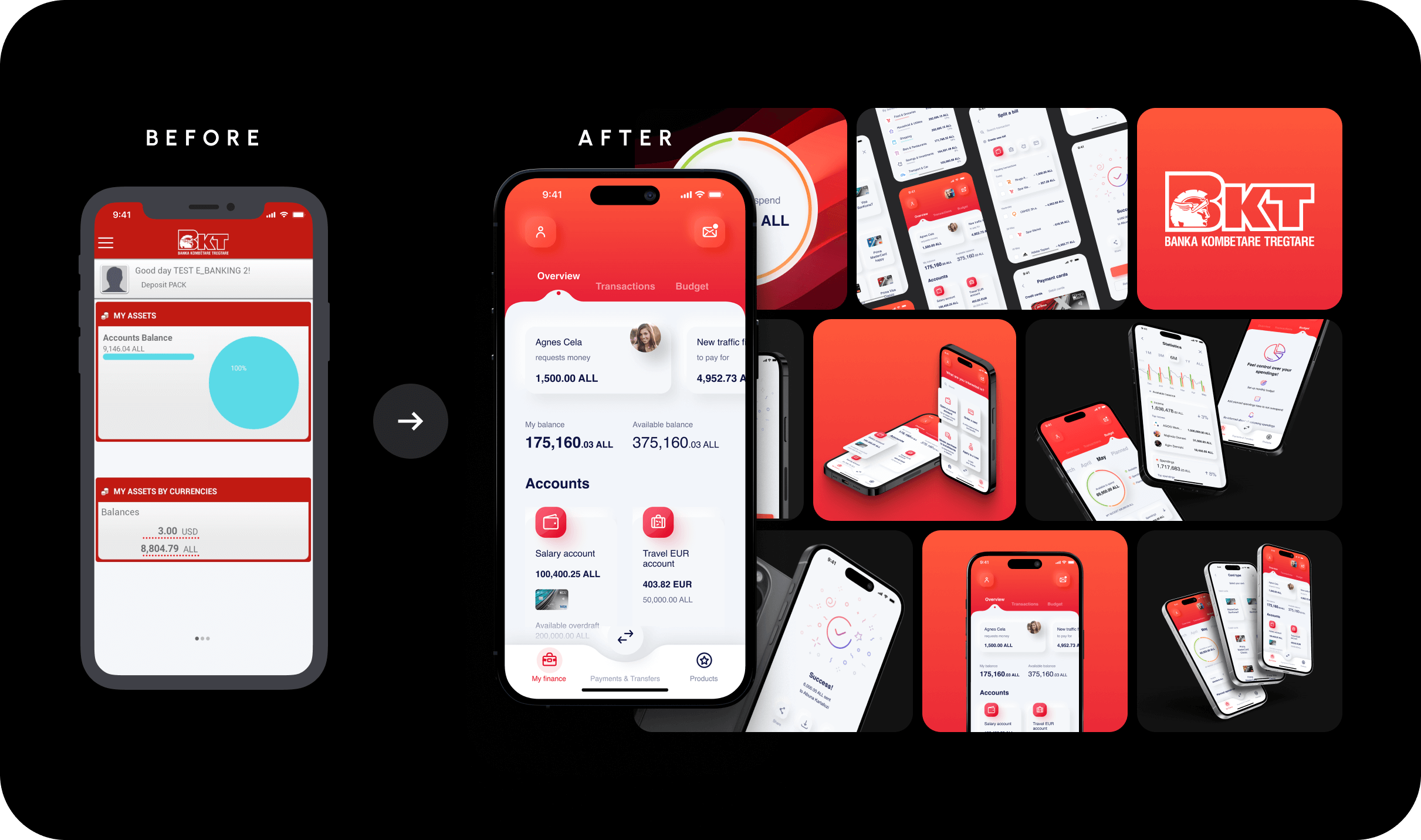

When UXDA partnered with BKT (Banka Kombëtare Tregtare), the mission was to transform a century-old financial institution into a digital-first innovator. While the bank had a powerful transformation vision, it needed a tangible, experience-driven strategy that could bring this vision to life for millions of customers.

Recommendation:

Link every design decision to:

- A business objective

- A brand promise

- A user problem

When pixels drive revenue, the product becomes a profit engine—not a cost center.

10. Measure success based on customers' outcomes—not internal KPIs.

A feature that doesn’t create real user value is hidden tech debt. Most apps track internal KPIs like DAU, MAU and conversions. It may be useful but it’s incomplete.

What to measure for real impact:

- Financial progress (e.g., savings, satisfaction, better choices)

- Tasks successfully completed and not just started

- Stress reduction in risky processes (e.g., loans, investments)

- User confidence metrics

- Feature effectiveness in real-life contexts

When the product optimizes for people, people optimize for the product.

Final Thought: The UXDA Principle

Exceptional digital products in finance are not built feature-by-feature; they are cultivated feeling-by-feeling. Competing on “feelings” does not mean designing emotional interfaces or adding superficial engagement layers.

It means understanding that:

- Trust is built through consistency, not persuasion

- Confidence emerges from clarity, not complexity

- Loyalty is reinforced through predictability, not novelty

Emotion in financial services is not something to design directly. It is the result of well-governed experience behavior over time.

This is the core of UXDA’s principle: your product is not a collection of screens—it is a living experience system shaped through continuous empathy loops.

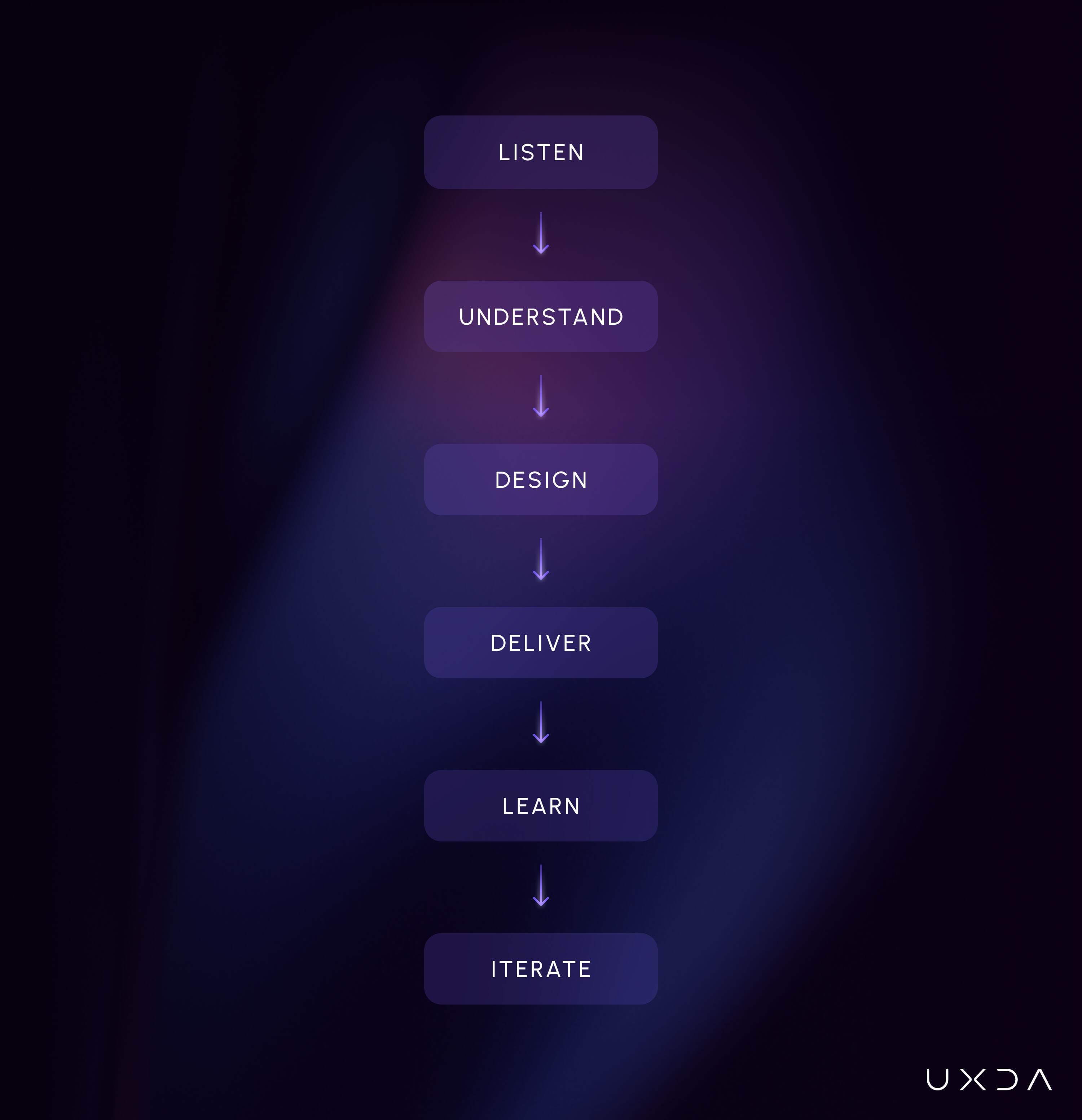

Listen → understand → design → deliver → learn → iterate.

Every loop deepens the emotional relationship between your institution and your customer. And this emotional bond is no longer a “nice to have”—it is the new competitive moat.

Because customers rarely remember features. They remember how confident they felt. How clearly things worked. How predictable the institution was during important moments.

In financial services, those memories shape trust. And trust, once established, is the most defensible competitive advantage an institution can hold.

Digital Experience Branding in Action

As digital channels become the primary interface between institutions and customers, experience has become the most visible expression of brand.

This shifts responsibility:

- From marketing to leadership

- From design teams to governance

- From isolated projects to long-term systems

When digital experience is treated as a strategic asset — aligned with brand intent and protected through governance — it becomes a source of sustainable advantage. When it is not, differentiation erodes regardless of feature investment.

When a product consistently expresses the DNA of your brand—your values, your promise, your character—it becomes more than a tool. It becomes:

- a signal of your institution’s integrity

- a daily ambassador of your purpose

- a differentiator that no competitor can copy

Digital Experience Branding (DXB by UXDA) ensures that every touchpoint—visual, verbal, interactive—tells the same cohesive story: “You can trust us with your financial life.”

This is where most financial products fail: they deliver functionality, but not identity. They complete transactions but don’t convey meaning. And in the modern marketplace, meaning wins.

Why Some Institutions Consistently Outperform Others

Institutions that outperform over time tend to share common characteristics:

- They treat experience as part of brand strategy

- They prioritize coherence over constant innovation

- They design for confidence and clarity, not stimulation

- They govern experience decisions across teams and platforms

- They align execution with long-term institutional values

As a result, their digital experiences feel:

- Familiar rather than fragmented

- Trustworthy rather than impressive

- Stable rather than reactive

This is not accidental. It is intentional. Money carries fear, stress, hesitation and uncertainty. Yet digital products can transform these emotions into: clarity, momentum, confidence, and ultimately, progress.

UXDA's Dopamine Banking approach uses cutting-edge design and micro-moments of delight, achievement and encouragement to reinforce healthy financial behavior and emotional connection to the brand. When users feel rewarded, acknowledged, guided and safe, they begin to associate your product with positive emotion—a rare achievement in finance.

And when a financial product reliably generates positive emotion, it does something extraordinary: it becomes a habit. Not because of addiction, but because of empowered consistency.

So, the question is no longer whether to invest in digital experience. The question is whether to: continue competing through incremental features or reframe digital experience as a brand-driven, trust-building system.

The first path leads to parity. The second leads to differentiation that compounds over time.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel:

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin