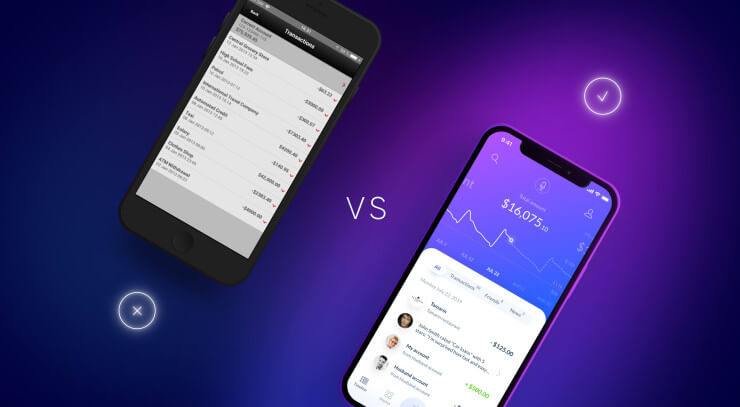

Despite technological innovation, digital banking feels uniform. Apps look-alike with identical copycat features and experiences, lacking uniqueness and personality. Banks are launching purely utilitarian and standard copycat apps that are not a joy to use. The promised revolution of personalization and redefined money interaction seems lost. Are we merely digitalising old banking models, or can we reimagine banking with creativity and individuality? Let's explore what's missing and reignite innovation. Are you ready to be the trailblazers who redefine banking?

It is a World of Experience

My friend once bought a beautiful electric tea kettle. He paid five times more than the cost of a standard one. It was difficult to wash, and it was not connected to WiFi. "What is the point,” I asked. “Doesn’t it boil water the same way?" He smiled at me and replied, “You aren’t the first one to ask me this question. I didn’t just want boiled water. I also wanted an experience. This kettle became one of my morning rituals. It sparks joy in me at the beginning of the day and gives me a feeling that I celebrate every single day I live."

People's routines consist of many items as trivial as this kettle, some of them evoking emotions and some not. The best brands in the world turn their products into a unique experience, which increases their price by dozens of times. You can find thousands of modifications of the same product with similar functionalities but completely different user experiences. The role of emotions becomes decisive. Cognitive overload due to global digitalization weighs on all of us, and our inner child longs for something simple, understandable and enjoyable.

The most effective way for a product to stand out from the competition is to provide not only a delightful customer experience, but also a feeling that the product helps you live your best life every day.

Emotional experience, human-centricity and responsible consumption have become a social trend in today's digital world. People deepen the quality of life through mindful living, finding happiness in common things and prioritizing genuineness and authenticity. Therefore, customers want businesses to act sustainably, with inclusiveness and to be socially responsible. Advanced brands use technology to humanize and improve the quality of interaction with the product.

Modern consumers value experiences over things.

But, digital functionality alone is not enough to delight the inner child; it requires nurturing attention, emotional support and engaging entertainment. We often feel frustrated when interacting with digital products. This is not because they do not help us solve our problems, but because we do not feel the human touch behind it, which makes us feel lonely and empty.

We live in an ocean of technology with millions of digital products. They often do not have their own face, without an attractive idea behind them and do not have a story. This makes them both boring and confusing. They are intended to simplify users' lives. However, they often make their lives not only more difficult, but also steal their time and energy. How can we improve this situation? Unfortunately, there isn’t a magic pill to solve this problem. It is more important for us to breathe life into financial industry by making it purpose-driven. Customers deserve humanity, understanding, and careful, human-centered design that adds soul to the digital product.

In today's business world, the value of a product or service is increasingly determined by the experience it provides to the customer. Businesses should increasingly focus on creating immersive, memorable, and engaging customer experiences rather than just selling goods or services. And TOP brands are already competing to provide unique, high-quality experiences beyond just the functional aspects of a product or service.

Best Experiences Come With a Soul

“We spent a couple of years and a lot of money on several attempts to improve the design of our new digital product and make it exceptional. But, every time it turned out to be a disaster, some kind of wretched, lifeless excel spreadsheet that could never delight users...” This was how one of the financial brands began its collaboration with the UXDA team. As a result, even before the launch of the project, their potential customers lined up after seeing screenshots of their new service posted on social networks.

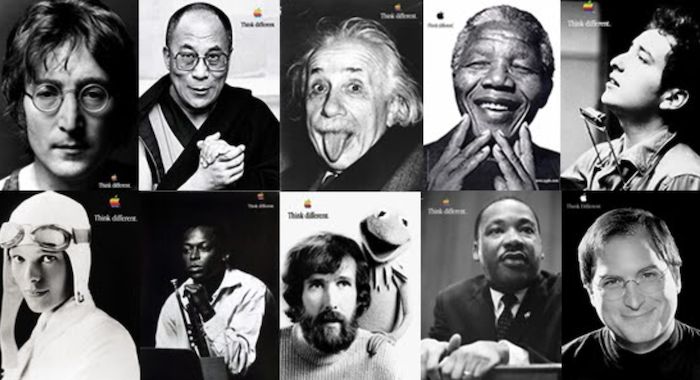

How did products manufactured by Apple, Nike, Mastercard or Dove become iconic? What’s their secret? Of course, they have stunning designs and are extremely user friendly and well crafted. However, there is something more that makes them special─something that sets them apart from the crowd of competitors.

Apple unleashes our creativity despite the fear of standing out from the crowd.

Nike unleashes our courage to achieve goals we believe in, despite resistance from the world at large.

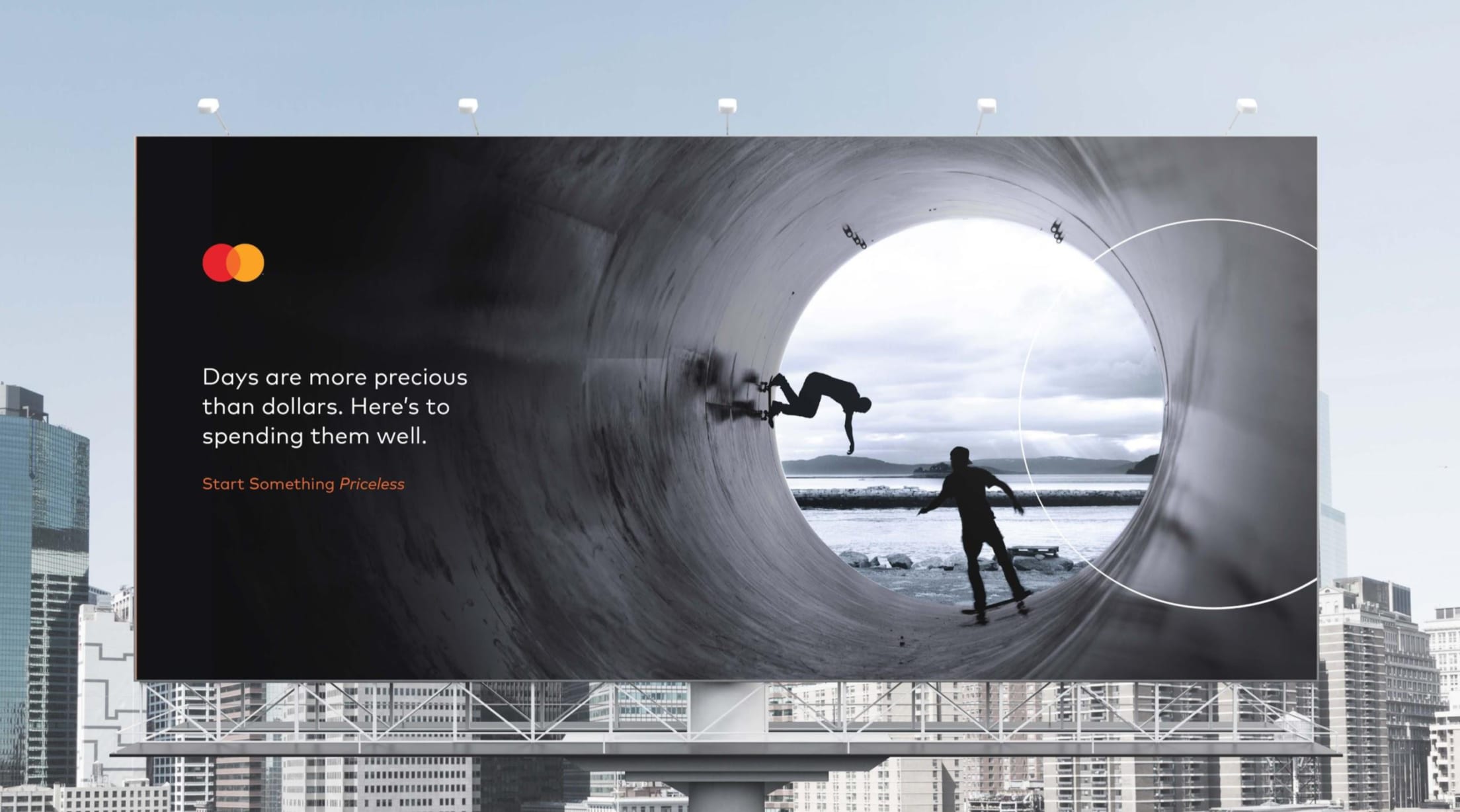

Mastercard unleashes our desire for priceless experiences, despite the efforts and money involved.

Dove unleashes our real beauty and self-esteem, despite the pressure of adhering to standard beauty stereotypes.

These brands' messages touch our hearts because they address our human side and inspire us with their purpose. They perceive customers as humans and treat them in the most humane way possible.

In recent years, the digital industry has been obsessed with improving the functionality, usability and reliability of technological products. Those qualities should be the basis of each product. However, it is not enough. I am talking about something more. It resonates with users, makes them feel cared for and creates a special bond. That is the product's "soul".

Products with "soul" allow us to feel differently, thus creating a completely new quality of customer experience. The only way to reach this level is to establish a deep emotional connection with customers and make them feel special.

The world's most successful products stand out from thousands of competitors through crucial differences. Some call it authenticity, essential benefit, value proposition, or uniqueness. We use the concept of a "soul" to describe the unique character or essence of the product and how it impacts its users. A digital product may have a "soul" if it can evoke strong positive emotions in its users. For example, a video game or a mobile app creates a deep sense of user immersion or engagement.

A digital product may also be said to have a "soul" if it is able to embody the values or vision of its creators in a meaningful way. For example, a social media platform that is designed to promote connection and community building might be said to have a "soul" that reflects the creators' purpose to bring people together.

Also, a digital product "soul" reflects its ability to live, grow and change in response to users’ demands and needs. The question is whether it is possible to add "soul" into digital financial products. Some people think that it isn’t. However, this is our answer:

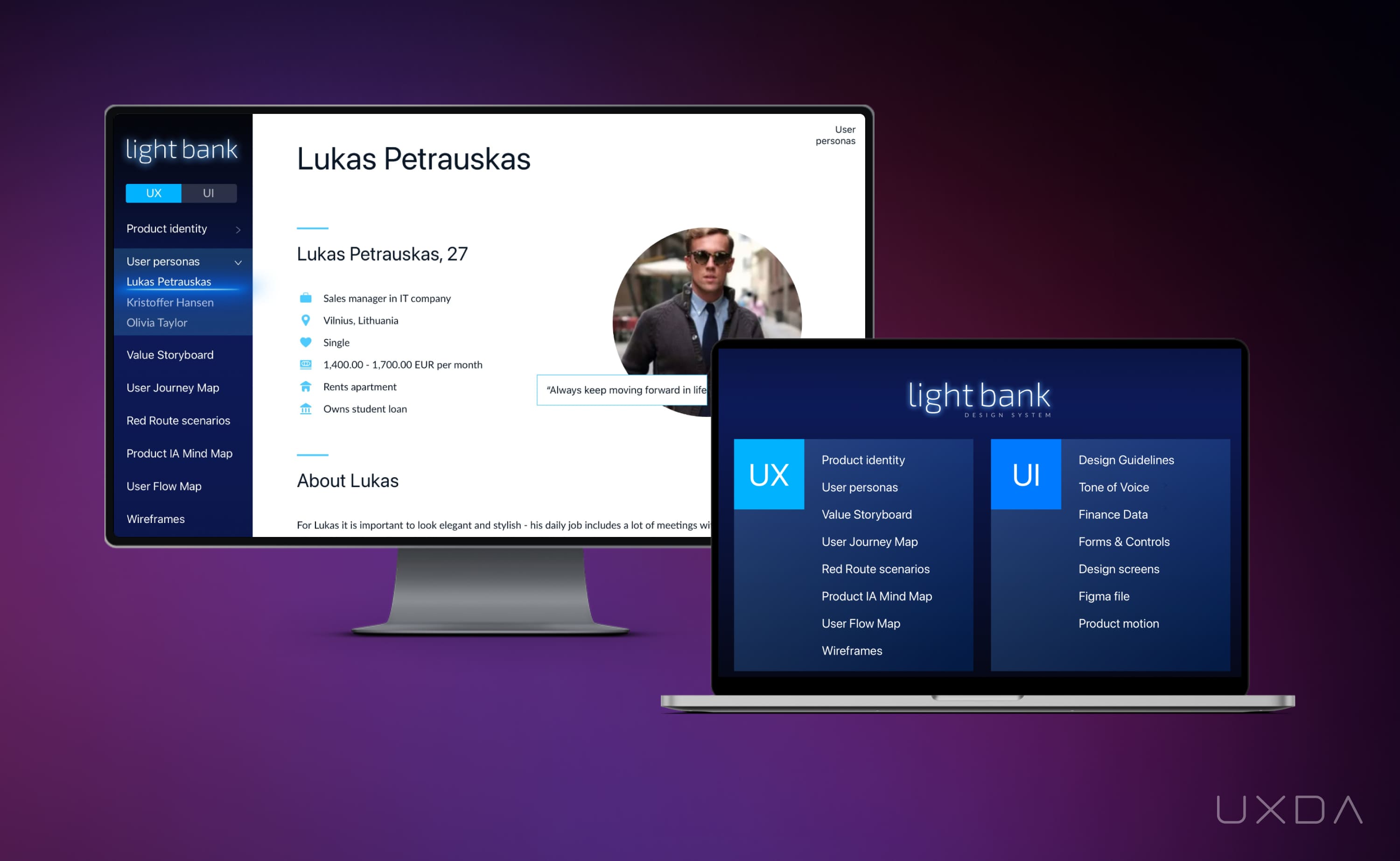

Let me give you a few examples of purpose-driven financial products to which we add "soul". Each of these challenges is unique. However, what they have in common is that we designed them by focusing on the users. Our aim was to provide a very special experience that will allow users to say that the product touches their hearts. Only then will we know that we have added "soul" to it.

How the UXDA team added "soul" to the ITTI Digital core banking design solution:

How the UXDA team added "soul" to the Kids Banking App design solution:

In today's "experience economy," where consumers are increasingly seeking out unique and memorable experiences, it is more important than ever for digital products to have a sense of "soul." Here are a few reasons why:

1. A product with soul can create a deeper connection with the user

When a digital product is able to evoke strong emotions or feelings in its users, it can create a deeper connection and sense of immersion. A digital product with soul can create value through the emotions and experiences it is able to evoke in its users.

2. A product with soul can differentiate itself from competitors

In a crowded market, a digital product with a unique character or personality can stand out from competitors and be more memorable to users. This can be especially important for challengers or startups looking to differentiate themselves from larger, more established brands.

3. A product with soul can foster a sense of community

Digital products that are able to bring people together and create a sense of connection and community can be especially appealing in the experience economy. For example, digital financial platform that are able to create a sense of belonging or shared purpose can be especially successful.

4. A product with soul can create value beyond the functional

In the experience economy, consumers are often willing to pay more for products that provide a sense of value beyond just their functional capabilities. This can be especially important in the experience economy, where consumers are looking for products that provide a sense of meaning or purpose beyond just functionality.

5. A product with a soul can evoke trust

A human-centered product with a soul provides good customer service and a track record of reliable performance that generates positive word-of-mouth. It is essential to be transparent about how user data is used and what fees and other conditions are. In the financial industry, trust and reliability are critical concerns for consumers.

How Can You Add Soul to Your Product?

What makes digital products special? It is when they make us feel special.

There are several ways in which you can add a "soul" or sense of personality to your financial product:

- Start by understanding your audience and what they are looking for in a product. This will help you tailor your product to meet their needs and expectations, and create a sense of connection and relevance for them.

- Focus on creating a compelling user experience that is intuitive, engaging, and enjoyable. This can involve designing a user interface that is visually appealing and easy to use, as well as adding features and functionality that enhance the user's experience.

- Consider incorporating elements of storytelling or narrative into your product. This can help to create a sense of immersion and connection with the user, and give the product a sense of character and personality.

- Think about how you can make your product stand out and be unique. This could involve using innovative technologies or approaches, or simply finding ways to differentiate your product from competitors.

- Make sure to listen to your users and incorporate their feedback and suggestions into your product development process. This can help to ensure that your product is constantly evolving and improving, and can help to create a sense of community and connection with your users.

You can’t touch the heart of your customers, if your product doesn’t have a soul.

Such an experience does not come just from the use of colors, icons and button placement in the interface. The experience is the result of a design that makes a meaningful statement throughout the customer journey, in accordance with the beliefs of the brand and desires of the clients.

Purpose-driven banking is a philosophy that emphasizes the role of banks in promoting the common good and supporting sustainable development. This approach to banking seeks to align the bank’s goals with the needs and values of its customers and the broader community rather than solely focusing on maximizing profits. This can involve supporting social and environmental initiatives, providing financial services to underserved communities, and transparent and ethical business practices. The goal of purpose-driven banking is to create long-term value for all stakeholders, including customers, employees, shareholders, and the community.

There are certain criteria that differentiate products with a soul provided by purpose-driven companies from ones without one:

1. Humanity

Unfortunately, digital technology and data-driven services often tend to treat customers like numbers. This should not be allowed, because people feel it. Prove that your business is more than just making a profit, make it mission-based. If we take care of our customers, which many financial products do not do, we can move the financial product from the world of numbers to the world of humans.

Giving back to your community and the environment are no-brainers, when it comes to building your brand’s soul.

The best way to show people the human side of a company is to run a responsible business. It must be committed to benefiting society, by making a positive impact on technology, people and the planet.

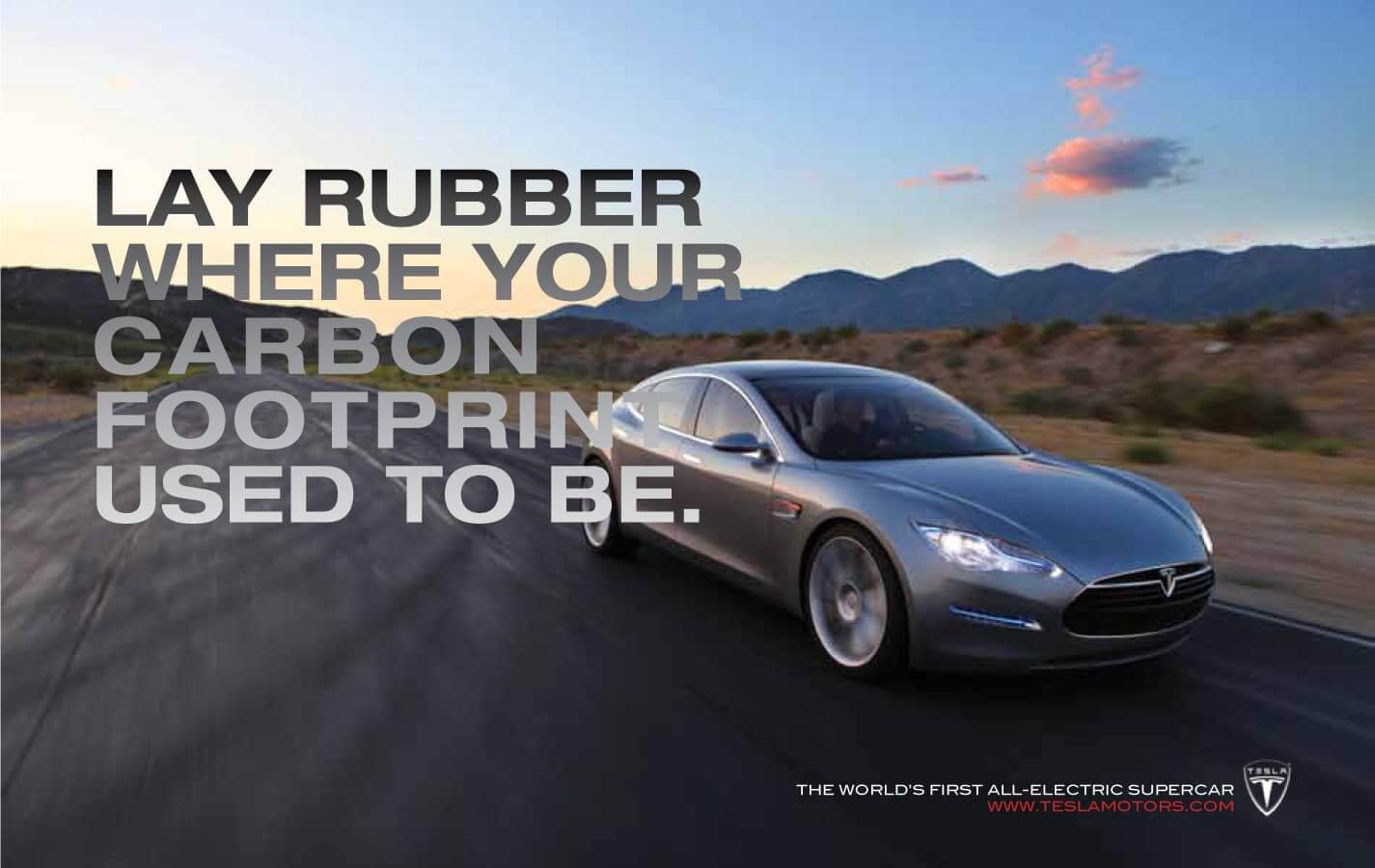

Tesla empowers sustainable living despite the dominating global oil paradigm.

The NY Times empowers the ability to recognize the truth in a medium dominated by fake news.

The Body Shop empowers natural goods fair trade, by enriching community and nature in a world where exploitation has become part of the supply chain.

We value these products for appealing to our humanity and for allowing us to become the best version of ourselves.

Technology can help brands to expand this humanity through global accessibility, instant support and personalization.

According to the Forrester Consulting Thought Leadership Paper Commissioned By Braze, 57% of consumers said they would be more loyal to a human brand. Human brands enjoy a 19 percentage point boost in how likely they were to be “loved” by customers, outperforming non-human brands by 20 percentage points on “likelihood to recommend.”

Consumers are 17 percentage points more likely to make a purchase or use a service with a human brand and are 22 percentage points more likely to be satisfied overall with a human brand compared to a non-human one. Еmotional indicators, including “responsive,” “friendly” or “thoughtful,” provided some of the strongest drivers to consumers’ perception that a brand was dealing with them in a human way.

Case Study: How do we add humanity to financial products?

In everything we do to create digital products in financial services, we relate to human values. From our experience, the only way to ensure this is to empathize with the needs and pain points of end users at each step of the product design process.

For example, in every project we work with, we are implementing the experience mindset that prioritizes serving over selling, emotions over information, solutions over features, disruption over protection and flow over fragmentation. This helps the project teams switch their mindset to put it behind everything that they are doing and believe, thus ensuring that their approach is always human-centred.

Explore more on this topic through an Experience Mindset

2. Purpose

According to Deloitte, in this era of heightened consumer expectations, being “customer-centric” is no longer enough. Building resilient bonds of loyalty means weaving the real inputs and data from customers into the why and how of what your company does and is.

Having a purpose is not just a reflection of product values; it's a challenge to improve something─experience, people or even the world.

People love products that strive to be more. Let’s take a look at companies that are disrupting industries. They dedicate their work to creating unique, authentic and meaningful products. The soul is closely related to the purpose and value the product brings to the customers.

In the digital age, things are changing very rapidly. The fastest growing purpose-driven Fintech products have reached millions of customers in just a few years, while traditional financial brands have taken decades to do so.

- Wise delivers money without borders, saving on fees;

- Revolut brings freedom with a sustainable alternative to traditional banks;

- Chime provides accessible banking that makes a profit with customers, not from them;

- Nubank exists to free people from the bureaucracy of the financial system;

- Klarna makes shopping smooth and frictionless for the consumers;

- Finally, our designed BELLA Loves Me is a conversational banking app powered by love in a numbers-driven industry.

We are used to the financial industry being cold and lacking soul. However, the aforementioned disruptors have proven otherwise. They brought higher purpose and care to their customers, thereby finding a place in their hearts.

Challengers are not afraid to show customers who they are and what they stand for. The highest customer-centricity you can strive to achieve in financial services design is a soul-driven financial product─one that really makes the world a better place for living.

Don't be afraid to stand up for something.

According to Havas’ global Meaningful Brands® 2019 research, 77% of consumers buy brands that share their values. Meaningful brands that are viewed as making the world a better place outperform the stock market by 134%.

Brand essence is at the heart of the most successful companies’ growth strategies. Their brand values, mission and vision are expressed through the products of the company, and through its service. Simon Sinek, through his "Golden Circle" concept, describes this connection as follows:

- WHY is the center of brand essence that defines the raison d'être (reason for being) of the company.

- HOW are the values that distinguish the company from others, its particular way of functioning.

- WHAT is the result of previous stages that the company delivers to customers—its products and services.

Accenture Strategy's global survey of nearly 30,000 consumers found that 62% of customers want companies to take a stand on current and globally relevant issues, like sustainability, transparency and fair employment practices. The closer a company’s purpose aligns to their own beliefs, the better.

Fifty-two percent of respondents have indicated that they prefer brands that believe in something greater than just the products and services they sell. This is also confirmed by a study by New Paradigm Strategy Group & Fortune, which found that 64% of the US population believes that the company's primary goal should be to "make the world a better place."

Case Study: How do we help to connect financial products with brand purpose?

According to Mambu and The Financial Times Focus (FT Focus) research, 81% of banking executives strongly agree that replacing outdated mindsets with a progressive social purpose is vital to growth strategy.

To clearly define the main purpose of why the product exists and then implement it on all digital service levels, we need to understand what customer problems the financial company wants to solve, identify its mission and goals and determine why any potential customer should care about it. We need to ensure that the entire mission-based bank or fintech product's team is on the same page to have a successful kickoff.

For example, when designing financial products, we achieve a deeper understanding by reflecting human needs, as described in Maslow's pyramid (physiology, safety, love and belonging esteem and self-actualization) through technology benefits that we mention in UXDA's Value Pyramid (functionality, usability, aesthetics, status, mission). It allows us to create an integrative, holistic product design that clearly answers the question: why does this financial product exist?

Explore more on mission-driven finance design through UXDA's Value Pyramid

3. Connection

In today's highly automated digital world, products with soul have a special appeal. They make emotional connections part of their DNA. By speaking to customers as friends, human-centered services take precedence over ruthless cost optimization (that leads to robotic interactions).

To establish an emotional connection, we need a product to stand out in customers’ hearts. This requires an emotional touch that resonates with customers' values and beliefs.

Ninety-four percent of Americans say brand empathy is now more important than ever, according to the study, "The Empathy Imperative: Consumer Percepts On Brand Empathy Through Pandemic." In addition, consumers with an emotional connection to a brand have a 306% higher “lifetime value.” This means that they stay loyal to the brand for an average of 5.1 years compared to 3.4 years, and they are more likely to recommend brands to others (71% vs. 45%), according to Motista.

Get to know your customers as best you can─what they like and what they don't: events, places, brands, TV shows, blogs, services, etc. It is important to understand their surroundings in order to connect on a personal level and understand what is important to them. We need to go beyond general target data and resonate with the audience based on the beliefs you both care about. This is how product ambassadors are born.

According to Motista research, emotionally connected customers generate lifetime revenue nearly six times that of highly satisfied customers. Credit card customers who feel emotionally connected spend 46% more annually than those who are just highly satisfied, and their lifetime value is eight times higher.

“Every financial institution wants a highly satisfied customer, but in today’s competitive environment, that’s no longer enough,” explains Scott Magids, CEO of Motista. “Our research shows that, across all categories, an ”emotionally connected” customer generates 52% more annual value than just a “highly satisfied” one.”

Case Study: How do we ensure a banking product’s emotional connection with customers?

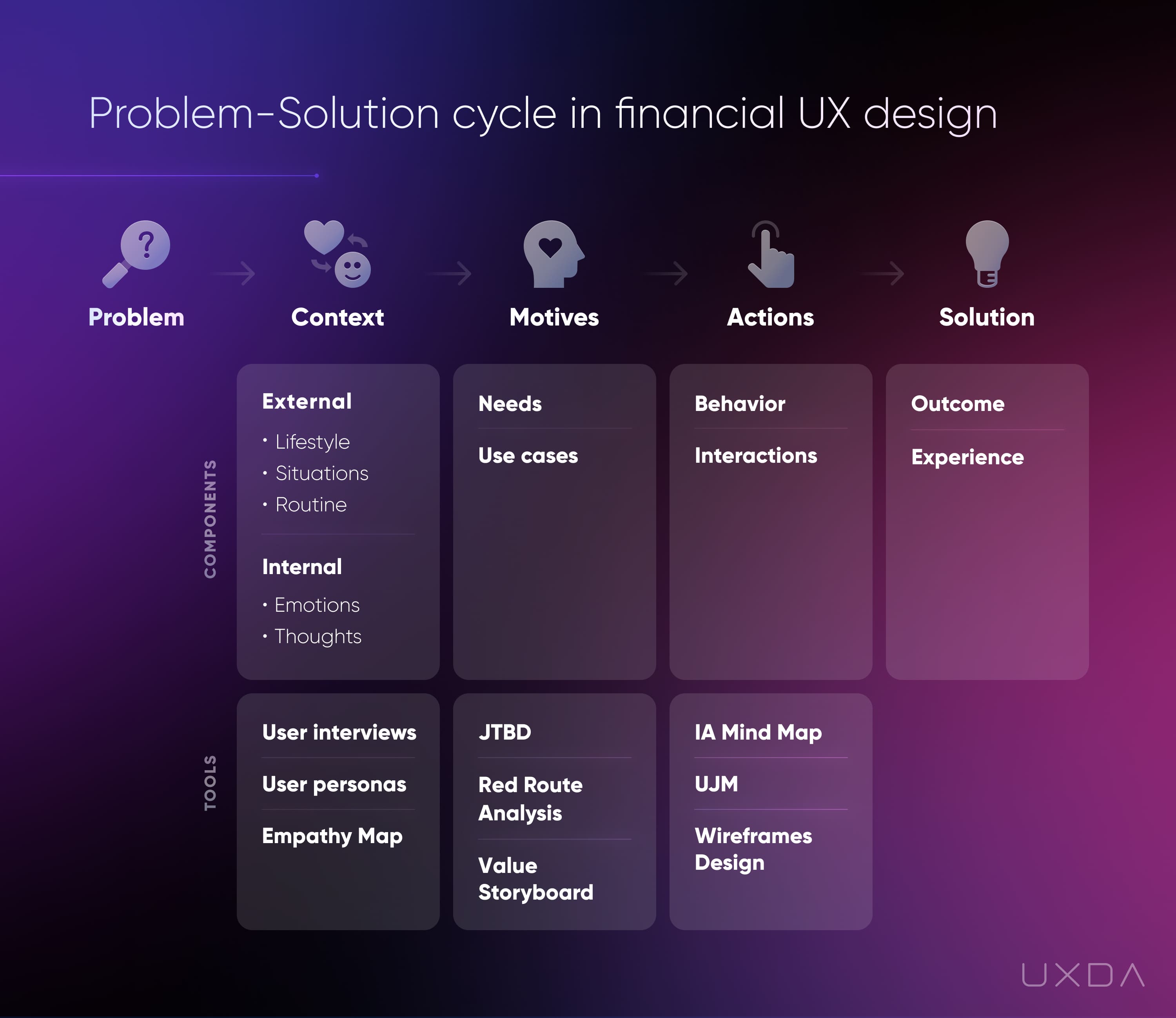

To make a banking product emotionally attractive, it was important for us to understand exactly what drives and engages the user.

To do so, we performed user research that helped us understand the context of the end-user’s psychology, expectations, needs and pain points. We used tools, such as user personas, an empathy map and Jobs-To-Be-Done (JTBD). As a result, while product stakeholders felt like they knew their customers very well, our methodology provided valuable insights into our users' lifestyles and context of use. This allowed us to understand jobs they want to hire a product for.

Research based user experience design creates aesthetically pleasing emotional connections between users and a product. However, the power of emotional design could move far beyond pleasant interactions. Design doesn't just make the user experience memorable, it creates new habits that change our world. No one could have imagined how much Ford's cars or Jobs' smartphones would impact the world.

Explore more on this topic through a Problem-Solution Cycle

4. Story

Stories not only entertain us, but also teach us by providing both role models and danger warnings. This helped people survive throughout evolution. Stories include myths, legends, old wives’ tales, Hollywood blockbusters and even the story of that guy next door who got sick after consuming mushrooms.

Our consciousness is constantly trying to organize the chaotic information around us into some kind of easily understandable story.

A Story helps us find the right answer and deliver it in an easy way. For example, Google has the answer to everything─algorithms and data; Apple has design and creativity (“with creativity you can change the world, and we give you tools for this”); Nike's answer lies in the power of personal achievement that encourages us to become the winner in life; Red Bull empowers life with adrenaline, making every moment count. This answer becomes the main value they provide to the customer, and all the communication and products build their story around this.

Once you have defined your brand essence, you can construct a powerful story that ties the brand and product assets together and fills them with human experience and imagination. Such a narrative will direct and support company growth for years, sharing your purpose, values and personality in a clear and emotionally engaging way. Especially during the pandemic, 70% of consumers said brands should boost positivity and share uplifting stories, according to Twitter research, because people live through stories and want to feel the vibe and get more dopamine.

Who is the main character in your product story? This is not about your product. The hero is your customer, and the product is just an ally, like Yoda for Luke Skywalker.

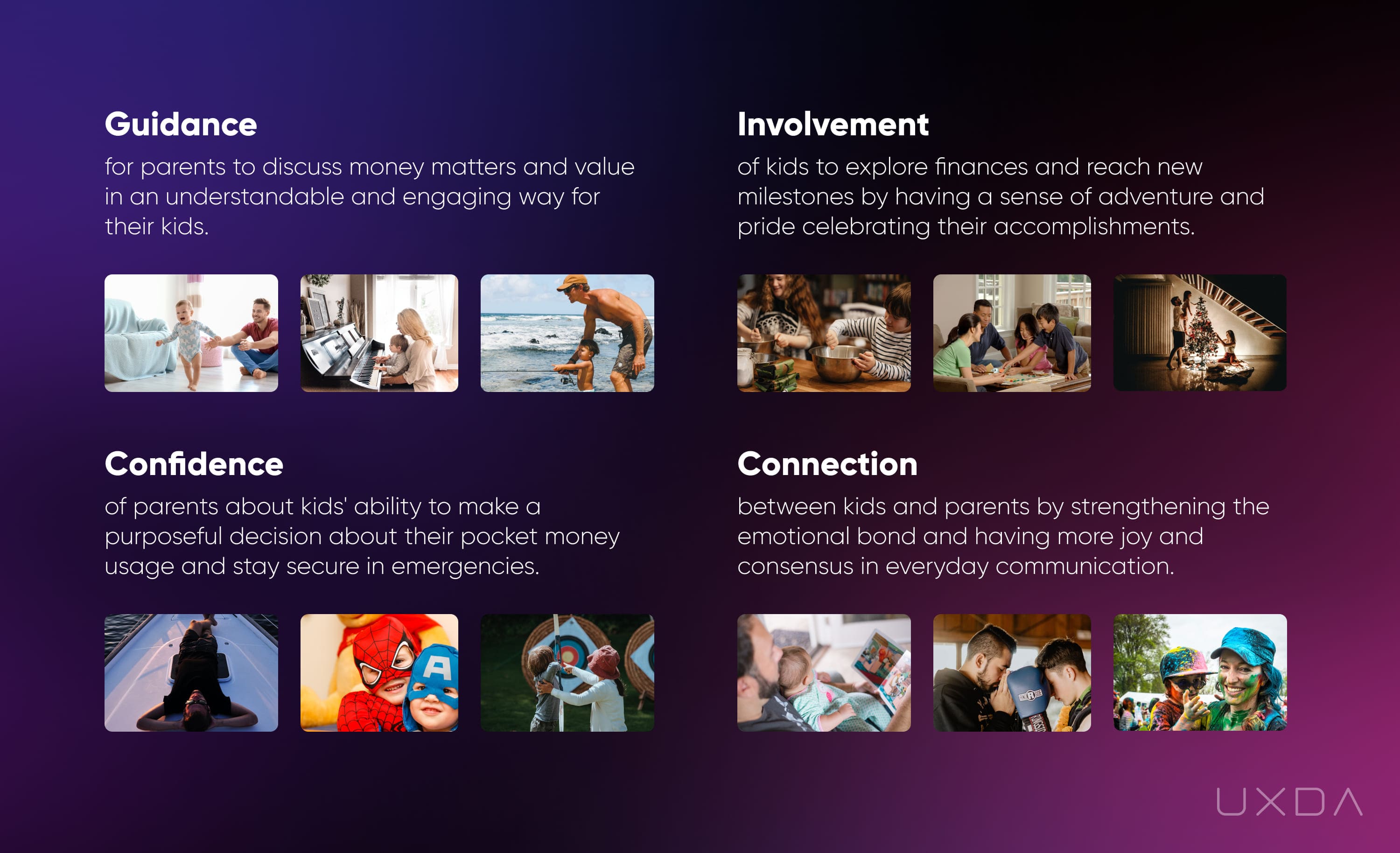

Case Study: How can we help Kids’ banking tell its story through the product?

To make a family banking app much more meaningful and valuable to the customer, we have treated it as an integral part of the story the financial brand conveys. In order to create such a story, all the dots that were defined at the research stage were connected through a user journey map.

A user journey map showed consistent user flow that matched service features with the user and business' goals at every product touchpoint. This gave an exact picture of what the family expectations are and how our product can meet them to ensure the best possible experience across the entire journey─not only through exact features, but also through overall value and service principles.

To find out how to help parents teach healthy financial habits to their kids, we defined four principles that a banking app should be based on:

To convert it into the story, we used our own storytelling framework modified from Joseph Campbell's monomyth for the Hero's Journey, that he discovered by analyzing archetypal narrative patterns in ancient legends and myths.

A Kids' banking story generated through this model looks as follows:

Little Peter's parents are under a lot of stress from raising a child. Peter wastes all his pocket money and demands more. Similar to 49% of parents, they do not know how to talk to Peter about money related issues. Emotions take over, conflicts often arise and they fear that Peter will not be able to adapt to the digital economy, displaying unhealthy attitudes and habits that could ruin his future.

It would be great for Peter's parents to have an ally that can help teach the child the basics of financial management and motivate him to take responsibility and deal with day-to-day family responsibilities. An example of such an ally is a mobile app that guides the parent on how best to educate Peter, gives him access to pocket money and encourages him to help his parents. However, the main obstacle is that Peter does not want to learn all this. He already has a lot of school responsibilities, and at home he wants to play video games.

What if e-wallet, education and a home task manager are combined in an attractive game that transforms a child's first financial experience into an exciting journey? Task manager, reports, community, еverything... is captured and transferred through gamification.

Finally, Peter's parents can enjoy a peaceful and friendly atmosphere at home, a good relationship with Peter and ensure a happy and successful future for their son. They are now positive parents, calm, smart, and responsible, who can love their kid without conflicts and unnecessary stress.

Explore more on how to deliver authentic purpose-driven design

5. Personality

We are under attack by the clones. Thousands of soulless digital products lacking personality create an ocean of sameness around us. To bring a product with personality to life, we need to dig deeper and discover the true essence of a financial brand.

Personality is a set of emotional characteristics through which users perceive a product. For example, customers feel that trustworthiness (83%), integrity (79%) and honesty (77%) are the emotional factors that most align with their favorite brands, as indicated by a Deloitte study.

Products that are assembled from functions that are defined from marketing reports about abstract consumers are unlikely to evoke an emotional reaction. Every tiny detail should express the authenticity of the product. Language, design, layout, style, architecture, functions and others should reflect the brand's true identity.

According to Stackla research, 86% of consumers say authenticity is important, when deciding what brands they like and support. However, 57% of consumers think that less than half of brands create content that resonates as authentic.

Be different and authentic to transfer personality through stunning product design, which expresses the values of the company.

Iconic brands don’t use boring templates and copy faceless corporate designs. Their products and communications are aesthetically pleasing, unique and consistent with design best practices and trends.

McKinsey tracked the design practices of 300 publicly listed companies over a five-year period in multiple countries and industries. They interviewed and surveyed senior business and design leaders, collected more than two million pieces of financial data and recorded more than 100,000 design actions. As a result, McKinsey found that companies from the top Design Index outperformed twice as well, in terms of revenue and total return to shareholders.

Case Study: How did we find a unique identity for luxury banking?

What will customers feel when they interact with the product? Will it feel like they’ve been teleported 30 years back in time to the middle of a “desert” of confusion and complexity? OR will it feel like they’ve entered a place of joy and delight? Emotion-driven product design should unlock the door to a product's unique story, forming the design language.

To find the right mood and design vision for the luxury banking product, we collected different mood boards to explore ideas and move out of the usual banking perception:

In this way, we create the inspiration to move out of the box and experiment in the search for an authentic and visually stunning solution.

Everyone in the industry is under the pressure of existing rules, stereotypes and patterns that are copied and pasted from product to product. To create something fresh and unique, we need courage to act from the first principle and question the fundamentals.

Only when it feels like the product was developed by humans, do humans react to it emotionally. Such products enrich the user's identity and become part of their lifestyle. People will protect them and encourage others to use them because products with personality evoke love.

Explore more on how to deliver visually stunning luxury banking

6. Passion

In every business, there are pitfalls that destroy the motivation of a team. In the most successful digital startups, we see that the founders had such a powerful and engaging vision for the product that it made the entire team passionate and motivated about it despite the obstacles. Steve Jobs said, "People with passion can change the world for the better."

If we look closely, we can find a simple formula: the product vision must be so inspiring as to sustain the passion of the entire team.

Today, many are striving to understand what users will like and create a product for them. This is right, but only after you have started with yourself. When you make a product for yourself, at least one person is already excited─you! In the human community, any movement always starts with one passionate visionary.

It doesn't matter who you are—an employee of a Fintech startup or a bank product owner—your attitude toward the product is critical. If the owner does not passionately believe in the product, no one will believe it. You need to align the external customer experience with the internal passion. You can put your soul into the product and bring it to life. However, you need your team to believe and sync with this passion to keep and expand this life.

It is not easy to bring such a passion to life. Despite the fact that digital is performed as a data-driven business, users evaluate everything through emotions.

Behind a product with a soul, there are always passionate people who fill the product with their energy. A passionate team is highly efficient and adaptive. According to Deloitte research, more than 90% of passionate employees feel confident when facing any technology disruption, easily figure out how to acquire new skills or tools, if needed, and achieve a better understanding of a problem or situation, regularly challenging their assumptions and considering what else is possible.

Case study: How we usually help with this.

To feel the power of a banking super app, even without its launch, and ignite passion into the team, we delivered an inspiring visual prototype that communicates the value behind the product and the soul it has inside. At this epic milestone, the feeling of our clients who see the design concept of their future product for the first time that they had previously only dreamed of, is usually amazing.

The first banking super app prototype made the entire team extremely excited to see and touch the first screen of the product they've been working so hard on for weeks. These emotions generated by the design of the product invigorate a financial product's team energy and motivation to bring the product to life.

In one of our recent projects, after seeing the product, the entire client team was seized with a passion to convey this value to users, despite the fact that most of the employees were located in different countries and worked remotely.

Explore more through this mobile banking super app case study

7. Focus

Sometimes we see how the actions of the company do not correspond to its statements. This is very frustrating for customers. For example, in a beautiful ad, a company talks about caring. However, its mobile app is terrible, its support team is arrogant and its managers are indifferent. Talking about the soul and establishing an emotional connection is meaningless in this case.

To create the best product with a soul, it's extremely important to ensure consistency in everything you do according to purpose.

Salesforce data shows that one of the biggest threats to a company is fragmented and uncoordinated products, services and business processes. This is especially true for large companies, since it creates a chaotic and unsatisfactory user experience. Seventy-six percent of customers expect consistent interaction between departments, but 54% say that sales, services and marketing teams generally do not seem to share information.

It is often because products lose sight of their path over time. They accumulate dozens of functions and lose priorities. They are losing sight of their users, thereby losing sight of the market. They pursue many uncoordinated goals at the same time and try to solve too many problems. This blurring of focus dilutes the essence of the product and weakens its soul. Lucidpress State of Brand Consistency Report found consistent branding can increase revenue by 33%.

All elements of your service, both external (communications, product design, visual style, user interface, support, etc.) and internal (business processes, employees, back-office software, operating principles, etc.) must be focused on a singular purpose.

According to a Claranet study, 43% of UK financial organizations cite centralizing customer data as a key challenge to improving the digital user experience, and also as a key barrier to creating a consistent experience across all channels. This was validated by Forrester, finding that top challenges to delivering a good CX are internal struggles: the lack of a cohesive strategy across teams (48%) and silos of various CX operations and functions across the organization (38%). At the same time, ensuring a seamless experience through all channels is a top priority for 42% of consumers, according to a study by Wunderman Thompson.

Case Study: How do we ensure product's consistency according to focus?

To ensure service consistency, we need to deliver connected and positive user experiences across the entire user journey. The company often silos and losing customer focus becomes the main issue for businesses. Therefore, the user journey helps to keep every company department focused on the user.

Digital product consistency can be ensured by a design system that includes a UX design guide, documentation and UI deliverables. The design system serves as a roadmap to keep the whole team on the same page about the product and provide a consistent user experience across all product modules and versions.

Explore more through the digital banking design trends

Customers Pay More for the Best Experience

The more people’s expectations grow, the more they make purchase decisions based on the customer experience (CX) they get. The study conducted by Forrester Consulting on behalf of CSG shows that there are four major consequences of failing to deliver a positive CX:

- Decreased customer retention (60%)

- Decreased sales (57%)

- Loss of company revenue (57%)

- Poor brand image (50%)

Financial companies follow digital trends, and, according to a Deloitte global benchmarking study of 318 banks in 39 countries, 34% of banks implemented fully digital processes (product opening, etc.) during the pandemic. This is still not enough, so the window of opportunity remains wide open. Hundreds of new Fintechs slip into it every year.

Everyone sees that moving to meet customer needs has a high potential for business performance, especially in the long term:

- 80% of customers now consider the experience a company provides to be as important as its products and services.

- 66% of customers expect companies to understand their needs and expectations.

- 65% of U.S. customers find a positive experience with a brand to be more influential than advertising.

- 42% of customers would pay more for a friendly, welcoming experience.

- 32% of all customers would stop doing business with a brand they loved after one bad experience.

As Rishad Tobaccowala author of, “Restoring the Soul of Business: Staying Human in the Age of Data,” said:

Conclusion

The UXDA team believes that soul is the vital force that gives a digital product and a purpose-driven financial brand a powerful vibe. We can perceive product soul as energy that makes customers feel better, makes the product team feel passionate and creates purpose and addresses our emotions. This energy cannot often be articulated precisely. However, it connects and attracts people on an emotional level, creating the basis for a long-term competitive advantage.

Designing for purpose, value and user experience doesn't stop at finding the shortest service route or the least cluttered interface design. As digital consumers are constantly on the lookout for new experiences, competition grows exponentially. Over 3 million apps worldwide are trying to seduce them, and the number is growing hourly.

There's absolutely no way to win this game by tampering with only rational parameters. Only soul-driven digital products that provide both problem-solving features and an exceptional user experience are up to creating an emotional connection with customers and succeeding in the long term.

Additional answers that might be helpful:

How does UX design approach helps to add "soul" to a purpose-driven company?

User experience (UX) design is a process that involves creating digital products or services that are easy to use, enjoyable, and effective at meeting the needs of the user. In the context of banking, UX design can help to add a "soul" to the product by:

- Aligning the product with the purpose and vision of the brand. A UX design approach should consider the brand values, its unique identity, and visual language to translate this into a digital service. This should provide a deep emotional connection between customers and the brand.

- Making the product easy to use and navigate: A well-designed banking app or website should be intuitive and easy for users to understand, with clear instructions and a logical structure. This can help users feel confident and in control when using the product and create a sense of satisfaction and enjoyment.

- Creating a visually appealing and cohesive design: A visually appealing design can create trust and reliability and make the product feel more personal and engaging.

- Incorporating features and functionality that meet the needs of the user: A UX design approach should involve understanding the needs and goals of the user and designing features and functionality that help them achieve those goals. For example, a banking app might include features such as budgeting tools or investment recommendations to help users manage their finances more effectively.

- Ensuring that the product is accessible and inclusive: A UX design approach should also consider the needs of users with disabilities or special needs and ensure that the product is accessible to all users.

Explore why non-purpose-driven banks are losing profit >>

What are the benefits of purpose-driven banking?

There are multiple benefits of purpose-driven banking for the bank and for the broader community. By focusing on the needs and values of customers, purpose-driven banks can create more satisfying and personalized experiences for their customers, building a more substantial reputation for the bank. Also, purpose-driven banks often have a strong sense of mission that inspires and motivate employees leading to higher levels of employee engagement and satisfaction.

The benefits of purpose-driven banking can vary depending on the specific approach and goals of the bank. However, some of the top benefits of this approach to banking may include:

1. Improved customer satisfaction and loyalty

2. Enhanced employee engagement and retention

3. Stronger community connections and support for sustainable development

4. Increased financial performance and profitability

5. Greater transparency and ethical business practices

6. Enhanced reputation and positive brand image

7. Support for innovation and experimentation

8. Opportunity for leadership and differentiation in the market

9. Increased resilience and sustainability in the face of economic and environmental challenges

10. The ability to create long-term value for all stakeholders, including customers, employees, shareholders, and the community.

Find out how to strengthen purpose-driven strategy in banking >>

What are the challenges to making a financial company purpose-driven?

Making a financial company purpose-driven can be challenging, as it involves a significant shift in how the company operates and the priorities it sets. Some of the potential challenges to making a financial company purpose-driven include:

1. Resistance from employees and leadership

Changing the culture and values of an organization can be difficult, and some employees and leaders may resist the move to a more purpose-driven approach.

2. Misalignment with business goals

In some cases, the goals of a purpose-driven company may not align well with the traditional business goals of the organization, such as maximizing profits. This can create tension and require careful balancing.

3. Limited resources and expertise

Implementing a purpose-driven approach may require significant investments in new resources and expertise, such as in sustainability, social impact, customer-centricity, and stakeholder engagement.

4. Regulatory and compliance challenges

In some cases, the pursuit of a more purpose-driven approach may run up against regulatory or compliance constraints, such as those related to financial stability or consumer protection.

5. Competition and market pressure

The financial industry is highly competitive, and other companies can implement a purpose-driven approach more effectively through their digital ecosystem. This can create competitive pressure and make it difficult for a purpose-driven organization to differentiate itself in the market.

Explore how to establish purpose-driven banking culture >>

Why are some businesses not ready to add a soul to their digital product?

There could be various reasons why some businesses might not be ready to add a "soul" to their digital products:

1. Cost

Adding a "soul" to a digital product could be a complex and costly process, depending on the specific goals and requirements of the business. This could be a barrier for some businesses, especially if they have limited resources or are operating on a tight budget.

2. Time

Adding a "soul" to a digital product could also be a time-consuming process, as it may require significant research, design, and development efforts. This could be a concern for businesses under time pressure to launch their product or service.

3. Lack of understanding

Some businesses might not understand what it means to add a "soul" to a digital product, or they may not see the value in doing so. They might not appreciate the importance of creating a positive user experience or building a strong emotional connection with customers.

4. Technological constraints

Depending on the specific technology and capabilities of a digital product, it might not be feasible to add a "soul" in the way that the business desires. This could be due to limitations in the core technology or the lack of technical expertise in the development team.

5. Prioritization

Finally, adding a "soul" to a digital product might not be a high priority for some businesses, especially if they focus on money-driven goals such as cost-cutting, improving budget efficiency, or increasing profitability. With this mindset, it is hard to see adding a "soul" to the product as critical to achieving these goals.

Find out how to hire right fintech designers to add soul >>

Why is it so hard to add soul to digital banking products?

It is certainly possible to add a "soul" to digital banking products, but it can be a challenging process that requires a deep understanding of the user experience, a clear vision for the desired outcome, and a willingness to invest the necessary resources and effort:

- Complexity: Digital banking products can be complex and multifaceted, with many different features and functions that need to be integrated and optimized. This can make it challenging to add a "soul" to the product, as it requires a deep understanding of the user experience and a carefully designed approach to creating emotional connections with customers.

- Regulatory constraints: Digital banking products are also subject to a wide range of regulatory constraints, which can make it difficult to add new features or make significant changes to the product. This could limit the flexibility of digital banking products to incorporate elements that contribute to a "soulful" user experience.

- User expectations: Customers of digital banking products often have high expectations for security, reliability, and functionality. These expectations can make it difficult to add elements that contribute to a "soulful" user experience, as they may be seen as less important than other priorities.

- Technological constraints: Digital banking products often rely on complex systems and infrastructure, which can make it challenging to add new features or make significant changes to the product. This could be a barrier to adding a "soul" to the product.

- Data privacy and security concerns: Digital banking products often handle sensitive financial data, which means that any changes to the product need to be carefully considered in terms of data privacy and security. This could make it more difficult to add a "soul" to the product, as it may require additional measures to ensure the security and privacy of customer data.

- Lack of understanding of user needs: Some digital banking products may not have a deep understanding of the needs and preferences of their users, which can make it difficult to design a "soulful" user experience. This may require significant research and user testing to identify the key elements that will create an emotional connection with customers.

- Limited design resources: Digital banking products may have limited design resources available, which could make it difficult to create a high-quality user experience that incorporates a "soul". This could require additional investment in design talent or external design support to achieve the desired outcome.

- Competition: Digital banking products may face strong competition from other financial institutions, which could make it more challenging to differentiate the product and create a unique, "soulful" user experience. This may require significant effort and investment to stand out in a crowded market.

- Limited internal resources: Digital banking products may have limited internal resources available to invest in adding a "soul" to the product. This could be due to a variety of factors such as budget constraints, a focus on other priorities, or limited staff capacity.

- Limited time to market: Digital banking products may face pressure to get to market quickly, which could make it difficult to invest the necessary time and resources into adding a "soul" to the product. This may require prioritizing other goals and features over creating a "soulful" user experience.

Find out is it time to redesign your app >>

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin