UXDA team is happy to see our partners between TOP11 global banking software vendors and is grateful for the opportunity to reinvent financial industry through customer-centered financial design. We are honored to participate in UX engineering and UI design process of moving our customers’ solutions to the next level.

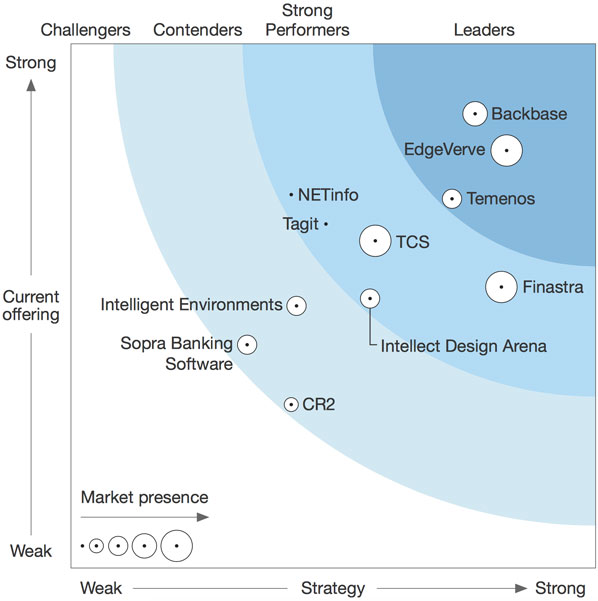

Best digital banking engagement platform vendors worldwide

Based on 35-criteria evaluation of digital banking engagement platform (DBEP) providers, Forrester Research identified the 11 most significant vendors worldwide:

- Backbase,

- CR2,

- EdgeVerve,

- Finastra (formerly Misys),

- Intellect Design Arena,

- Intelligent Environments,

- NETinfo,

- Sopra Banking Software,

- Tagit,

- Tata Consultancy Services (TCS),

- Temenos.

We congratulate our friends from Intellect Arena, CR2, Finastra and BackBase with TOP positions in The Forrester Wave™: Digital Banking Engagement Platforms, Q3 2017 rank. Thank you for your collaboration and challenges you have provided to us!

Of course, we also congratulate guys from EdgeVerve, Finastra (formerly Misys), Intelligent Environments, NETinfo, Sopra Banking Software, Tagit, Tata Consultancy Services (TCS), and Temenos for being a significant power that digitizes and enhances global banking industry with their digital banking engagement platforms.

Forrester (Nasdaq: FORR) is one of the most influential research and advisory firms in the world. Forrester works with business and technology leaders, and Forrester’s unique insights are grounded in annual surveys of more than 675,000 consumers and business leaders worldwide.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin