In the next 10 years, 78% of customers expect to use an augmented reality (AR), virtual reality (VR) or Metaverse app to see how a product will look, according to Futurum Research. Though it might take years for Metaverse to become a part of our daily lives, tech giants are already actively working on developing it. There's no doubt that banking in Metaverse (AR, VR and mixed reality) will take the customer experience to a brand new level. What to expect, and what's the best way for the banking industry to prepare and fully embrace the opportunities of the Metaverse?

GAFA is Shaping the Customer Expectations From the Future of Digital Banking

In the past decade, GAFA (Google, Apple, Facebook, Amazon) has actively shaped the customer expectations. The same ease, speed and overall intuitive experience of social media is expected from any service, including banking.

Customer expectations and demands rise every year as do the technological possibilities to satisfy these expectations and even over deliver on them. The big tech companies are actively seeking ways to use the possibilities of digital technology to provide customers with a brand new kind of experience.

Progressive banks and Fintechs that will be able to keep up with the technological advancements and deliver to the rising expectations will become the leaders of the new digital banking reality.

Augmented reality, virtual reality, conversational services, the Internet of Things, robots and neuro services are predicted to become an integral part of our daily lives in the near future.

Facebook is testing its futuristic AR devices on real-world people, this is part of a research project “Aria” that will help “build the first generation of wearable augmented reality devices,” as stated in Facebook's official release. The device is more like a "sensor array" for the smart glasses that Facebook is eager to develop in the future. This device will capture video and audio from the wearer's point of view, as well as eye movement and location data. Facebook also aims to train an AI assistant for the smart glasses through smart spatial audio technology.

In the photos that Facebook has shared with the public, the research glasses remind consumers of ordinary everyday glasses

In 2022, first AR smart glasses startups launched actively on the market. Indian smart glasses startup Nimo Planet announced in Instagram ar March 22 beta launch of their Nimo glasses with 720p per eye resolution and Android based computer onboard. Later, on August 23, 2022, Nreal, a Chinese startup of augmented reality products, launched its first AR glasses Nreal Air and the Chinese version Nreal X, the world's first full-functional AR glasses that features 1920x1080 per eye resolution, 90 Hz refresh rate, 5 hour battery life.

Though there are still a lot of technological challenges to overcome, tech experts predict that a fully featured AR experience could become a part of our daily lives in the next decade. Taking into account the time it takes to fully adapt the existing services to these kinds of new technologies, it seems that now might be the best time to expand the banking digital transformation plans, including a Metaverse banking strategy.

VR / AR Banking Will Revolutionize The Digital CX

There are progressive banks and Fintechs that are already “WOWing” their customers by demonstrating VR/AR features in their products. For example, Fintech “Acorns” is providing a debit card with an AR engagement that can be viewed through the smartphone, while Westpac Banking Corporation offers financial data visualization and budgeting through smartphone-based augmented reality. These are only a few of the available examples that attract the attention of the users and provide a brand-new view, quite literally, to their finances. But, the level at which the technology is currently implemented is still in its early stages. Though it seems to entertain, it's questionable whether it will make future banking more convenient and user friendly.

There are still major technological challenges that need to be solved in order to start a widespread distribution of VR/AR devices. To create truly comfortable AR glasses that would be enjoyable to wear every day, those should be as compact, light and easy to use as everyday glasses. But, due to the technological advancements that are required, it's not so simple.

The technological functionality of AR glasses is similar to a smartphone, consisting of a battery, a screen and a microprocessor that must be fitted into the glasses. It should also be noted that energy consumption will be significantly higher because currently available VR devices consume up to 7 times more than computers. Therefore, the implementation of this technology will require much more powerful batteries. Due to this, we are still 5-10 years for an ideal version of the glasses that we could actually use in our daily lives.

World's First Metaverse VR / AR Banking Design Concept by UXDA

However, when the technological challenges are solved, and these glasses become available to everyone, they are likely to become so popular that they could replace smartphones.

It is clear that augmented reality will take the possibilities of digital technologies and the user experience to a whole new level, combining the real and digital worlds and providing people with "superpowers" only previously seen in movies.

When the time comes, we can expect the future of banking to be shaken with the same impact as it was with smartphones and other touchscreen devices like tablets only decades ago. That's why the ability to adapt becomes more and more important if we want to conquer the digital age.

In fact, another creation of Facebook, the Oculus Quest - a VR set intended for gaming - has already been sold out for weeks in most of the stores due to the high demand. Though, currently, the VR sets are mostly used for gaming, this clearly demonstrates that people are hungry for this kind of brand new and exciting experience. Besides, just recently Facebook Connect introduced the "Infinite Office"— "a collection of new capabilities designed to create a virtual office space that will feel more productive and flexible."

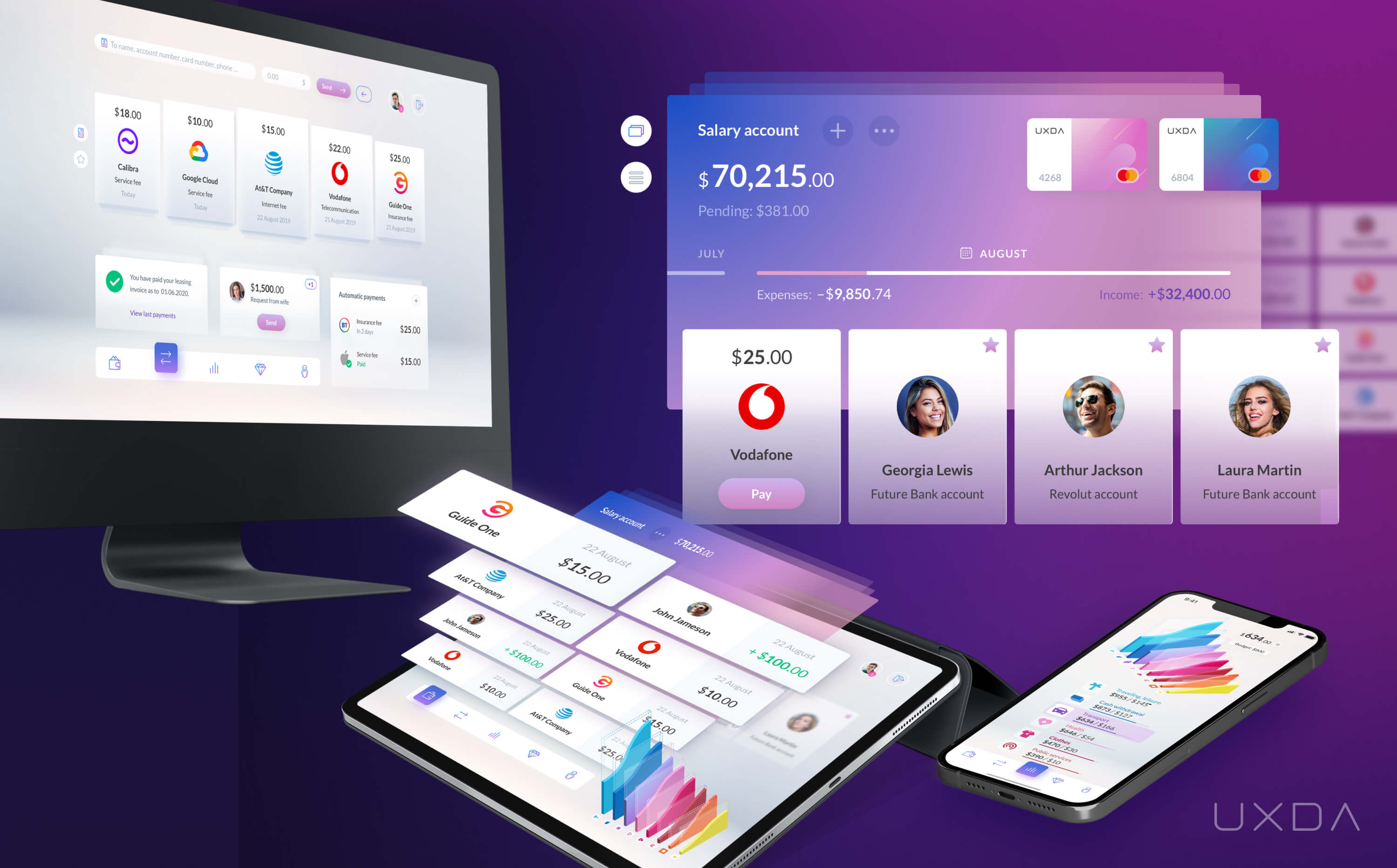

It's crucial to take into account the fact that banking in Metaverse, VR or AR will not instantly replace desktop and mobile future banking solutions. That's why VR/AR design products should be easily adaptable for online multi-channel use.

The first Metaverse future banking concept that includes virtual reality banking, augmented reality banking, tablet, desktop, wearable and mobile banking by UXDA

How Virtual Reality in Financial Services Could Impact the Customer Experience

Virtual reality in financial services can overstep the boundaries of the physical world through a rich, 3D sensory banking experience that corresponds to the person's movement in virtual reality. This allows the user to “feel” his/her finances in a completely different way and discover a revolutionary, previously unseen, virtual banking environment.

By blending the physical and the virtual world with augmented reality, banking in Metaverse overcomes the limitations of a physical screen, bringing finances closer to the user.

AR banking expands the opportunities an interface can provide to ensure the fastest and most convenient banking experience of the future.

To create well-functioning future banking solutions, the technology behind VR/AR needs to be properly developed . But, the main success factor is still all about the user experience the solution provides. Here is how VR/AR features would affect the user expectations, needs and behavior in Metaverse.

Overstepping the Limitations of the Screen

Compared to the desktop or mobile experience, VR/AR design is not limited by the screen size. Although it might be tempting to display all possible information at once, this wouldn't be a great idea as it could cause cognitive overload and frustrate the user. In the case of VR/AR banking design, it's especially important to remember that the main criterion for quality is simplicity.

World's First Metaverse VR / AR Banking Design Concept by UXDA

A Perfect Match Between Realities

Both virtual and augmented reality should relate to the experience in the real world. Properly structured VR design should reduce the painful effect of a mismatch caused by the difference between the eyes’ tracked movement in virtual reality and the feeling we perceive from physical reality through our other senses.

Ensuring a Smooth in-Depth Experience

One of the most significant challenges of VR/AR banking design is user interface transition from two-dimensional (2D) to three-dimensional (3D) interactions. This requires deep adaptation of UX/UI design principles and methods for the depth of volumed space.

An example of how these VR/AR features can be integrated into a future banking solution is available in the UXDA's Case study of the World's First Banking in Metaverse VR / AR.

How Can Banks Prepare for a Virtual and Augmented Reality in Financial Services?

“The number one bank in the world will be a technology company,” as predicted by Brett King, Founder of Moven, and this truly holds its ground. The progressive financial brands that are aiming to become the leaders of the future banking have already started to develop their inner digital competencies. This increases their ability to instantly adapt their service to any kind of digital platform.

1. Develop the Technological Competencies

Financial companies will gradually have to become tech companies. If they don't, then in the case of global digitalization, it would become very difficult to constantly manage and develop their digital products. Here, it is of great importance to improve their technological competency by developing a strong internal IT team. However, we will face complex and unique financial structures. Large banks can become the creators of BaaS (bank-as-a-service) platforms, while small banks can outsource core banking solutions by offering their unique service, as Fintech companies currently do.

2. Adopt a Disruptive Inner Culture

A bank can keep up with the technological innovations if it adopts a disruptive company culture. This way of thinking and operating allows it to be flexible and adapt to any new technological and customer trends. Such a company culture aims to reinvent the customer experience, bringing it to a new level and offering a solution that's way more pleasant and enjoyable than any other alternative on the market. This kind of brand provides an exceptional experience that's easily accessible throughout all of the platforms that people integrate into their lifestyles. Experience-driven businesses see almost 2x higher YoY growth in customer retention, repeat purchase rates and customer lifetime value than other businesses, according to Adobe and Forrester research.

3. Be Agile Towards the Changing Customer Expectations

To be ready to adapt, it's important to constantly monitor and detect any change in the digital behavior of the customers and have the technological resources to adapt to it quickly and efficiently.

By staying alert to rising changes in customers' needs, the financial companies will be able to prepare in advance and react in time, thereby expanding the digital solution to new platforms in a way that's enjoyable for the customers.

It's helpful to practice an experience-centered mindset throughout the entire financial organization and have the courage to challenge legacy. This will organically make the financial business maximally flexible to adapt to any digital innovations demanded by customers.

4. Be on Top of the Already Existing Experiences

It's important to remember that, in a rush for an outstanding competitive advantage, many banks forget that their existing digital solutions are far from perfect and can be fraught with friction that confuses users. Before we are faced with these brand-new innovations, there is a lot that can be done right now to improve the value customers get from the solutions that currently exist.

This will make the transition to the future smoother and easier, as the new technologies will be integrated into the existing products, providing a superb customer experience.

Embracing the Near Future of Digital Banking

As technologies are constantly evolving, we can surely expect to witness a revolutionary switch to a brand new digital reality that's powered by VR / AR banking experience. A great way to prepare for the future digital reality is to start generating ideas and concepts today by viewing the financial products through the lens of the future.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin