UXDA's CEO Alex Kreger and the Inspiration officer Monika Calite sat down with the world's TOP 3 finance influencer Jim Marous to discuss how financial organizations can use UX design and design thinking to improve internal processes, develop better products and services, maximize the product value for the users, and enhance the digital consumer experience.

Listen to our conversation on the Financial Brand home page or any other major podcast platform:

Transforming Banking With UX

We believe the digital transformation is all about the experience, and design is how we create this experience.

In fact, we call it the experience transformation, instead of a digital transformation - we use UX design and digital technology to take an awful user-experience and transform it into an unforgettable one that makes users happy and solves their problems.

We think that digital transformation is pointless if it doesn't transform the user experience.

UX Design as a Mindset not Packaging

There's a huge misconception that design is about product packaging, nice looking interface or marketing. For us design is a way of thinking and doing things to deliver the best possible value through digital services.

The digital age requires an absolutely new way of thinking and operating a business. It challenges us to put the user first, become user-centered and deliver experiences instead of manipulating customers to get profit.

It's not only a methodology you can use to create a successful product. It’s not about the tools we use, technology or innovation.

It's a mindset integrated at all levels of the company, where user is in the center of all business operations.

It defines the way you perceive the world aiming to make it a better place for people to live in. Without this, your provided solutions can’t become really valuable and demanded in a digital age.

Because digital revolution has changed the rules of the game we all play. If you don't adapt - you will most probably lose.

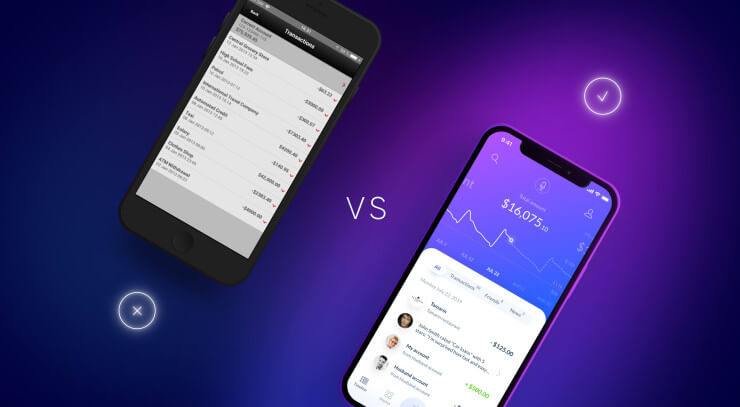

Fintechs VS Traditional Banks

There is a huge difference between how we call it - the marketing age - the one before the digital transformation was in a full speed, and the digital age or what we call it - the experience age.

What differs the successful fintech companies form the traditional banks? It's attitude towards customers and businesses. The main aim is to help the customer, not to get profit in any way possible. It requires a completely different business priorities that are built around the user.

User-centricity is a mindset that can work only if it's integrated at all levels of the company. For some of us, it is really difficult to jump over it, but there is no other way to get success in the future. To fit into the new conditions, a business must integrate it at the level of mindset and culture.

Companies that actively implement the work principles of the experience age aim to bring maximum value to the customer, in exchange the client gladly rewards the company and supports its development by recommending the service to friends and family.

This is a sincere “win-win” relationship that truly makes the world a better place.

UX Design - Critical for Survival

In the digital age, only a product that's 100% focused on user needs, can conquer the rising competition. There are so many choices available on the market at the moment - compared to the time before the digital age, the user doesn't have to put up with services that don't satisfy their needs, are complex to understand and use.

Thereby customers expect every product to live up to their expectations. Why settle for less when you can switch to another product that delivers what you need in a few seconds?

Even though it seems like simple math that products should work for customers, not against them, many banks still seem to make their customer lives extremely difficult and that is why gradually more and more people choose to leave the traditional banks with limited options for the fintech unicorns that offer convenience and positive emotions.

If some time ago it was a choice whether to be user-centered or not, now it is a MUST not only to succeed but to survive the digital age.

About the Banking Transformed Podcast

In each Banking Transformed podcast, the host Jim Marous has candid conversations with the world’s foremost leaders on what it takes to transform financial institutions during an age of digital disruption. His guests discuss technology, channels, innovation, customer experience, leadership, culture and competitive forces that are changing the banking industry faster than ever before.

Banking Transformed guests include the brightest and well-known financial and digital pace-setters in the whole world like — Brett King, Gary Vaynerchuk, Mike Walsh, Brian Solis and the co- founder of Apple Steve Wozniak. And now also the UXDA team has joined them!

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin