What is AI in banking and how it impacts user experience?

AI stands for Artificial Intelligence. In general, machine learning and AI in the banking industry can be defined as using technology for Big Data processing, highly personalized offers, automatic scoring, fraud detection, conversational banking and financial and advisory assistance. Thus, artificial intelligence in banking affects all the traditional services, generating a range of disruptive opportunities in the banking industry.

AI solutions in banking will bring digitization of the banking industry to a new level by automating complex service processes that were previously performed by highly skilled bankers. This will lead to millions of job cuts in the next decade. On the other side, this will increase competition in the financial industry that results in increased service quality and reduction of fees.

AI in the banking sector is extremely important to make the financial industry more transparent, safe and user friendly. Revolutionary AI technology in banking could process a huge amount of data that is not able to be processed by the human brain, and detect hidden correlations. Artificial intelligence will transform the banking industry into a personalized financial advisor who can predict the future based on the decisions you take, and suggest the best possible way of operating with money.

Check out the best articles by UXDA about using AI in banking and finance.

Black Swan Events and the Fragility of Banking Models

Discover how digitalization blindsided traditional banks, transforming customer expectations overnight. This article explores why tech shifts like mobile and AI are “Black Swan” events—and what banks must do to stay relevant in a disrupted world.

Financial AI in Practice: 21 Case Studies of Artificial Intelligence in Banking CX

This article explores how 2024 became the breakthrough year for AI in banking—no longer a future experiment, but a strategic powerhouse reshaping digital customer experience. Discover how leading banks are using AI to unlock deeper personalization, smarter self-service, and faster, more human-centric digital interactions.

The Globalization of Digital Banking and Its Strategic Implications

In this article, we explore how Fintech-driven banking globalization mirrors the media industry’s transformation, what obstacles and opportunities arise when financial services become borderless and how artificial intelligence (AI) is poised to change the game even further.

ChatGPT Prompts in Digital Banking and Fintech Product Design

This article unveils the secrets of using ChatGPT prompts to drive innovation in banking UX, providing insights into how this tool can be integrated into the standard design process for transformative results.

Decision-Making Under Pressure: What Banking UX Can Learn from NASA

How prepared are traditional banking players? Despite all their experience, resources, confidence, and influence, could they still fail their customers, leaving them stranded in the 'digital' space like NASA astronauts? The standoff between Boeing and SpaceX in space suggests this is entirely possible, but there is a solution.

On-Device vs Cloud AI and the Future of Personalized Banking UX

Integrating AI into banking services will obviously revolutionize the user experience in financial services, offering real-time advice and 24/7 transaction monitoring. The main question is which AI will serve banking first ─ on-device AI or cloud-based AI? Let’s compare!

AI as a Humanizing Force in Financial Brand Marketing

There is another promising area of AI use for financial brands ─ marketing and brand communication. The UXDA team assessed the potential of humanizing financial brands using ChatGPT and Midjourney by creating digital mascots based on the mobile service interface.

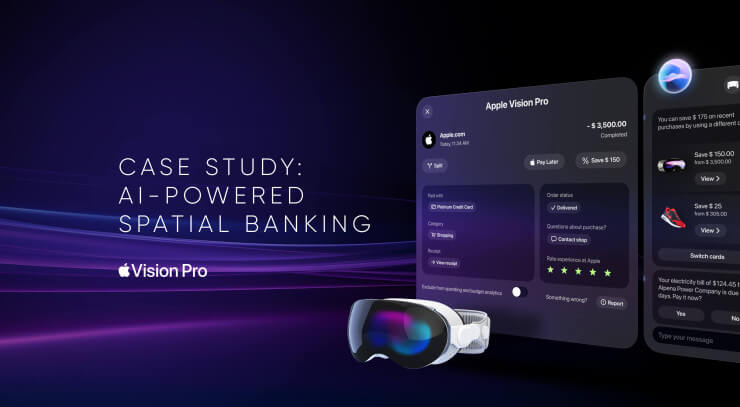

UX Case Study: Implementing AI to Shape the Future of Spatial Banking

Apple Vision Pro could start the next digital revolution. Wizards from Cupertino offer a mind-blowing spatial experience on the visionOS platform. But how could spatial banking feel and look?

UX Case Study: Challenges of Business Banking Transformation

SME owners often face the challenge of adapting business strategy to a highly dynamic environment while simultaneously managing day-to-day financial operations. It's like Formula 1 racers, where only precise and quick decisions can save them from failure.

Surviving Digital Disruption Through UX-Driven Banking Innovation

As the usage of physical cash diminishes and digital consumption skyrockets, traditional banks are undergoing a seismic shift to adapt to changing customer preferences. Digital transformation is reshaping industries and consumer behaviors, and the banking sector stands at a crossroads, poised to redefine our financial experiences in unprecedented ways.

UXDA's AI Banking Design Wins A'Design Award Gold in Italy

UXDA received the Gold Award for the AI conversational banking app UX/UI design in the most prestigious and renowned Italian design competition A’ Design Award.

- 1

- 2