It's trendy to talk about the use of design in digital product development and banking digital transformation. But there is a great misconception about digital products that not a lot of people are aware of...

Banking Transformation Is About Customer Feelings

Design is NOT a matter of how your product looks like. Design is about what your customer feels.

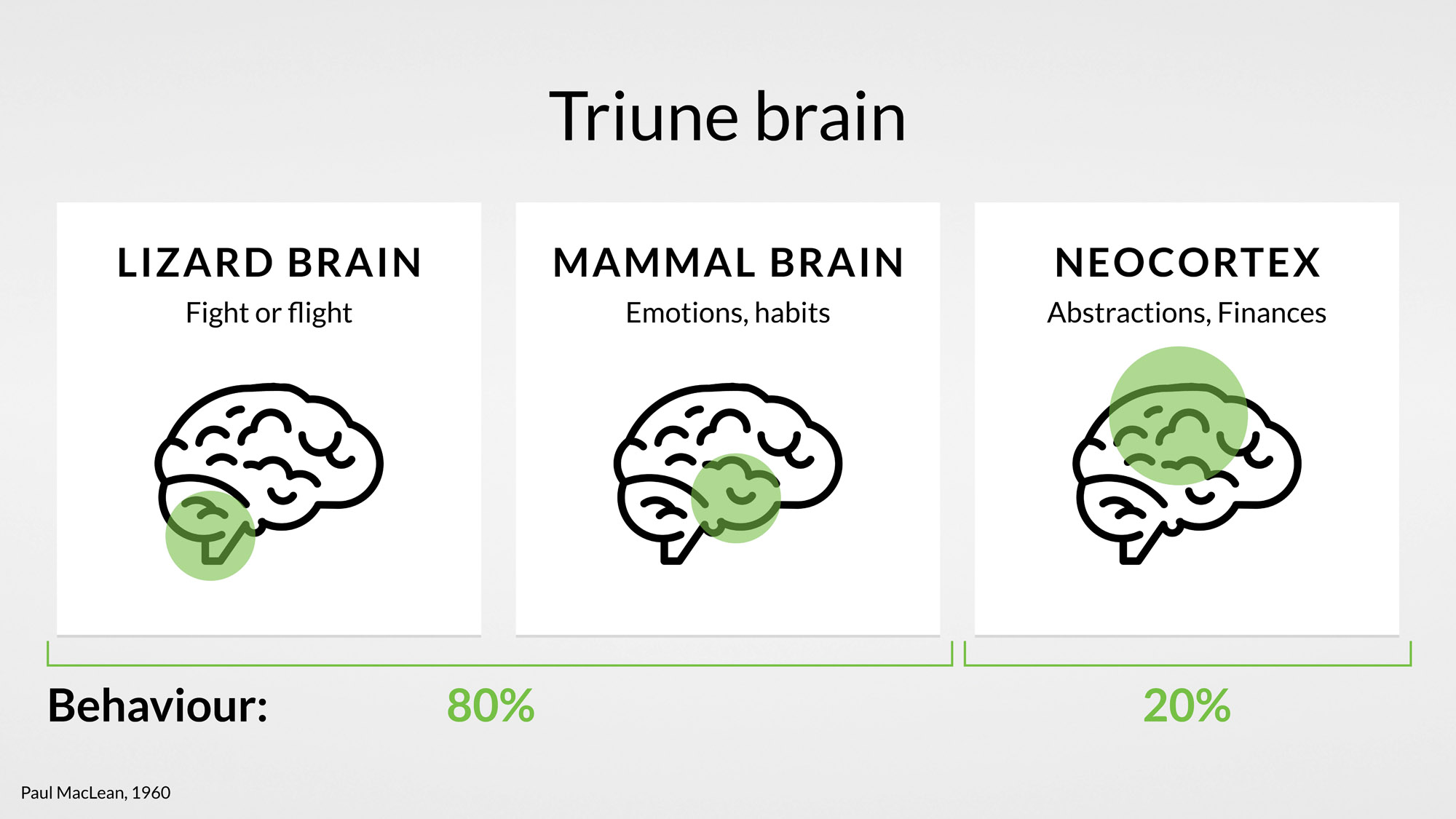

A lot of decision-makers believe that finance is all about rationality. But that's not true. Humans are economically irrational. And that's a fact proven by the research of Nobel laureate Daniel Kahneman.

Why Digital Banking Transformation Depends on Users

Human brain does not enjoy doing calculations and remembering numbers. And you know what? It's perfectly normal and natural because economics are NOT in human nature. We are emotional creatures! Our irrational, unconscious emotions drive 80% of our behavior.

Many believe that digital banking transformation requires only coding, technology, innovations, and other technical stuff. But if the user can't

- understand your product;

- get some value out of it;

- feel the emotional connection with it

neither a seemingly brilliant marketing strategy nor a huge advertising budget won't ever save your banking product.

We have come to a point where it's extremely important to understand that mistakes made in the financial design can lead to millions in losses.

In order to prevent this and ensure the success of your digital product in the long term - bring emotions to it by executing the best user interface design in banking. Make sure your banking UI design is pleasant to use! As Don Norman, the father of cognitive engineering has said:

"There is no need to sacrifice beauty for usability or, for that matter, usability for beauty".

The only way for successful banking transformation is to create a product your users will love by developing digital solutions through the User Experience methodology and the Design Thinking approach. This will enrich your digital banking transformation strategy with the needed “magic” ingredients to deliver solutions that will not only serve customers according to their needs but also set up an emotional connection fulfilling their expectations.

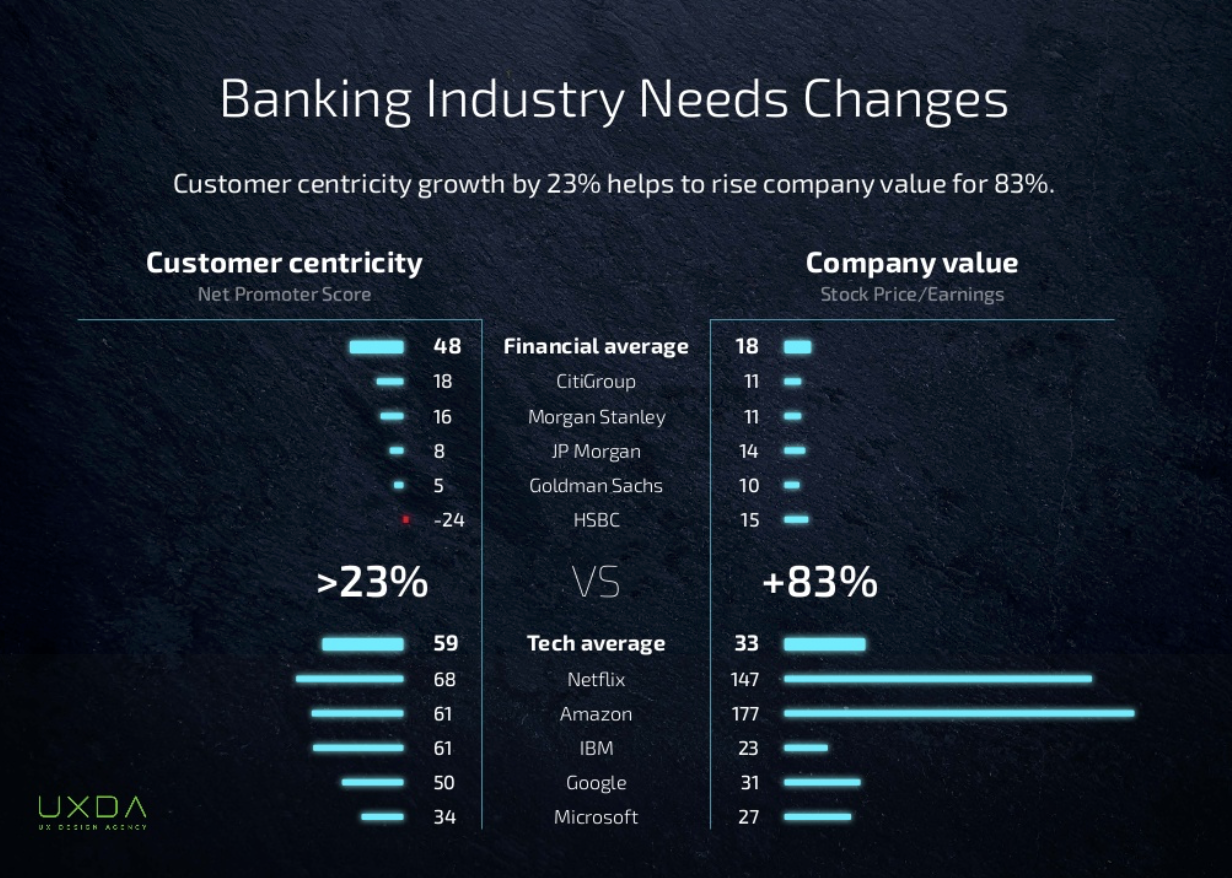

If you look at hugely successful companies that have integrated Design Thinking into their very core, into their DNA you can see five times bigger Ratios/Earnings rates than average.

Let the numbers speak, do your math but please, DO NOT forget about the emotions.

Do you have any questions about financial design, Design Thinking and User Experience Methodology advantages in banking product design?

Feel free to send them in as a comment or a direct message, we will cover the topic in the next UXDA Vlog video!

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin