Financial service complexity is no longer an excuse for confusion. In the intricate world of corporate banking, CBX (Contextual Banking Experience) by iGTB (Intellect Global Transaction Banking) simplifies and clarifies transactional banking. What was once a labyrinth of thousands of features has been transformed into an intuitive, user-centered platform that redefines the future of corporate finance. Guided by a relentless focus on user experience and customization, UXDA collaborated with iGTB to shape this groundbreaking evolution. Dive into this case study and discover how we helped iGTB lead in the arena of next-gen corporate banking.

Client: World's Leading Vendor in Wholesale and Transaction Banking

IBS Intelligence has ranked iGTB, part of Intellect Design Arena, the #1 transaction banking system and the leader in Wholesale and Transaction Banking. With a presence in 97 countries, iGTB is revolutionizing banking with innovative software solutions that empower commercial banks to thrive. Serving more than 60% of the world's top banks, including HSBC, CitiBank and Barclays, iGTB’s expertise spans America, Europe and Asia, supported by a global team of 4,500+ professionals.

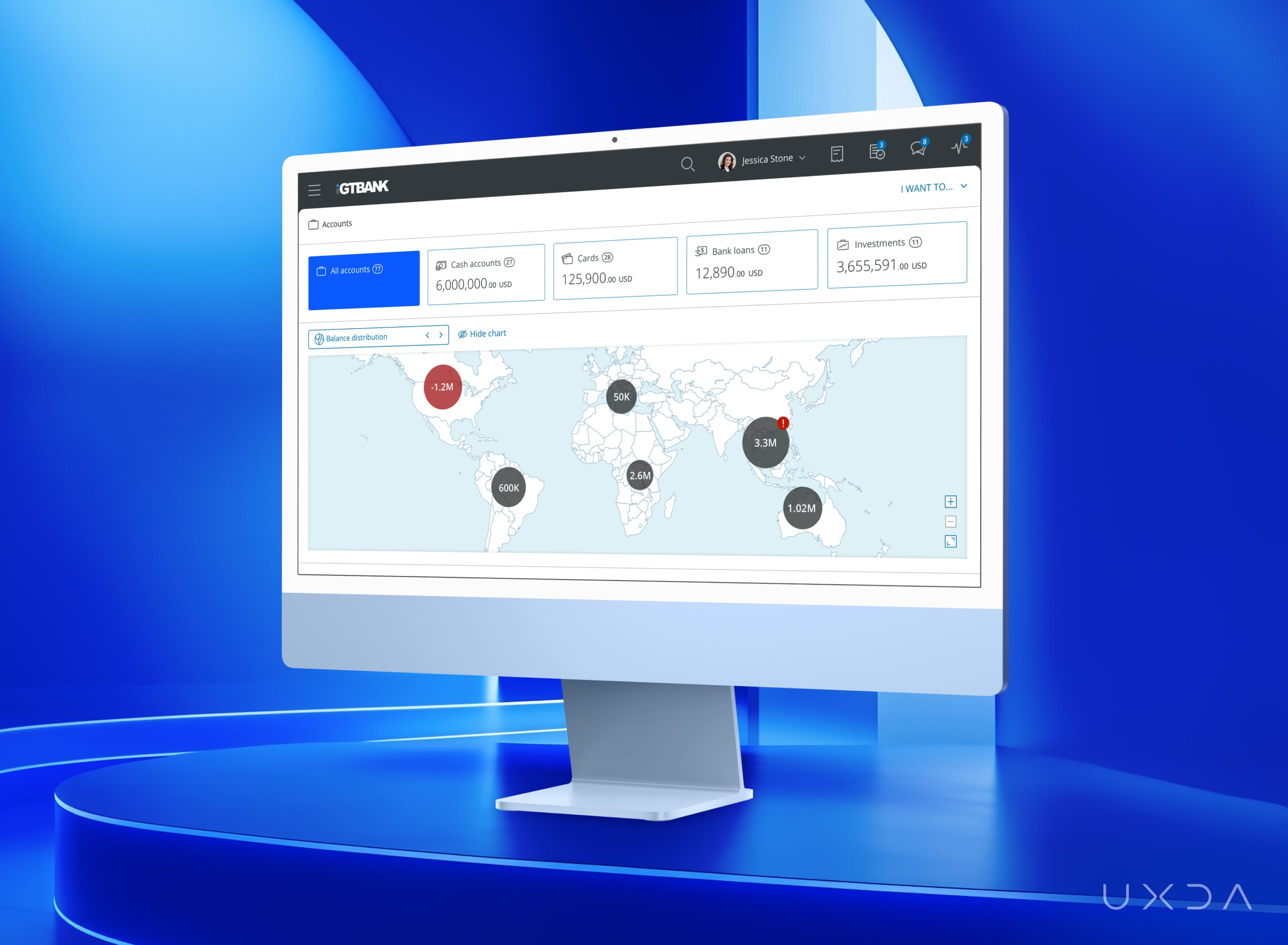

iGTB is transforming corporate banking with its innovative and sophisticated module-based, white-label platform: CBX. It is a contextual banking platform designed to streamline multi-account budgeting for corporate treasurers and financial managers. For example, CBX provides a unified view of cash flow across all markets, simplifying financial operations and enabling corporates to make smarter decisions and allocate funds more efficiently.

CBX understands corporate clients' needs by providing real-time, intelligent recommendations and a seamless digital experience. Banks can choose to fully implement the platform or select only the features they require. Trusted by 8,500+ corporates and 40,000+ users, CBX is reshaping corporate banking for simpler, smarter and more efficient management.

Challenge: Revolutionizing a Massive Corporate Banking Platform with a User-Centered Approach

Managing billions in corporate funds requires tools that can efficiently handle global accounts. These tools must also ensure security, liquidity and control. Even small errors can disrupt operations, cause compliance violations or lead to audit penalties.

Many corporate banking solutions are too complicated and don’t fit the needs of individual banks. Generic one-size-fits-all solutions overlook the unique complexities of transactional banking, like market demands, growth potential and specific business types. For a solution to be effective, it must be flexible and adaptable to each bank’s requirements.

To address these challenges, iGTB set out to transform CBX into a modern, modular and user-centered solution for corporate banking. The platform was designed to be customizable and user-friendly, making financial management easier. It reduces errors, adapts to each business's unique needs and provides seamless execution with smart, real-time recommendations.

iGTB was challenged to refine the platform’s user experience, ensuring its thousands of workflows were easy to navigate, integrate and adapt to diverse user profiles. The team required additional expertise to scale the project and guarantee both user-friendliness and financial precision.

To achieve this goal, iGTB partnered with UXDA, a design agency specializing in financial UX and understanding banks' needs for white-label solutions. UXDA delivered the complete visual design for one of the most complex module-based, contextual corporate banking solutions, along with all assets perfectly tailored to integrate seamlessly into the design system.

Solution: Revolutionizing Corporate Banking With a Customizable White-Label Solution

Over four years of collaboration, we designed a customizable white-label platform that empowers banks to achieve their digital strategy goals. Banks no longer need to struggle with the limitations of transactional banking or face in-house development hurdles like bugs, errors and security risks. Instead, they gain a stable, fully tested platform with minimal downtime and compliance with industry standards.

With automated, adjustable transactional banking modules, banks can shift their focus to what really matters—building strategies, connecting with customers and driving impactful marketing. This shift not only boosts the operational efficiency of iGTB but also accelerates innovation and enables banks to adapt more quickly to market changes, giving them a competitive edge.

This impact of the CBX solution is built from many pieces that come together like a puzzle.

Customizable Modules for Tailored Corporate Banking

With 15 customizable modules and over 450 user journeys covering key processes like cash concentration, sweeping, intercompany loans and notional pooling, banks can tailor the platform to their specific needs. This customization helps them address requirements more quickly and cost-effectively, freeing up internal teams to focus on strategic initiatives. At the same time, we adjusted CBX’s modules for six leading banks, adjusting hundreds of screens and workflows to fit their unique needs and strengthen their brand identity.

At the same time, we adjusted CBX’s modules for six leading banks, adjusting hundreds of screens and workflows to fit their unique needs and strengthen their brand identity.

Simplifying Liquidity Management

Streamlining automation in liquidity management empowers treasurers to optimize cash across accounts and regions, ensuring surplus funds are put to work—whether moving them to interest-bearing accounts or covering payments. With real-time insights, treasurers can make smarter, data-driven decisions, reducing guesswork and improving strategic planning.

During development, several major banks tested the platform and quickly recognized its value through automated processes and self-service features, positioning CBX as a market leader in liquidity management. They noted that the platform offers clear, actionable insights, significantly enhancing their control over operations.

Designing the Future Vision for Corporate Banking

As corporate needs evolve to demand seamlessness, adaptability and the latest technologies, we helped iGTB shape the future vision of a contextual corporate banking solution. This vision strengthens iGTB's position in the competitive white-label market and supports its mission of continuous innovation, addressing the growing demand for digital transformation in corporate banking.

Designing an Innovative Ecosystem for a White-Label Solution

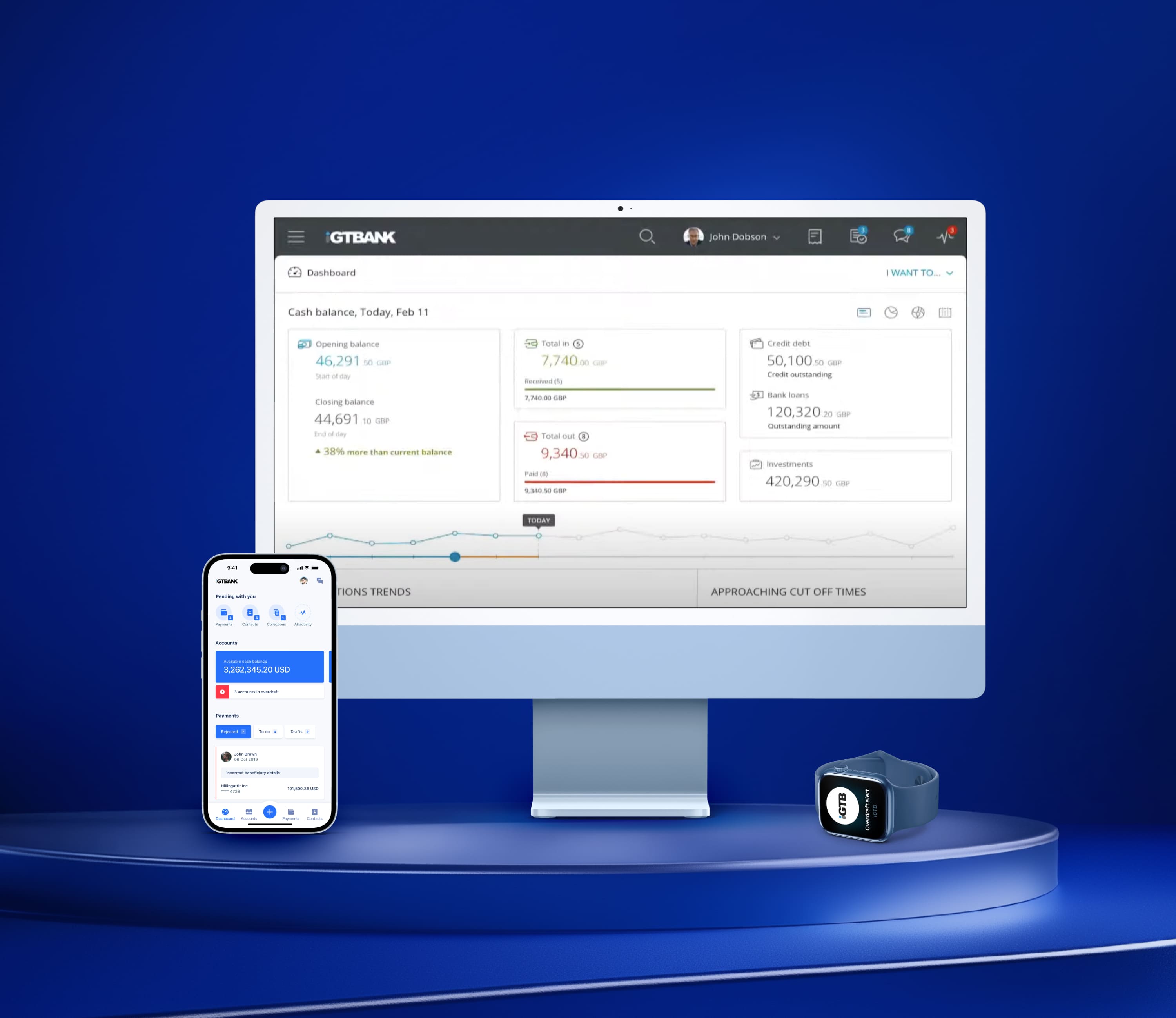

The partnership expanded even further into a comprehensive financial management ecosystem for corporates. By enabling seamless access across desktop, mobile, tablet and even wearables, we enhanced iGTB's clients’ ability to manage corporate finance anytime, anywhere.

Approach: 5K Screens Toward a Banking Platform That Can Easily Manage a Billion Dollar Cash Flow

The UXDA team worked strategically to bring our financial UX expertise to the table. We streamlined the design process to ensure CBX adheres to top user experience standards with a clean interface, allowing banks to easily adapt the platform to their brand and efficiently simplify corporate transaction operations.

Streamlining Processes for a User-Centered CBX Design

To support iGTB's mission of serving corporate needs, we conducted in-house research to update user personas, identify key requirements and better understand the platform's users. Using our financial UX design expertise, we simplified each CBX module to better address those needs while ensuring alignment with industry standards. To ensure the new CBX platform was built on current, user-centered ideas, we tested our concepts through wireframes and transformed these insights into design screens, rather than relying on the previous version of the CBX platform's UI and UX.

The UXDA team also verified that the platform met accessibility standards, making it easy for all customers to use. As we shaped the future vision for CBX, our architects and designers focused on delivering a high-quality, responsive and intuitive experience across the entire ecosystem.

Ensuring Flexibility and Clarity for the Platform

With nearly 5,000 screens and countless user flows, even small changes can significantly impact the platform. To ensure a seamless user experience, we meticulously evaluated the platform’s content and features, focusing on minimizing complexity and creating a clear, user-friendly structure. Our team mapped out hundreds of scenarios, detailing how the platform should respond to every action, decision and error. This approach kept navigation clear and efficient, enabling clients to manage billions in assets with ease while transforming transaction management into an automated, stress-free process.

Understanding the unique needs of financial institutions, we focused on customizing the platform to meet iGTB’s clients’ specific business requirements. We carefully adjusted each module and user flow to align with iGTB’s design system, streamlining workflows and improving overall business efficiency.

Liquidity Management: A Key Business Driver

Using the Liquidity Management module of the platform as a key example, we’ll highlight our expertise and proven approach to designing this impactful financial product. The module addresses the core need of businesses: to have easily accessible funds while ensuring that surplus money is actively working to generate profit. This is especially critical for large corporations, as keeping funds passive in multiple accounts often leads to missed opportunities.

Sweep Management

Sweeps are more than just moving funds between accounts. Without automated sweeps, businesses risk costly overdraft fees or missing out on profits from idle funds.

Our approach focused on expanding self-service, allowing corporate users to independently create and adjust sweep structures step-by-step. We simplified sweep management by designing intuitive features that cater to businesses of all sizes. For example, users can easily set up and execute sweep structures tailored to their needs. To further enhance the experience, we used real-time visuals to show users exactly what they’re setting up, making the process clear and intuitive. This helps users confidently manage cash flow, as visual information is more easily processed than text-based instructions.

We also removed confusing industry jargon, replacing it with straightforward, user-friendly digital language to make the system accessible to anyone with basic liquidity knowledge. This step ensures a seamless, efficient experience that empowers users to manage their finances with ease.

Streamlining Management of Intercompany Loans

By digitizing user interactions, we empowered corporate users to take full control of setting up and managing intercompany loans (ICLs) directly, saving them time, maximizing efficiency and eliminating the need for constant interaction with bank representatives.

To achieve this, our approach has been focused on:

- Centralized View: To provide users with a clear understanding of how each loan relationship works and what’s being utilized, we designed a tailored page that illustrates all loan relationships.

- Self-Service Capability: To eliminate delays and give corporate users full control over their financial structure, we have designed features that allow them to set up, adjust and manage ICLs independently.

- Drill-Down Functionality: To empower users with deeper insights, our designers focused on creating features that allow for easy exploration of loan details, including interest rates, tax information and transaction history, ensuring more informed financial decisions.

Maximizing Returns with Notional Pooling

Notional pooling allows companies to group accounts together and earn interest on their funds without the need to move money. This means the funds stay put but still work to benefit the business, making it a smart way to boost returns.

While notional pooling isn't available in all markets, CBX makes it easy to track earnings from each pool. If earnings aren't meeting expectations, users can quickly review the pool structure and rates for adjustments.

Here's how we made it simple to manage and understand:

- Visual Overview: See all pools at once in easy-to-read charts or lists, making it easy to compare performance.

- Deep Dive: See how the pool’s earnings change over time and identify who’s involved.

- Account Insights: Go further to see how individual accounts are performing so you can pinpoint which ones are most profitable.

- Compare Data: Compare current earnings with past performance, helping you spot trends and make smart decisions.

The UXDA team was instrumental in transforming the CBX platform into a user-centered, highly customized and efficient digital solution for corporate banking. By focusing on simplicity, flexibility and real-time intelligence, we helped iGTB reshape the user experience for large corporations managing multi-account financial operations across the globe.

Collaboration: Building the Future of Digital Corporate Banking

Despite the challenge of geographical distance—UXDA in Latvia and iGTB spread across Canada, the UK, the US and India, with clients worldwide—the teams seamlessly synchronized in a remote setting, collaborating daily to maintain progress and align project priorities. For key milestones, we also came together in person in the UK, Thailand, India and Canada.

The shared vision and dedication of the teams resulted in strong collaboration, with each team contributing to the project’s success. This teamwork resulted in a groundbreaking product that is reshaping digital corporate banking. With its user-centered design, the CBX platform now serves tens of thousands of users worldwide.

5 Key Takeaways: How to Ensure a Successful High-Scale Banking Product UX Design

Working with Intellect Design Arena has been a remarkable experience for UXDA, offering us the opportunity to collaborate with one of the world’s leading banking software vendors. The scale and complexity of the project provided invaluable insights into crafting powerful, user-centered corporate banking solutions.

Following are some of the key takeaways we learned working with a project of this scope and significance that is significantly disrupting the banking industry:

1. Step out of the Comfort Zone: Scale-up Expertise Through Outsourcing

Collaborating with outsourced experts brings fresh ideas and boosts efficiency. As digital transformation progresses, the line between in-house and outsourced teams will continue to blur. Those who embrace this change will gain a competitive edge in driving innovation and success.

2. Design System is a Must for Large-Scale Ecosystems

For projects of such scale, establishing clear standards and frameworks is crucial to maintaining consistency across modules. Small changes can affect larger flows, impacting hundreds of screens.

Creating a UX/UI design system from the start helps streamline the process, ensuring efficient collaboration among designers and developers. A well-organized system for naming and managing design assets ensures quick handovers to developers, aligning everyone on the same page for smooth project development.

3. Connect Developers and Designers Right From the Start

Collaboration among developers and designers from the start prevents costly mistakes and delays. Ongoing UX support ensures the final product adheres to the original vision and provides a great user experience. In large projects, clear communication keeps everyone on track, preventing errors and ensuring smooth execution.

4. Be on Top of the Communication

Efficient communication across teams is crucial. With global teams involved, daily check-ins and clear internal deliverables are key to ensuring everyone stays aligned and avoids mistakes. UX designers play a key role in ensuring smooth collaboration, keeping everyone updated to prevent mistakes and ensure maximum efficiency.

5. Be as Precise as a Swiss Watch in Planning and Tracking the Progress

In large-scale projects, task planning and tracking are crucial. With thousands of tasks across various roles, poor planning can increase project risks. A clear task plan and prioritization of designers and developers ensure smooth progress. Using a single board to track the entire process—from design to testing—helps maintain visibility and control.

iGTB's CBX showcases the power of UX in transforming corporate banking products. We are proud to collaborate with a client dedicated to making life easier for millions of users globally and streamlining banking processes.

Explore other of our client's next-gen financial digital products and UX transformations showcased in the UXDA team's latest showreel:

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin

Meanwhile, Explore Other TOP-Read Case Studies by UXDA:

Emirates NBD Case Study: Driving ROI with Strategic UX in Middle East Banking

Garanti BBVA Securities Case Study: Designing a World-Class Investing Experience

Liv Bank Case Study: Lifestyle-Driven Innovation of MENAT Digital Banking